As Bitcoin inches closer to its next milestone, the excitement within the cryptocurrency community is palpable. Riding a wave of optimism, BTC recently grazed its remarkable all-time high, setting the stage for a potential leap above $112,000. This threshold is more than just a number; it’s a critical junction that could redefine market dynamics if breached decisively.

What’s particularly fascinating during this phase isn’t solely about price surges—it’s about the underlying trends in investor behavior. Leading crypto analysts have pointed out a sharp decrease in Bitcoin inflows to major exchanges, which is indicative of a broader shift in market sentiment. This reluctance among long-term holders to sell, even as prices flirt with record highs, showcases a growing confidence in Bitcoin’s sustained value.

The implications of this influx decline are significant. Generally regarded as an indicator of potential selling pressure, the drop in inflows may suggest that investors are holding onto their assets, anticipating upward momentum rather than engaging in profit-taking. This combination of favorable market conditions and reduced sell-side risk positions Bitcoin uniquely at a pivotal moment in its history.

The Turning Tide in Bitcoin Inflows

As Bitcoin approaches pivotal price points, a mixture of enthusiasm and caution characterizes market trader sentiments. The current economic climate, including bullish trends in equity markets and positive labor market indicators, enhances the overall backdrop for crypto assets.

Fresh analytics reveal that Bitcoin inflows to top trading platforms have reached unprecedented lows, unseen since the peak of previous bear markets. Reports indicate that the average monthly flow to one leading exchange, for example, has plummeted to approximately 5,300 BTC, with recent daily numbers trailing at about 4,600 BTC. Such figures, aligning with persistent bullish momentum, signal a reluctance to sell among investors.

In contrast to outflows, which can be influenced by various internal exchange transactions, inflows offer a streamlined insight into possible selling behavior. The current trend away from sending Bitcoin to exchanges suggests that many investors are confident in holding their assets for future gains rather than cashing out now.

If bulls can conquer the $112,000 mark decisively, this unique combination of minimal inflows alongside robust buying sentiment could signal the onset of a new bullish phase in Bitcoin’s growth trajectory.

BTC Price Dynamics: Navigating Key Resistance Levels

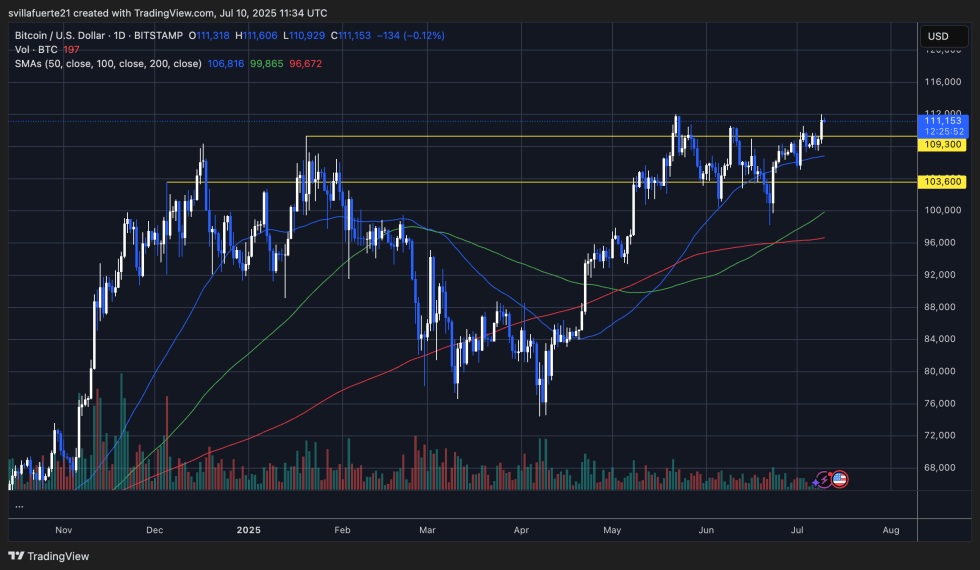

Currently, Bitcoin is trading around $111,153, having just peeked above previous highs. The daily chart illustrates that BTC is in a consolidation phase, hovering near the crucial resistance level of $112,000. This level previously acted as a top earlier this year, and understanding its importance is crucial as traders speculate on future movements.

The trend indicators, such as the 50-day moving average hovering just above $106,800 and the 100-day moving average near $99,865, provide insight into Bitcoin’s mid-term trajectory, indicating bullish fidelity. Additionally, the 200-day moving average positioned lower at $96,672 further supports the overarching upward trend.

While volatility remains a factor, the lack of substantial volume increase accompanying the recent price surge hints at lingering uncertainty among traders. If Bitcoin manages to maintain its position above $109,300 and successfully exceeds the $112,000 threshold, it could trigger a significant pathway to new price discovery. Conversely, failing to break through this barrier might result in another period of market consolidation.

All eyes are on Bitcoin as it navigates this critical juncture, with even minor movements carrying the potential for larger implications in this dynamic market landscape. The interplay of investor psychology and market forces continues to mold the narrative of Bitcoin’s journey ahead.