Amidst the evolving landscape of cryptocurrency, Bitcoin (BTC) appears to be at a crossroads, experiencing a shift in market dynamics that hasn’t been seen since the end of 2022. While Bitcoin has been the frontrunner for a considerable time, it is now facing challenges as Ethereum (ETH) and various altcoins gain traction. Investors are now closely observing this transition, as Bitcoin has historically been the cornerstone of the crypto market.

Notably, expert analyst Darkfost has illuminated the activities of long-standing Bitcoin whales who are re-emerging in the market, which adds an element of uncertainty. One particular whale has been observed exchanging BTC for ETH on a platform called Hyperliquid. Darkfost suggests that this whale might be a miner, evidenced by their association with the Bixin platform, which reportedly ceased operations in 2019. This trend of portfolio diversification among early investors and miners may be contributing to a shift in capital flow.

This moment in the crypto cycle signifies a potential challenge to Bitcoin’s historic leadership as Ethereum continues to gain strength, driven both by institutional interest and the accumulation of assets by affluent investors. The next few weeks will be pivotal in determining whether Bitcoin can reclaim its spot at the top or if Ethereum will continue its ascent.

The Impact of Dormant Bitcoin Whales

According to Darkfost, the resurgence of activity among long-term Bitcoin holders, commonly referred to as whales, is significantly influencing the current market environment. These wallets, typically associated with early adopters and miners, are now active, which raises questions about their intentions. Historical data indicates that spikes in such activities often coincide with market frenzies, frequently signaling the onset of corrections.

Darkfost emphasizes the importance of the Spending Binary CDD (Coin Days Destroyed) metric as a critical indicator of market health. This metric tracks the movement of older coins and has recently hit notable levels that have historically preceded market downturns. The logic is straightforward: when long-untouched coins begin to circulate, it often hints at distribution from seasoned investors, thereby increasing market supply at particularly volatile times.

The present market scenario appears to echo this pattern, as Bitcoin’s price exhibits signs of consolidation and dwindling bullish momentum. Darkfost alerts investors that without a significant uptick in demand—or a halt to the movement of these dormant BTC—it will be challenging for Bitcoin to escape its current state of limbo.

Should demand fail to counterbalance the rising selling pressure initiated by these old wallets, Bitcoin could face more pronounced corrections before attaining stability. Conversely, if the distribution by whales slows down, it could provide Bitcoin with the opportunity to regain strength. Regardless, the choices made by these historic holders will significantly shape the short-term outlook for Bitcoin.

Price Movement Analysis

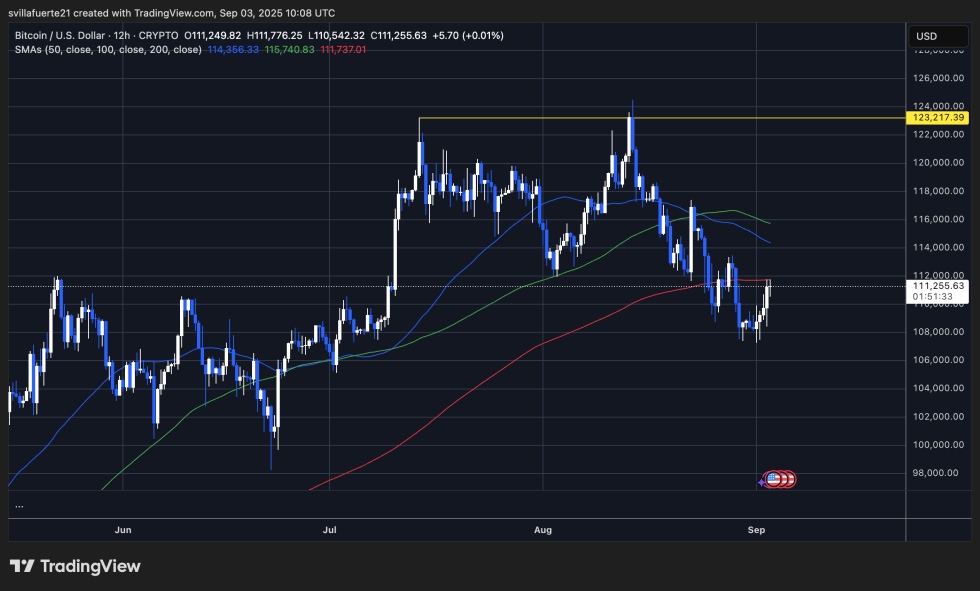

Currently, Bitcoin (BTC) is trading around $111,255, showing signs of recovery from a sharp dip that had pushed its value closer to the $108K range. The technical analysis reveals that BTC recently rebounded off the critical 200-day moving average (represented by the red line), a significant support level historically known for providing stability during market corrections. Maintaining above this line is essential for sustaining a broadly bullish narrative.

In terms of resistance, Bitcoin must navigate immediate challenges at the 100-day SMA (approximately $115,740) and the 50-day SMA (around $114,356). Both of these moving averages are currently positioned above the price, creating a convergence of resistance that could hinder short-term upward movement. Unless Bitcoin can break through and securely hold above these averages, the market may continue to oscillate between the $108K and $115K range.

The critical resistance mark at $123,217 stands out as paramount, signifying the last significant peak prior to the recent downturn. Successfully reclaiming this level could indicate renewed bullish energy and potentially reset the market trajectory toward achieving new highs.

Featured image from Dall-E, chart from TradingView