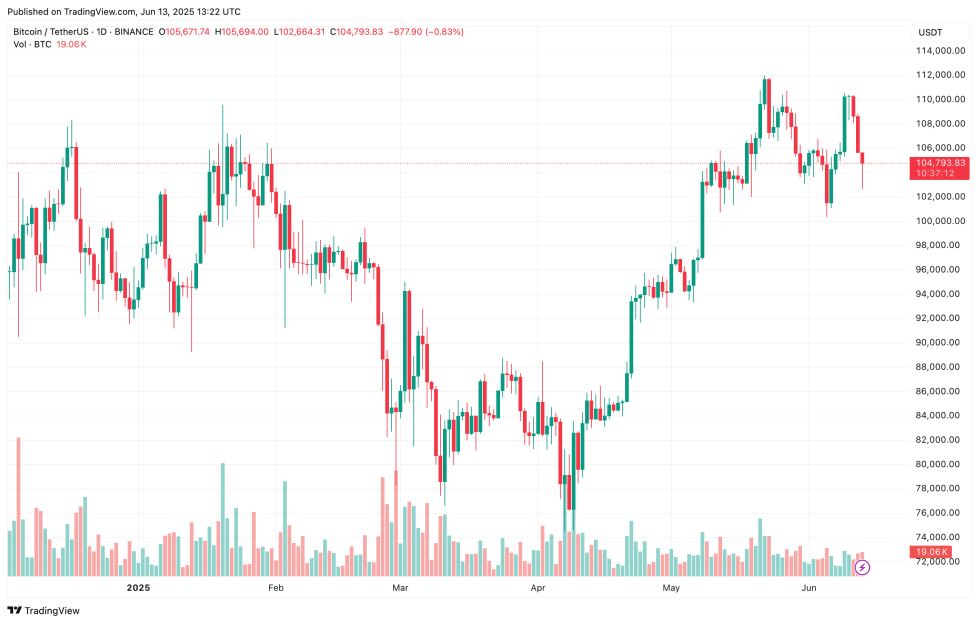

Amidst fluctuating global economic conditions, the cryptocurrency market displays resilience, particularly evident in Bitcoin’s (BTC) recent activity. Following a dip attributed to international uncertainties, market indicators suggest a continuing upward trend, keeping BTC in a competitive price range.

The Implications of On-Chain Metrics

One pivotal on-chain metric, the Puell Multiple, indicates signs that BTC may be poised for further growth. Currently, this metric stands close to a threshold that suggests undervaluation, implying that recent price movements may not reflect the full potential of crypto adoption.

Essentially, the Puell Multiple analyzes the daily revenue generated by Bitcoin miners in relation to its historical average, offering insights into potential market corrections or growth opportunities. Values below 1.0 typically highlight periods of miner distress or accumulation trends, while higher values could suggest overheated markets.

On analyzing its recent performance, experts have observed that although Bitcoin’s price has risen, miner earnings do not yet reflect this growth. This volume disparity might indicate that external factors—such as substantial institutional investment—are influencing the price rather than miner participation alone.

The current dynamics suggest that while prices surge, miner revenues are yet to catch up, hinting at a possible buildup of market activity that could lead to increased valuations in the near future.

Additionally, the reduction in block rewards due to the April 2024 halving is likely impacting miner revenue generation. Despite BTC’s price appreciation, miners may still be feeling the squeeze, creating a unique accumulation phase for potential investors.

Institutional Interest Surges

Despite the fluctuations in retail interest, institutional players are rapidly diversifying their portfolios to include BTC, showcasing a broader acceptance of cryptocurrency as a legitimate asset class. This growing inclination is reflected in various corporate strategies focused on Bitcoin accumulation.

For instance, GameStop has made headlines by securing $1.75 billion through convertible debt instruments and simultaneously adding a significant BTC position to its balance sheet. This mirrors trends seen in other forward-thinking companies leveraging debt financing to enhance their cryptocurrency holdings.

As Bitcoin’s potential continues to unfold, forecasts for new all-time highs are gaining traction. Analysts like Bitwise CEO Hunter Horsley assert that the upcoming BTC price break past significant thresholds, such as $130,000, might come with little resistance once achieved.

Looking ahead, crypto analyst Ted Pillows anticipates a swift rise to $130,000 could materialize by Q3 2025, indicating a bullish sentiment towards Bitcoin’s long-term growth trajectory. Currently, Bitcoin is trading at $104,793, reflecting a slight decline of 2% over the past day.