Success in the financial world often means seizing opportunities, a principle highlighted by numerous trillionaires globally. Recently, the Trump family has made headlines not just for their business ventures, but also for their significant investments in cryptocurrencies like Bitcoin.

Is this trend towards Bitcoin the most strategic move in the ever-evolving cryptocurrency landscape?

Despite the buzz surrounding BTC, experts caution that massive acquisitions might distort true market dynamics. Concerns have been raised that such large-scale acquisitions could potentially weaken Bitcoin’s appeal to institutional investors.

While major figures venture into Bitcoin, savvy investors should consider diversifying into lesser-known altcoins that show immense potential for growth.

The Trump Family and Cryptocurrency

When Donald Trump claimed he would embrace cryptocurrency, it raised eyebrows and questions about how he would integrate digital currency into mainstream finance.

The Trump family’s involvement in cryptocurrencies has become more pronounced lately, with initiatives ranging from the release of $TRUMP tokens to various ventures in blockchain technology.

Donald Trump Jr. and Eric Trump are at the helm of a new project named American Bitcoin, aiming to accumulate Bitcoin systematically. Their SEC filing details a serious commitment:

American Bitcoin regards its holdings in Bitcoin as a core aspect of its business strategy, focused on long-term acquisitions.

—American Bitcoin SEC filing, American Bitcoin

Although their Bitcoin portfolio has just begun with 215 BTC, their plans to increase this amount signify a broader commitment to cryptocurrency.

Interestingly, American Bitcoin’s strategy aligns with observable trends in the broader crypto ecosystem, affirming the necessity of diversified investment approaches.

Are Large-Bitcoin Treasuries a Concern?

Recent analyses by Sygnum have shed light on large corporations acquiring extensive Bitcoin reserves, indicating a shifting landscape in cryptocurrency investment.

Currently, major players hold about 3% of Bitcoin’s total potential supply, causing some experts to conclude that significant holdings could destabilize the market.

The risks arise from both economic principles and market psychology. When large amounts of Bitcoin are locked away, it leads to reduced liquidity, which can exacerbate market fluctuations.

Furthermore, a single event such as a major company divesting its Bitcoin could trigger panic selling, not unlike how positive news can provoke bullish trends.

Given these factors, large holdings might dissuade institutional investors from adopting Bitcoin fully as a reserve currency.

For those looking to invest wisely, diverting attention from high-profile players could be an advantageous strategy. Consider exploring the altcoin market, where undiscovered gems may lie.

1. Solaxy ($SOLX) – The Answer to Solana’s Shortcomings

Solaxy ($SOLX) emerges as a promising solution to the ongoing challenges faced by Solana, enhancing transaction efficiency and scalability issues.

Offering a robust Layer-2 framework, Solaxy optimizes performance while maintaining the benefits of Solana’s low costs. It is designed to support a wide range of applications while ensuring speed and reliability.

The advancement into Layer-2 solutions signifies an evolution within the Solana ecosystem, merging Ethereum’s stability with Solana’s rapidity. Investors should keep an eye on the ongoing presale, as $SOLX could see significant appreciation by the end of 2025.

Learn how to secure your portion of $SOLX while the presale is still engaging early investors.

2. XRP ($XRP) – The Rising Star in Crypto

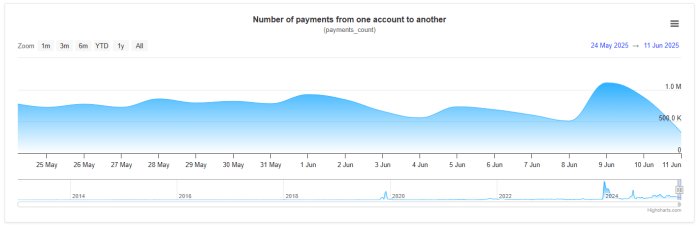

XRP has been gaining traction with a series of significant developments:

- The introduction of an EVM-compatible sidechain

- Speculations about collaborations with major financial institutions

- New ventures launched in conjunction with investment firms

Such advancements have contributed to a marked increase in XRP transactions recently.

With the upcoming potential for a spot ETF, demand for XRP is predicted to continue rising as the asset further solidifies its role in cross-border finance.

Review the comprehensive technical documents to understand why XRP remains a cornerstone for many investors.

3. Snorter Token ($SNORT) – Revolutionizing Meme Coin Trading

Meme coins often generate buzz but can come with high risks, such as fraudulent activities and scams.

To combat this, the Snorter Token is equipped with features to identify and avoid scams while enabling quick trades through its innovative Snorter Bot. This bot enriches user experience by providing tools for swift transactions and strategic investments.

Participating in the presale presents the opportunity to earn impressive annual yields, making it an attractive option for long-term investors.

Explore ways to purchase Snorter Token while prices remain favorable and take advantage of its potential for substantial returns.

Investors Seeking Avenues Beyond Bitcoin

While the Trump family focuses on Bitcoin, intelligent investors are broadening their scopes. The market’s uncertainty calls for a more diversified approach.

Investors who evaluate alternatives like Solaxy, XRP, and Snorter Token may uncover substantial growth opportunities without the heightened risks associated with large BTC holdings.

In this rapidly changing environment, it’s crucial to remember to conduct thorough research before diving into investments.