Recent market dynamics have sparked significant movement within the cryptocurrency ecosystem, especially for investors involved in short positions. Many short holders have faced an unprecedented wave of liquidations as Bitcoin and other cryptocurrencies soared.

Bitcoin Soars to New Heights, Crossing $111,000

Against a backdrop of earlier skepticism, Bitcoin has surprised many by not only reclaiming its former all-time high but also surpassing it, achieving an exhilarating peak close to $111,800. This remarkable rebound has captured the attention of both investors and analysts alike.

The following visual illustrates the powerful uptrend that has defined Bitcoin’s recent performance:

Earlier in the month, Bitcoin seemed poised for a breakthrough after reaching $103,000; however, it initially struggled to gain momentum, leading to a period of consolidation. Fortunately, that has changed dramatically in recent days, as renewed interest has propelled the price upward.

While altcoins have enjoyed some positive movements, Bitcoin has outperformed them in terms of weekly returns. For instance, Ethereum has seen a modest increase of about 3.5%, which pales in comparison to Bitcoin’s impressive 8.5% gain.

Over $500 Million in Crypto Liquidations in Just 24 Hours

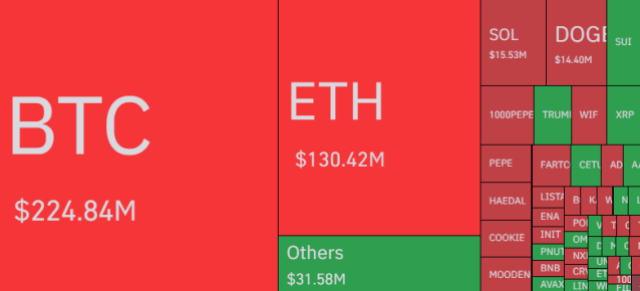

Data from CoinGlass highlights the chaos that has unfolded in the derivatives market, with over $516 million in liquidations occurring within the last day. These liquidations typically arise when open contracts are forcibly closed due to accumulated losses exceeding a certain threshold.

Here’s an updated snapshot of the latest liquidation statistics within the cryptocurrency market:

A closer examination reveals that approximately 64% of these liquidations—totaling around $334 million—are attributable to bearish short positions. Given the bullish momentum of Bitcoin, this was to be expected, particularly as Bitcoin and Ethereum led the charge in liquidation figures.

Such a mass liquidation event is often referred to as a “squeeze,” specifically a “short squeeze” in this context, given that short positions have been particularly affected. Market reactions can lead to rapid price surges, causing even more liquidations in a worrying cycle for short sellers.

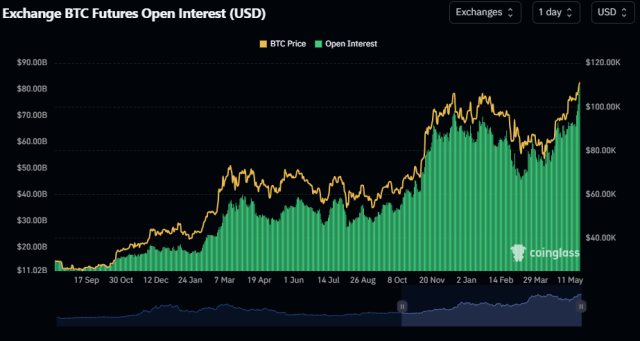

Despite the significant liquidations taking place, the allure of the crypto market remains strong. The Bitcoin Open Interest continues to rise, indicating that many traders are still engaged, demonstrating confidence in future price movements.

Currently, Bitcoin Open Interest stands at a staggering $81 billion, a notable rise from $65 billion seen earlier this month, signifying growing investor engagement and anticipation of further price action.