The cryptocurrency market is witnessing an intriguing phase as Bitcoin’s price action tightens around crucial resistance levels. Enthusiastic investors are eager to see BTC surge higher, confirming the ongoing bullish trend; however, the atmosphere remains tinged with caution. Despite technical indicators showing potential for upside movement, increasing macroeconomic challenges are impacting overall sentiment. Factors such as inflation, geopolitical uncertainties, and tightening monetary policies are contributing to a cautious stance among crypto investors.

Additionally, recent statistics from CryptoQuant indicate a significant decline in average trading volume on centralized exchanges, reaching levels not seen since October 2020. This trend points to a hesitance among traders, suggesting that many are choosing to retain their positions rather than actively engaging in buying or selling.

Presently, Bitcoin maintains a position above crucial support levels, indicating resilience. Nonetheless, without a notable increase in trading volume or a compelling catalyst, the forthcoming price movements could either be muted or remarkably volatile. The days ahead are likely to be crucial in determining whether BTC will break free or experience a temporary stall.

Bitcoin on the Brink of All-Time Highs Amid Market Anticipation

Bitcoin is currently hovering just 6% below its historical peak of $112,000, prompting heightened interest on whether bullish momentum can surpass this last hurdle. After a substantial upside of over 50% from its April lows, BTC has entered a consolidation phase right beneath resistance—a typical precursor to either a breakout or a reversal. The forthcoming price action is expected to significantly influence market behavior, potentially leading to accelerated momentum or deeper consolidation.

While the technical outlook remains promising, macroeconomic factors continue to cast a long shadow on investor confidence. Heightened geopolitical tensions, particularly between major economies like the US and China, along with elevated bond yields, introduce risks that could permeate the cryptocurrency landscape. Many investors are adopting a wait-and-see approach before committing to new positions.

Market analyst Axel Adler recently tweeted insights gleaned from CryptoQuant data showing that average spot trading volume on centralized exchanges has dipped significantly. Adler highlighted that this lack of trading indicates market participants are neither aggressively selling nor seeking to buy. Most are opting to hold their assets tightly, leading to limited on-chain activity.

This phenomenon, often referred to as “HODL mode,” may reflect growing long-term conviction among investors but also highlights a degree of uncertainty. With minimal trading activity, price surges may require fresh capital inflows. However, if Bitcoin manages to convert the $112K level into support, it could unleash a wave of buying momentum.

BTC Approaches Crucial Resistance Levels

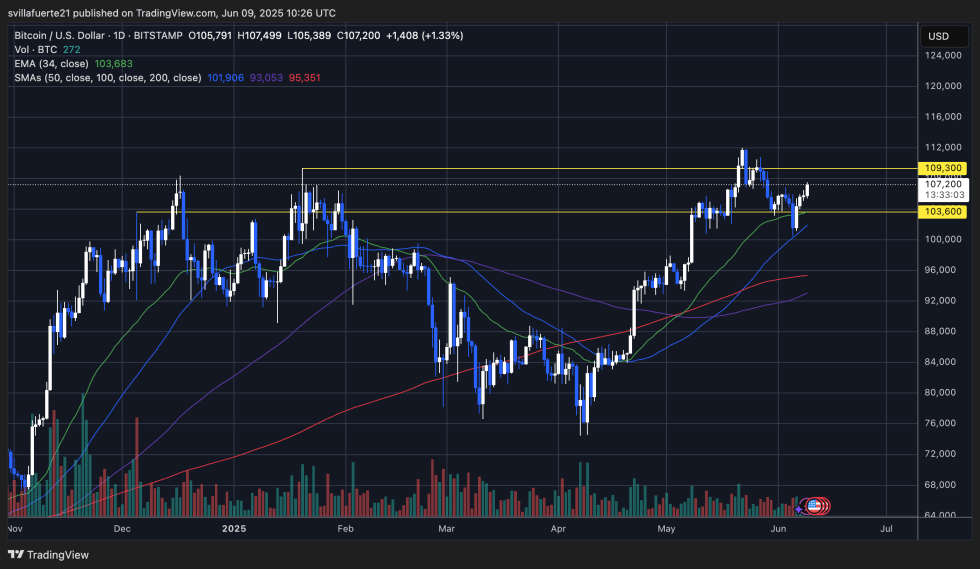

At present, Bitcoin is trading at $107,200, showing a daily increase of 1.33% as it rebounds from the support threshold of $103,600. An analysis of the daily charts reveals that BTC is steadily reclaiming the 34-day EMA at $103,683, while remaining comfortably above the 50-day and 100-day SMAs at $101,906 and $93,053, respectively. This clear recovery of essential moving averages sends a bullish signal, indicating an improving momentum for buyers.

Bitcoin Price Trend Analysis | Source: Btcusdt Chart On Tradingview" width="980" height="569" title="Bitcoin Traders Brace For Impact As Cex Volume Hits Lows-Bitrabo">

Bitcoin Price Trend Analysis | Source: Btcusdt Chart On Tradingview" width="980" height="569" title="Bitcoin Traders Brace For Impact As Cex Volume Hits Lows-Bitrabo">

Price is nearing the key resistance level of $109,300—the last barrier before a potential retest of the all-time high situated at approximately $112,000. This region has served as a ceiling since late May, making it a critical level to monitor. A daily close exceeding $109,300 may catalyze a breakout, propelling BTC into new price discovery territory.

Despite relatively low trading volumes compared to previous surges, current price movements seem to be supported more by steady buying pressures than by aggressive trading. The overall market structure appears constructive as higher lows have formed since the bounce in early June.

As long as Bitcoin remains above $103,600 and continues its upward trajectory toward resistance, the prevailing bullish trend is likely to hold. Conversely, a rejection at $109,300 could result in a return to consolidation phases. The next few trading sessions will be pivotal.

Image sourced from Dall-E, chart provided by TradingView.