Recent data analysis indicates that despite Bitcoin’s price lingering near $110,000, there has been a significant decline in Spot and Future Trading Volumes. This represents a notable trend in the cryptocurrency market that investors should pay attention to.

Current Trends in Bitcoin Trading Activity

Insights from the on-chain analytics company Glassnode highlight a concerning downturn in Bitcoin Trading Volumes across both spot and futures markets. This metric reveals the total volume of Bitcoin transactions on major exchanges, providing a lens through which to view market health.

The following illustration from Glassnode captures the yearly trend, depicting fluctuations in trading volume for both markets:

As shown in the chart, trading volumes for both Spot and Futures surged when Bitcoin’s price surpassed $100,000 late last year. This surge aligns with typical trader behavior; heightened market activity often spurs increased trading as speculators seize opportunities. However, as the market cooled earlier this year, trading volumes decreased, a trend that has curiously persisted even as Bitcoin has reclaimed a position above $100,000 in recent months. While Futures Volume spiked in tandem with price increases, it subsequently waned during price consolidation phases.

Despite Bitcoin maintaining a near $110,000 price point recently, it has been evident that investor enthusiasm is waning, leading to a decline in both Spot and Futures Trading Volumes. Currently, Spot Trading Volume stands at $5 billion, while Futures Volume is reported at $31.2 billion, marking the lowest levels seen in over a year—with both metrics continuing a downward trajectory.

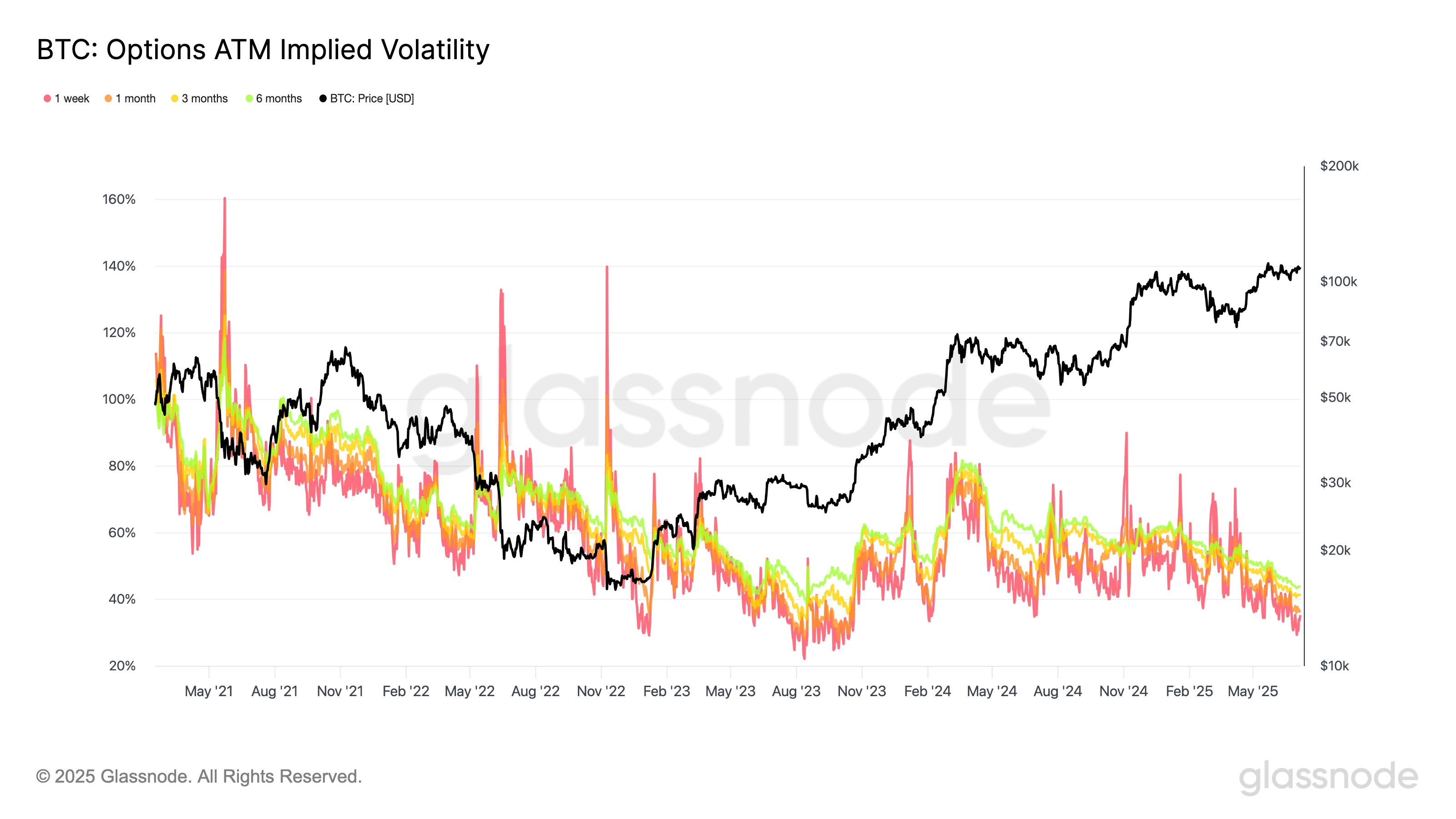

The declining trade volumes are not isolated indicators of a market slowdown. Additional analyses by Glassnode reveal that the Options market reflects similar sentiment.

The above chart represents the Bitcoin Options At-The-Money (ATM) Implied Volatility, which serves as a gauge of future market fluctuations as perceived by options traders close to the current spot price. Notably, the recent trajectory shows diminishing volatility expectations across various expiry timeframes. Glassnode remarks, “We’re witnessing some of the lowest volatility levels since mid-2023, even as Bitcoin prices hover near historic highs.”

Current Bitcoin Price Analysis

In the past few weeks, Bitcoin has exhibited a stagnation in price, hovering around $108,400, indicating a period of consolidation.