The cryptocurrency landscape has recently seen Bitcoin ascending above the pivotal $92,000 mark, spurred by a tumultuous beginning to 2026. Key events globally, especially geopolitical shifts, have dramatically influenced market dynamics. For example, a significant military operation was undertaken by the United States, targeting Venezuela, which created ripples in the region’s political and energy sectors. Such moves are vital, as they contribute to shifts in oil supply chains and broader economic sentiments worldwide.

In parallel, tensions have flared between monetary policy authorities and political leaders. Federal Reserve Chair Jerome Powell’s assertions regarding the independence of the central bank from political interference highlight an ongoing struggle in the U.S. administration. Powell emphasized that the Federal Reserve’s main concern remains the economic wellbeing of the public, despite external pressures.

Interestingly, in the midst of these geopolitical and political happenings, Bitcoin appears to have entered a period of stability with realized volatility decreasing to notably low levels. This typically indicates a temporary equilibrium in market dynamics between supply and demand.

Historically, moments of prolonged calm like this can precede significant price shifts, as pending imbalances often culminate in sharper directional movements. This leads the market to potentially experience a crucial breakout, particularly as it holds near the key $92K threshold.

Current Market Conditions Indicate Possible Shifts

According to a recent analysis by expert Axel Adler, a pivotal change in Bitcoin’s market conditions has become apparent. The realized volatility index has contracted to indicates a 23.6% decrease, aligning with the lower spectrum of historical data. Instead of indicating a clear market direction, this reduction signifies a pause in momentum, where price fluctuations are narrowing.

From a technical perspective, this compressive phase is crucial. As volatility decreases, built-up supply and demand imbalances may stay concealed until they reach a critical threshold—often triggering abrupt price transitions.

Further confirming this perspective, the recent 30-day high-low range for Bitcoin has been closely observed. The diminishing gap between these rolling highs and lows indicates that Bitcoin’s price is stabilizing within a constricted band. Notably, both short-term intraday and longer multi-day changes have lessened, indicating a lack of decisiveness from both buyers and sellers at this stage.

Historically, market breakouts from such constricted ranges tend to draw in algorithmic traders and trend-followers, magnifying movements once a breakout occurs. Although this scenario does not guarantee which direction the price will take, it does imply an increased likelihood of substantial movement. With both volatility and price metrics converging, Bitcoin is seemingly on the cusp of a significant transition from its current consolidatory phase.

Decisive Moments for Bitcoin Above $92K

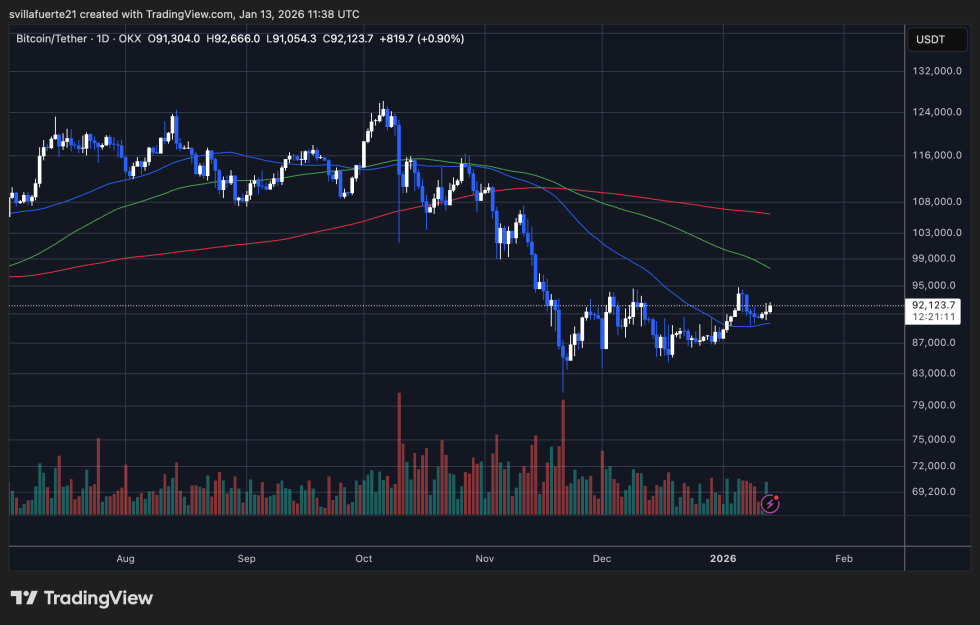

Currently, Bitcoin is making efforts to secure its position around the $92,000 level, following a significant consolidation period that started after a sharp drawdown in November. On the daily charts, a solid base has emerged in the $86K–$88K area, marking a shift from aggressive selling to a more stable outlook where buyers are slowly gaining ground.

The latest movement above the descending short-term moving average indicates some improvement in market momentum. However, Bitcoin continues to operate below larger trendline resistances and long-term averages, particularly in the $98K–$105K range. This reinforces the understanding that Bitcoin’s journey back into a strong bullish trend is still an ongoing process.

Additionally, trading volume has remained relatively subdued during this recovery phase, suggesting that recent price movements stem more from reduced selling pressures instead of invigorated buying. This reinforces the perception that the market is moving toward stabilization rather than immediate expansion. The $92K level now represents a crucial benchmark for market participants: sustaining price above this level could confirm a transition to higher levels while potentially unlocking a broader rotational range targeting $96K–$100K.

If the price cannot maintain this breakout, Bitcoin could find itself reevaluating support near $88K. This context suggests caution in navigating current markets as we await direction from future price action.

Image source: ChatGPT with chart details from TradingView.com