The recent drop in Bitcoin’s value below the $80,000 mark has sparked significant volatility in the cryptocurrency market. This sudden decline has led to an unprecedented scale of liquidations, affecting traders and institutions alike. Many are keen to assess the implications for large holders and their strategies, particularly those like Michael Saylor, whose investment strategies are now under pressure.

The Dynamics Behind the Rapid Bitcoin Decline

Currently, the cryptocurrency market is experiencing extraordinary turmoil as Bitcoin and Ethereum lead the plunge. In a shocking turn of events, approximately $2.51 billion in leveraged assets vanished in a single trading session, marking it among the most severe liquidation events the industry has faced. This contrasts with the former crises caused by COVID-19, which saw around $1.2 billion liquidated, and the FTX breakdown, which reached about $1.6 billion.

Liquidation Statistics. Source: @AshCrypto On X

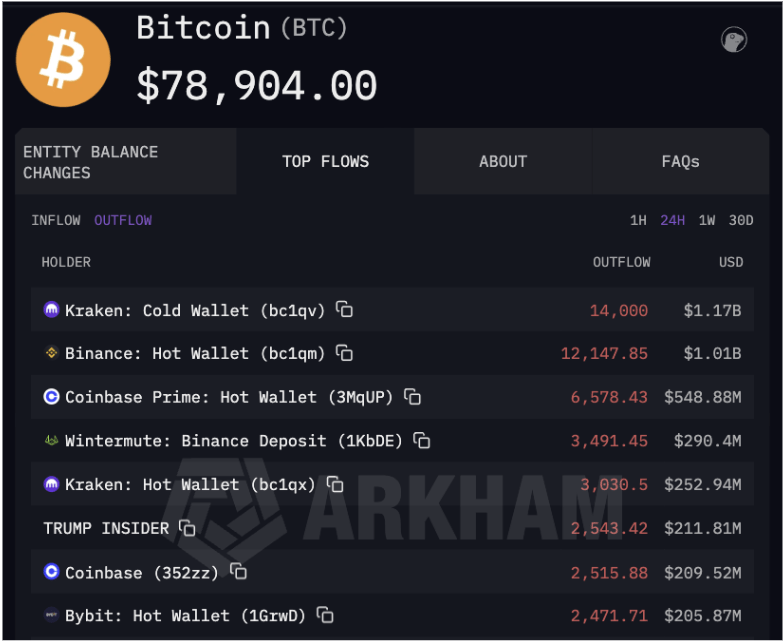

Arkham Intelligence reports that several major entities proactively transferred Bitcoin onto exchanges prior to the crash. Kraken was notable, offloading approximately 17,030 BTC, while Binance released around 12,147 BTC and Coinbase contributed another 9,093 BTC. Market maker Wintermute added 3,491 BTC, and other wallets, including those labeled as Trump Insider and Bybit, contributed additional significant amounts.

These actions resulted in a cascade of liquidations, especially as Bitcoin breached the critical $80,000 zone without meaningful resistance.

Recent Transfers of Bitcoin. Source: Arkham Intelligence

Analyzing Strategy’s Bitcoin Holdings and Current Position

As a substantial corporate player in the Bitcoin arena, Strategy is acutely feeling the repercussions of this recent market decline, with its holdings precariously close to the breakeven point.

The company currently possesses 712,647 BTC, valued at approximately $55.72 billion based on recent prices. These assets were accumulated at an average price of $76,037 per Bitcoin, placing Strategy just around 1.8% above breakeven after the crash.

This narrow margin raises concerns, yet the holdings remain profitable for the time being. At the market’s peak, Strategy’s Bitcoin assets were valued at about $81 billion when Bitcoin reached approximately $126,000, despite holding nearly 70,000 BTC less at that time.

It has been nearly 2,000 days since Strategy committed to adopting the Bitcoin Standard. This decision has increasingly tied its financial success to Bitcoin’s performance.

As of now, Bitcoin is trading around $78,500. A slight further downturn of just 3% could potentially flip Strategy’s position from profits to losses on paper. Should this occur, the firm may need to reevaluate its Bitcoin strategy in a downward market.

This article features visuals from Unsplash and TradingView