In recent months, Bitcoin has faced significant challenges, struggling to navigate the complexities of an evolving market landscape. After a series of fluctuations, it is clear that the digital currency is caught in a prolonged bearish trend since late October. Relief rallies have emerged but often lack the strength needed for a sustained breakout, leaving investors increasingly anxious.

This apprehension raises a critical question: Is Bitcoin’s recent performance indicative of a shift away from the historical bull and bear cycles that traders have come to know? The uncertainties in today’s market dynamics suggest that many are beginning to rethink these traditional frameworks.

Insights from prominent analysts shed light on significant changes observable within Bitcoin’s ecosystem. The recent data showcases a striking decline in active Bitcoin addresses since April 2021. Typically, bull markets are characterized by an influx of new investors, reflected by increasing active addresses. However, the current scenario diverges from this trend, suggesting a need to reconsider how market participation is defined.

Even during times when Bitcoin’s price showed some strength since 2022, active addresses have continued their downward trajectory. This unusual behavior hints at a potential transformation in the market structure, steering away from retail-driven dynamics to a model that is more influenced by institutional involvement.

Understanding the Decline in Active Addresses

Data analysis indicates a critical point: despite periods of rising prices, Bitcoin has seen a significant drop in active on-chain participants. An illustrative comparison reveals a stark contrast, as Bitcoin boasted approximately 1.15 million active addresses in April 2021, while the current count stands at around 680,000—a notable decrease that cannot be overlooked.

This trend may not stem from a singular cause; it likely embodies a complex interplay of factors affecting how Bitcoin is owned and accessed. One observable shift is the rising number of inactive addresses, signifying a possible movement toward long-term holding as more investors choose to retain their assets instead of engaging in frequent transactions.

Moreover, a segment of the market narrative suggests that many participants are opting for centralized platforms and alternative financial products like ETFs to gain exposure to Bitcoin. This maneuver results in a reduced demand for traditional on-chain activity even while investor interest and capital allocation to Bitcoin remain substantial.

Consequently, the ongoing decline in active addresses may signal a paradigm shift in Bitcoin’s market structure. It appears that the dynamics are transforming, becoming less driven by retail transactions and leaning more toward institutional custody and participation.

Price Dynamics and Support Levels

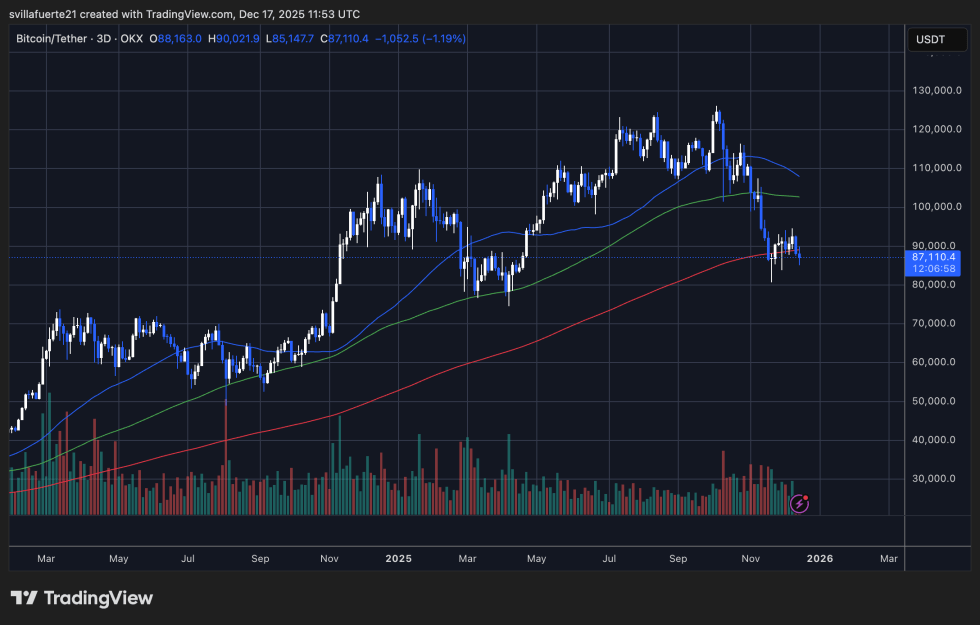

Bitcoin’s trading volume and price action have displayed alarming signs of weakness. After failing to maintain momentum above the $100K-$110K range earlier this year, BTC has shifted into a corrective phase, marked by declining higher highs and significant selling intensity. The latest price maneuver towards the $87K range places Bitcoin precariously on the edge of a critical support zone.

This loss of support levels has broader implications. The short- and medium-term moving averages have flipped from support to resistance, underscoring the prevailing bearish sentiment. The crucial long-term moving average is now a key level, historically marking the boundary between bull and bear markets. A breakdown below this threshold could escalate the risk of further declines, potentially dragging Bitcoin down towards the $80K range.

Volume patterns add another layer of complexity. An observable increase in selling pressure during notable drawdowns contrasts sharply with recovery attempts characterized by weaker trading volumes. This divergence indicates that buyer enthusiasm is less aggressive, signaling a cautious approach among investors, rather than a robust recovery.

In summary, defending the $85K-$88K price zone becomes imperative. If this support fails, it could confirm a more pronounced shift in market direction. Conversely, a sustained reclaim of the $95K-$100K area is necessary to counteract the current bearish trends.

Engaging with these market dynamics effectively requires vigilance. As Bitcoin navigates through this challenging landscape, a nuanced understanding of its evolving structure will be vital for traders and investors alike.