Bitcoin’s recent price action has revealed notable volatility, dropping to $102,300 after almost reaching $106,500. This movement demonstrates the persistent struggle of bulls to breach essential resistance levels. Sellers are actively engaging at critical supply zones, rejecting bids that could lead to new price peaks above the previous all-time high of $112,000. Notably, Bitcoin has managed to maintain its position above the crucial $100,000 psychological barrier, providing support since early June.

Recent insights from market analytics platforms like Gemini and Glassnode indicate a significant shift in the composition of Bitcoin’s supply. Currently, over 30% of the circulating Bitcoin is held by merely 216 centralized entities, which encompass a broad spectrum of actors, including exchanges, ETFs, investment funds, and governmental players. This centralization trend raises important questions about the future of Bitcoin’s decentralized nature, while simultaneously igniting optimism regarding enhanced market adoption.

As macroeconomic conditions remain unpredictable—characterized by soaring US Treasury yields and persistent geopolitical unrest—Bitcoin’s price trajectory is increasingly responsive to changes in market sentiment and liquidity. The ability of Bitcoin to uphold its support levels will heavily depend on the actions of these dominant custodial entities, as well as upcoming market volume reactions.

Centralization and Geopolitical Influences on Bitcoin’s Direction

Bitcoin is currently trading about 8% lower than its all-time high of $112K, in a broad consolidation phase without a clear breakout direction. This stasis indicates a crucial decision point for the market, with traders contemplating two scenarios: a potential drop toward the $94,000 level or a resurgence toward price discovery. This uncertainty is further complicated by geopolitical tensions, notably regarding the situation between Israel and Iran. Many market observers caution that U.S. involvement could result in widespread market panic, influencing not only traditional stocks but cascading into the crypto landscape as well.

In light of the evolving ownership structure of Bitcoin, as explored through data from Glassnode and Gemini, the growing accumulated holdings by centralized parties is noteworthy. This trend illustrates a dual aspect: on one side, there is a rise in institutional interest for Bitcoin as a reserve asset, and on the other, an alarming trend toward custodial centralization that raises concerns over the core principles of decentralization.

Most of the significant holdings are found in crypto exchanges, ETFs, and investment funds. Alongside them, various public and private companies have integrated Bitcoin into their assets. Additionally, a portion of Bitcoin is secured in DeFi contracts, including holdings affected by governmental actions like seizures or acquisitions.

Although this centralization could enhance both legitimacy and investment inflows, it also introduces vulnerabilities into liquidity dynamics and asset distribution. Given the current fragile state of the macroeconomy, Bitcoin’s forthcoming movements will hinge not solely on technical indicators but also on how these major stakeholders react under pressing conditions.

BTC Price Trend Analysis: Bulls Struggling to Gain Traction

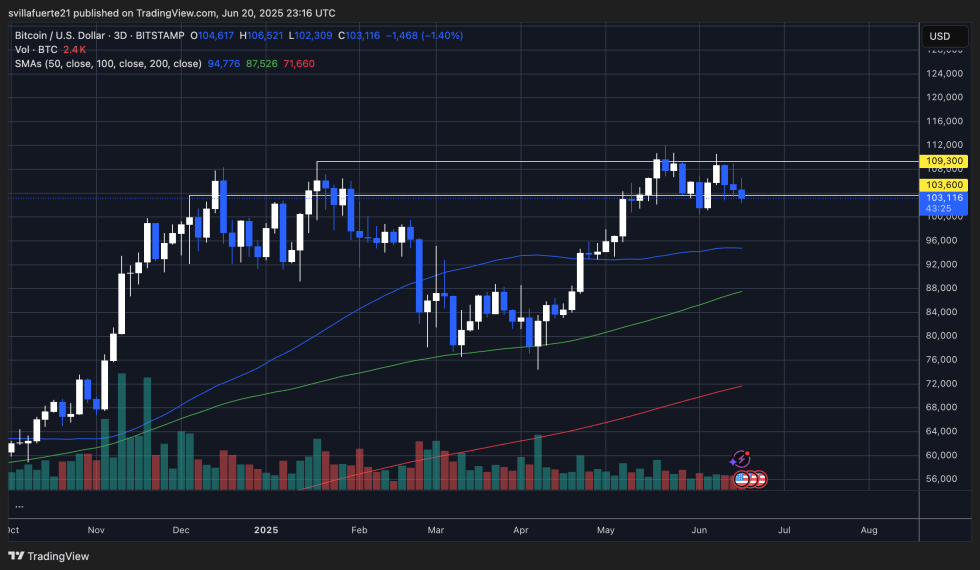

Bitcoin’s recent downtrend from its local peak of $106,500 has positioned it around $103,100, interacting closely with a key support area marked prominently on the charts, notably the $103,600 zone. This area, which previously acted as resistance, is now a pivotal demand zone crucial for maintaining this phase of consolidation. A closing below this threshold on daily or three-day charts could pave the way for a further decline, potentially testing the significant $100,000 support level.

Technical analysis reveals a pattern of lower highs developing since the peak at $112,000, suggesting the formation of a descending triangle, typically signaling a bearish continuation. Rejection of price at around $109,300 suggests that sellers are still exercising control at higher price points. A slight rise in volume associated with downward candles points toward increased selling pressure.

The 50 and 100-day moving averages are positioned at approximately $94,700 and $87,500, respectively, suggesting that there is potential for further retracement if the current bearish sentiment escalates. Nevertheless, the overarching upward trend remains intact unless there is a decisive breakdown below the $100,000 threshold.

Bulls must regain control by pushing beyond $106,500 and ensuring a close above $109,300 to indicate renewed strength. Until then, Bitcoin seems confined within a narrowing range, heightening short-term downside risks.

Featured image from Dall-E, chart from TradingView