As Bitcoin navigates a crucial phase, volatility is at the forefront of investor concerns. The balance between buyers and sellers is teetering, with signs pointing to growing unease within the market. Each unsuccessful attempt to rise is further entrenching the prevailing bearish sentiment, prompting many to reflect on the future stability of BTC.

A recent analysis by prominent cryptocurrency researchers indicates a significant struggle among short-term investors. Currently, the average entry price for the BTC 1-3 month holders stands at approximately $113,692, signaling considerable challenges as these investors grapple with substantial losses.

This focus on the spot market highlights a unique group of participants known for their rapid transactions and speculative strategies. This group tends to make moves during times of pronounced market enthusiasm, and their decisions often serve as important indicators of market trends and shifts.

With many holders facing deep losses, the market’s abrupt reversal is evident, emphasizing the pressures on these short-term players. As Bitcoin approaches essential support levels, the actions of this cohort will be pivotal in determining whether the current downtrend stabilizes or accelerates into something more severe.

The Impact of Short-Term Holder Behavior on Market Dynamics

According to findings from Darkfost, the Bitcoin holders active in the last 1-3 months have been navigating a challenging landscape, sitting on unrealized losses averaging between 20% and 25%. Historically, such conditions have often coincided with critical bottom formations in the market.

Reactive in nature, these traders face a challenging choice when losses reach alarming levels: to exit the market and cut their losses, or to hold out for a potential recovery.

In previous cycles, significant loss phases have often preceded substantial turning points. The recent capitulation observed among these speculative traders suggests that selling pressure may soon wane. This transition could open doors for patient investors focused on accumulating Bitcoin at potentially advantageous levels.

However, it is essential to recognize that these patterns are valid only if long-term bullish sentiments remain intact. Analyzing structural on-chain factors, demand trends, and the behavior of long-term holders indicates that Bitcoin’s overarching trend has not been fundamentally altered.

Despite expected short-term volatility, the alignment of capitulation signals with a sustained long-term trend could make current price levels an attractive entry point for strategic investors.

Assessing Bitcoin’s Price Movements and Key Support Levels

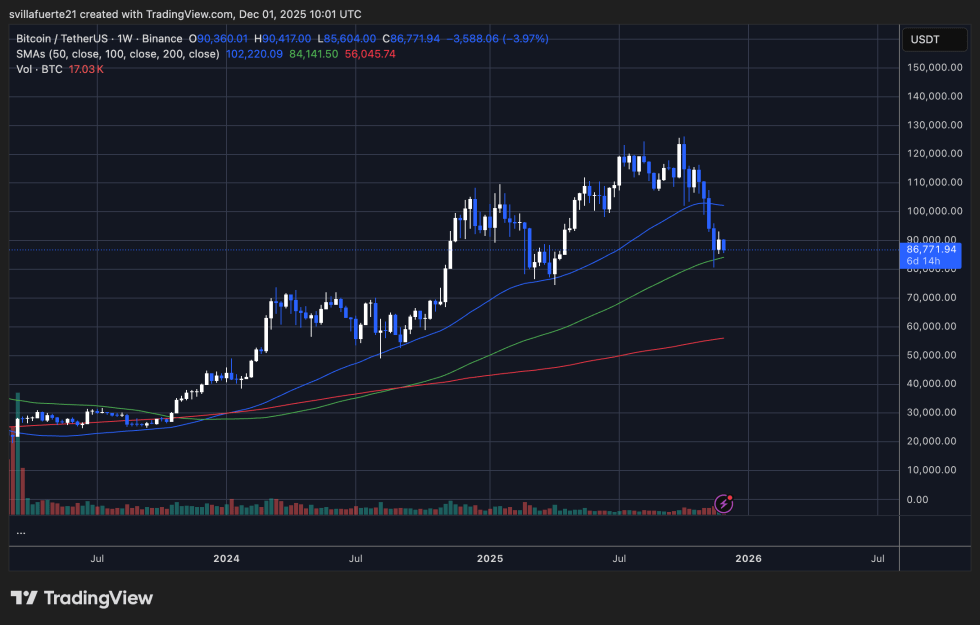

On the weekly chart, Bitcoin exhibits its most considerable corrective move since the early market phases, dropping from the region around $120,000 and seeking stability near the 100 Simple Moving Average (SMA) in the $84,000-$85,000 range. Historically, this level has proven to be a vital support during bull trends, marking a critical turning point in the current market phase.

The breach of the 50 SMA highlighted a significant loss of momentum, indicating that sellers are exerting control over the higher-timeframe structure. Nevertheless, the formation of a wick below the 100 SMA hints that buyers may be coming back into the market, attempting to stabilize prices around this critical point. For a robust recovery, BTC must secure a decisive weekly close above $90,000.

Current trading volumes during this decline reveal a landscape dominated by forced selling rather than a natural trend reversal. Typically, pullbacks toward the 100 SMA signal potential medium-term bottoms in an ongoing bullish market, but this trajectory relies heavily on Bitcoin’s ability to maintain its position above this critical support level.

As the market demonstrates unpredictable trends, traditional investors and savvy traders alike should remain vigilant, monitoring the evolving dynamics to seize the most opportune moments. Insights from market indicators will be essential for making informed decisions in this ever-changing landscape.