The Bitcoin market is facing significant challenges as it attempts to maintain its position near the $100,000 mark. Market analysts note that while some on-chain indicators show promise, the overall sentiment remains shadowed by uncertainty and hesitation among investors. The ongoing conflict between bullish and bearish trends is creating a landscape where price stability is critically at stake.

Experts suggest that the market is undergoing a dramatic transformation. A growing wave of institutional involvement and financial products like Exchange-Traded Funds (ETFs) is reshaping traditional price movements, affecting how traders interpret familiar on-chain metrics.

Despite this shift, certain metrics remain crucial for gauging the market. One notable indicator is Coin Days Destroyed (CDD), which reflects the activity of long-term holders. This metric has garnered attention from analysts like Darkfost, who assert that understanding the buying and selling behaviors of these investors is vital to predicting market trends.

Currently, it is estimated that between 75% and 80% of Bitcoin is held by individuals who have maintained their positions for a long time. This showcases a strong faith in Bitcoin’s future despite periodic fluctuations. Should short-term fears subside, a resurgence in price could be on the horizon, driven by these steadfast investors.

Understanding CDD and Its Impact on Market Movement

Darkfost emphasizes the importance of the Coin Days Destroyed (CDD) metric as a robust tool for assessing market dynamics. CDD measures how long Bitcoin has been held before being transacted, providing a unique insight into market behavior. A rising CDD often indicates that more coins are being held tightly, which can be a precursor for a price surge or shift in market strategy.

The current CDD figures have shown a notable increase, roughly doubling since mid-summer. Historical data indicates that similar trends preceded previous price rallies, underscoring the importance of tracking long-term holder actions within the Bitcoin ecosystem. In a broader context, the ongoing surge in CDD serves as a signal for the considerable activity among long-term holders.

Compared to past cycles, current CDD values have surpassed levels recorded during the 2021 highs, approaching figures from 2017. This implies a unique stage in Bitcoin’s evolution where supply dynamics are subtly shifting among traders, signaling potential changes in market strategy and investor behavior.

Bitcoin is maintaining a price level above $100,000, suggesting a more resilient and liquid market compared to previous years. This adaptability showcases the increasing maturity of Bitcoin, allowing long-term holders to make substantial moves without significantly disturbing the price.

Current Price Range and Market Forecasts

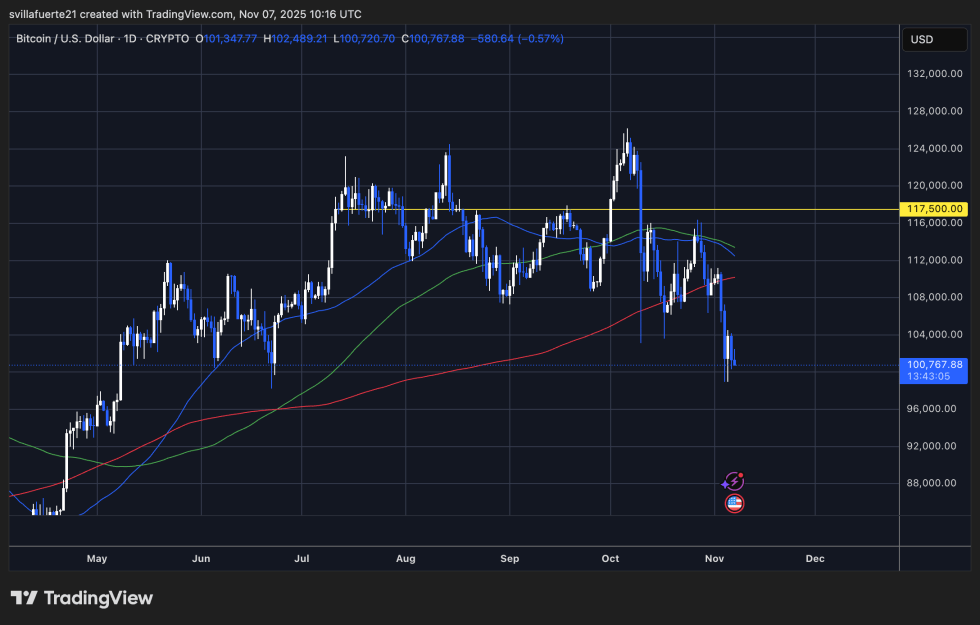

As of the latest trading session, Bitcoin is hovering around $100,767. The market has been on a turbulent track, highlighted by significant selling activity. The latest trends suggest that BTC is once again testing the psychological boundary of $100,000, which investors view as a critical support level to uphold against further downward movement.

Technically, Bitcoin remains positioned beneath its 50-day (blue) and 100-day (green) moving averages, indicating prevailing bearish influences in the short to mid-term spectrum. The 200-day moving average (red), just above $106,000, acts as resistance, reinforcing the ongoing correction landscape that began in the latter part of October.

Achieving a closure over the $103,000–$104,000 thresholds could provide a catalyst for a rebound towards the $108,000–$110,000 range. In contrast, any significant dip below the $100,000 mark could herald a more severe correction, potentially retesting levels around $95,000 and assessing whether market sentiment can consolidate amidst the ongoing fluctuations.

In summary, the current state of Bitcoin exemplifies a complex interplay of long-term strategic investor trends alongside the volatile nature of market sentiment, setting the stage for future price movements.