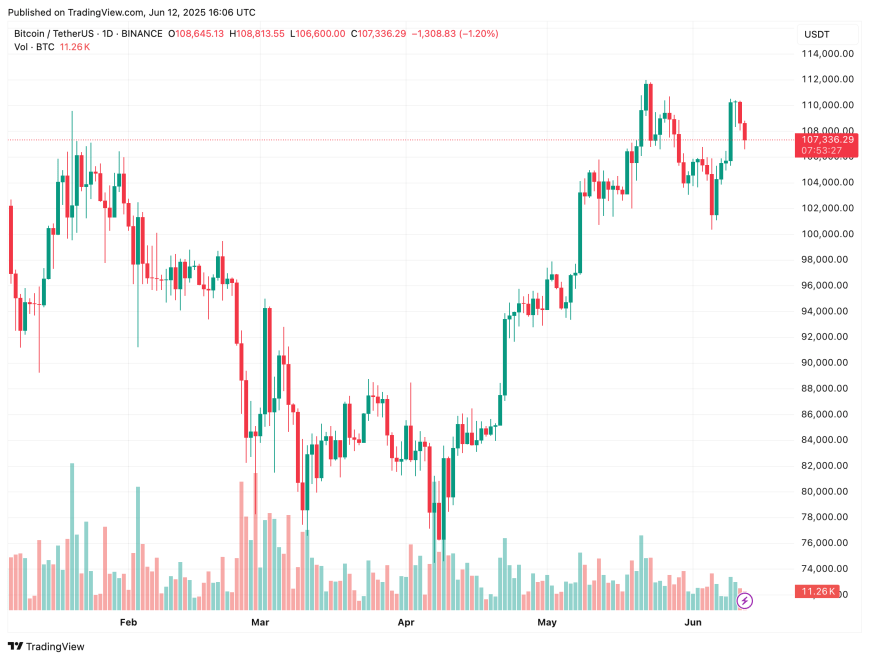

As Bitcoin (BTC) approaches the significant milestone of $110,000, analysts have begun noting crucial indicators that traders should be mindful of. While the current price remains impressively close to a new all-time high (ATH), recent metrics suggest we may be on the verge of a potential shift in market dynamics.

Analyzing Market Divergence

A crucial observation in the crypto landscape is the growing divergence between BTC’s price and the open interest on futures exchanges, particularly Binance. This trend is a signal that could imply a shift in market sentiment.

A recent analysis highlights a stark contrast: while BTC’s value has pushed upwards, the futures market engagement—reflected by Binance’s open interest—has not followed suit. This hesitancy in the futures markets indicates that traders may be adopting a more conservative approach.

The technical analysis underlines this crucial disconnect. While BTC recently attempted to breach the $110,000 barrier following a dip in U.S. inflation rates, Binance’s open interest did not reflect corresponding enthusiasm. The lower open interest suggests a retreat in trader confidence, posing a warning that BTC may face a consolidation phase or even a correction.

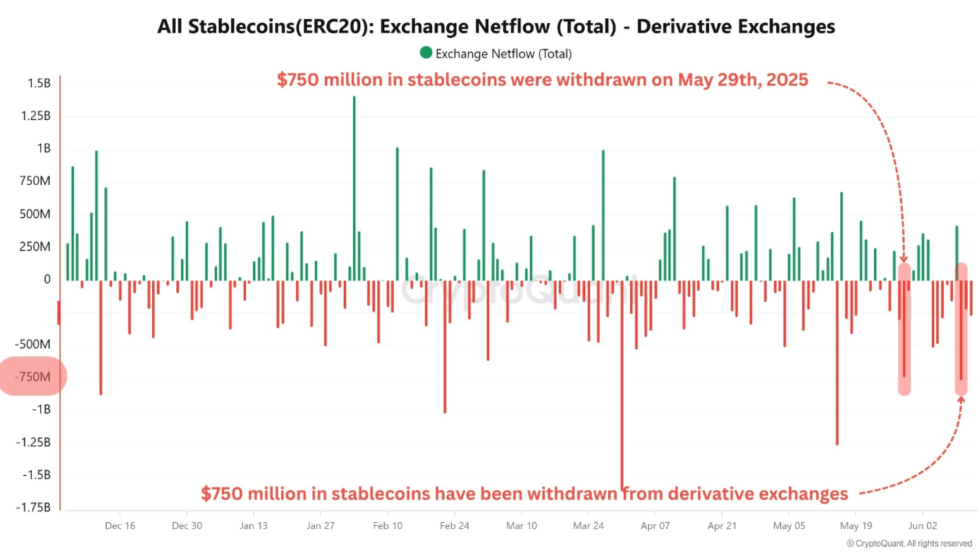

Additionally, data shows significant withdrawals—over $750 million in stablecoins—from derivative exchanges. This pattern mirrors past events that preceded price declines, hinting at possible trader hedging activities or strategic repositioning. As stated by the analyst:

The trend of substantial outflows can serve as an indicator of capital migration. When these occur near significant price peaks, it may suggest an overarching rethinking among traders regarding market positions.

The lack of momentum to surpass previous highs, coupled with the decreasing open interest and stablecoin withdrawals, positions BTC for a potential short-term retraction. However, this doesn’t negate the larger bullish outlook; rather, it signifies a necessary breather in the market’s upward trajectory.

A Bullish Outlook Despite Challenges

Amidst these cautionary signals, the overall BTC market sentiment tends to remain optimistic. Unlike previous surges characterized by retail euphoria, this rally lacks signs of speculative bubbles that often precede market downturns.

Moreover, while recent spikes in miner-to-exchange transfers indicate heightened selling activity from miners, broader economic indicators suggest that the bullish trend may still prevail. Factors such as increased global liquidity strongly correlate with BTC’s price movements, reinforcing a positive long-term view.

At the time of writing, BTC trades around $107,336, reflecting a slight decrease of 2.4% in the last 24 hours, yet continues to hold strong against bearish pressures.