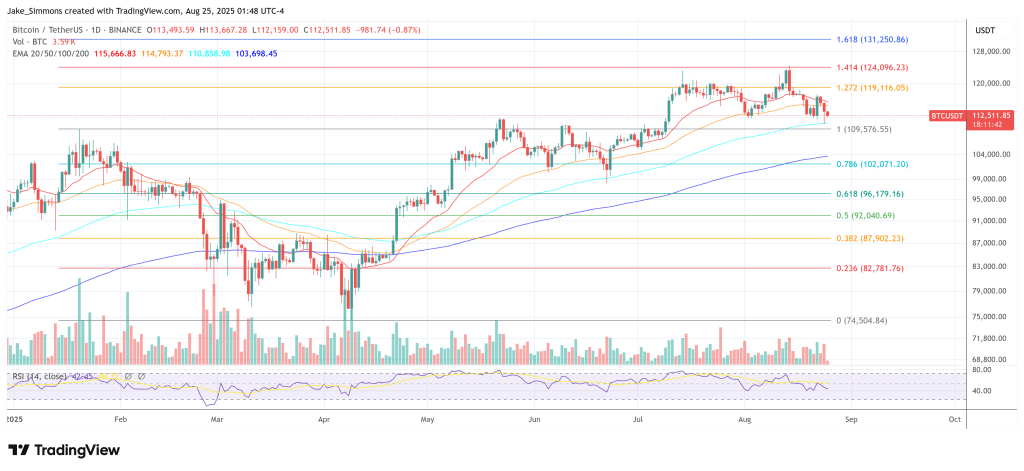

In recent weeks, the cryptocurrency market has witnessed notable fluctuations, particularly with Bitcoin’s price dynamics. Late on a Sunday in August, Bitcoin experienced a sudden decline, falling from approximately $114,790 to $110,680 within a mere ten-minute timeframe — representing a significant drop of about 3.6%. This intense movement quickly drew the attention of market analysts and enthusiasts alike, leading to widespread discussion regarding the driving forces behind this change.

The Underlying Factors of Bitcoin’s Price Movement

Speculation surrounding the dramatic price shift began circulating on social platforms, with insights from notable market observers. One of the key figures in this discussion, a user known as Sani, highlighted the impact of a substantial seller unloading a significant amount of Bitcoin through specific trading links. Reports indicated that a single entity had liquidated their entire balance, setting off a chain reaction of market activity that further contributed to the price decline.

As discussions ensued, analysts investigated the origins of the funds. This specific entity continued to possess a substantial holding of over 150,000 BTC across various addresses, casting doubt on whether this sell-off was a move towards liquidity or merely a strategic reshuffling of assets. Many attributed the source of these funds to historical trading practices, connecting them back to contributions from major exchanges.

The conversation quickly evolved into a debate about ownership and potential motivations behind the liquidation. Users expressed varying opinions on who the seller might be, with one prominent theory suggesting a historical connection to high-profile traders linked to significant cryptocurrency platforms in Asia.

Amid the speculation, another interesting trend caught the eye of market observers: a striking shift in trading patterns towards Ethereum. One account, tracking the movements closely, illustrated how an aggressive trading strategy seemed to pivot from Bitcoin into the Ethereum ecosystem, showcasing a significant rotation that underscored the ever-changing nature of crypto investments.

The urgency to analyze these patterns intensified, with many noting a surge in liquidations across the board. Data from liquidation monitors showed a dramatic flush through the market, particularly impacting Bitcoin long positions. Recent statistics revealed a staggering $218.29 million in long liquidations, marking it as one of the largest liquidative occurrences in recent times.

Adding complexity to the situation, technical analyses suggested that this sudden drop created a new gap in Bitcoin futures trading. Traders recognized that such gaps often prompt additional market movements, indicating potential for future fluctuations. Some market players pondered on the historical precedent of these gaps often driving price corrections or new trends, urging caution but also offering insights into possible future movements.

As the situation continues to unfold, Bitcoin was trading around $112,511, with many traders waiting to see how the market would respond in the coming days. With ongoing analyses and speculations, the landscape remains dynamic and unpredictable, serving as a reminder of the volatility that defines the cryptocurrency world.

Bitcoin price" width="1024" height="471">

Bitcoin price" width="1024" height="471">