As the cryptocurrency market navigates turbulent waters, Ethereum’s recent plunge below the $2,800 threshold is causing alarm among traders and investors alike. This sudden drop invokes fears of a potential lengthy bear market, raising questions about the resilience of Ethereum going forward.

With the prevailing atmosphere becoming increasingly strained, many analysts worry that if Ethereum cannot regain stability soon, we may witness a prolonged downward trend.

Interestingly, amidst the chaos, some significant players in the market are taking a different approach. One such entity is Bitmine, which has been diligently increasing its Ethereum holdings. Despite the market’s downturn, the firm has consistently made substantial purchases over the last few weeks, interpreting the drop as an opportunity rather than a setback.

For many investors seeking signs of hope, Bitmine’s actions are a beacon of cautious optimism. While the overall market structure appears fragile and prices continue to decline, the steady buying activity from an institutional investor hints at possible stabilization and a future rebound.

Bitmine’s Strategy: A Show of Confidence

Recent data from blockchain analytics firm Arkham reveals that Bitmine has remained relentless in its accumulation efforts, recently acquiring over 7,000 ETH valued at roughly $19.8 million. This acquisition is significant and indicates a strong commitment.

This latest round of acquisitions further builds upon weeks of buying activity, underscoring Bitmine’s steadfast belief in Ethereum’s potential, even as prices hit lows not seen for months. Their strategic purchases during such volatile times represent a notable trend in accumulation.

Currently, Bitmine holds approximately 3.43 million ETH, totaling around $9.6 billion at current market prices. This positions them as one of the largest recognized institutional holders of Ethereum. While many investors retreat amid the market downturn, Bitmine is notably increasing its exposure.

Such accumulation from a significant player often signals confidence in the long-term fundamentals of Ethereum, regardless of short-term market fluctuations. For many in the investment realm, Bitmine’s expanding position creates a counter-narrative to the dominant bearish sentiment, suggesting that larger participants may be positioning themselves for a market recovery.

Analyzing Ethereum’s Recent Movements

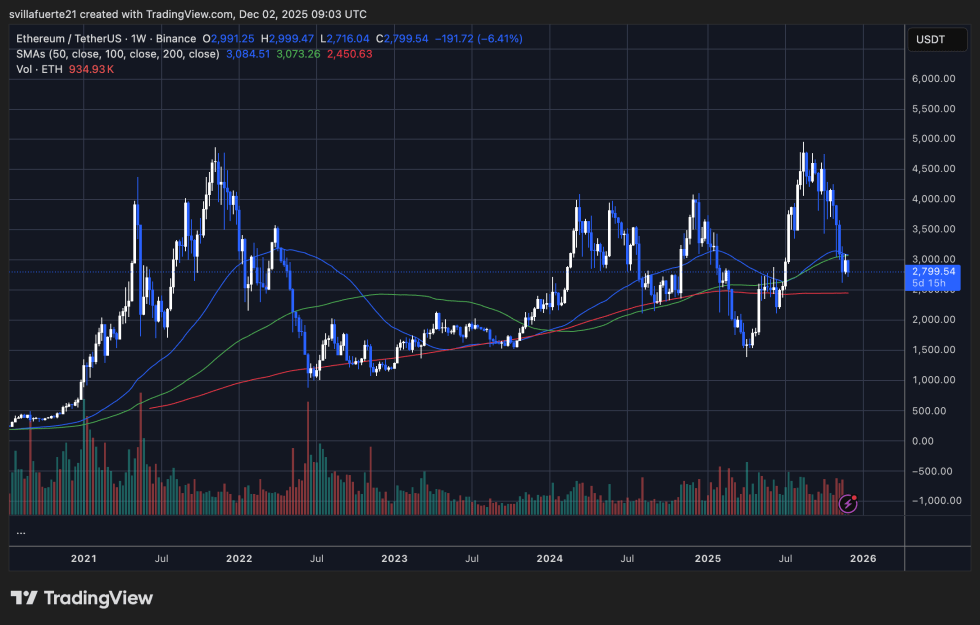

Ethereum’s weekly chart illustrates a striking loss of momentum, as the price has recently dipped below the critical 50 Simple Moving Average (SMA) and is now teetering on the 100 SMA near the $2,750–$2,800 range. This price zone has historically been a critical support level during previous corrections, making the present scenario a pivotal moment for Ethereum’s trajectory. The swift decline from the $4,500 mark showcases one of ETH’s most significant weekly downturns since 2022, underlining the severity of the current sell-off.

The downward curvature of the 50 SMA indicates initial signs of medium-term trend weakness. In contrast, the 100 SMA is stabilizing, serving as the last line of support before the 200 SMA, which rests at $2,450 — representing a significant long-term floor. A decisive weekly close below this 100 SMA could pave the way for a more profound correction toward that critical support level.

As trading volume spikes during this downturn, the dynamics of the market are shifting, reflecting forced selling driven by liquidations rather than planned profit-taking strategies. However, the emergence of long lower wicks around the $2,700 area suggests that buyers are actively trying to maintain support.

Image credits: ChatGPT, chart from TradingView.com