Ethereum is currently hovering around the $4,400 mark, showcasing stability after a recent weekend momentum that saw it reach new all-time highs. This impressive ascent was largely driven by robust institutional interest and an upbeat market atmosphere. However, the price has experienced some adjustments over the past two days, indicating a return to testing lower support levels. Regardless of this brief pullback, ETH continues to be a focal point in the cryptocurrency landscape, with both optimistic and cautious investors keenly awaiting the next pivotal movement.

Market analysts find themselves at an impasse. Some suggest that Ethereum’s capacity to hold above the $4,400 mark indicates a strong foundation for a potential climb towards $5,000. In contrast, others express concerns about possible signs of buyer fatigue, suggesting that a shift in market sentiment could trigger a more significant correction.

Enhancing the unfolding narrative, data from blockchain analytic platform Lookonchain disclosed that Bitmine, the largest corporate holder of Ethereum, has recently acquired an additional 4,871 ETH, valued at approximately $21.28 million. This acquisition elevates Bitmine’s total Ethereum holdings to an impressive figure, underscoring the trend of significant institutional accumulation.

The interplay of whale activity, escalating institutional interest, and the unpredictable nature of short-term price fluctuations highlight a crucial moment for Ethereum. The decision whether ETH will ascend into unprecedented territories or face declining pressures will significantly impact the broader altcoin ecosystem.

Institutional Interest Fuels Positive Market Sentiment

According to Lookonchain, Bitmine’s current holdings of 1,718,770 ETH, valued at around $7.65 billion, solidify its position as a leading corporate holder in the Ethereum market. This trend of accumulation by institutions, highlighted by actions from other firms like Sharplink Gaming and Bit Digital, has become emblematic of the present market cycle. Such significant institutional engagement strengthens the bullish outlook for Ethereum, establishing it as a pivotal player for those seeking long-term growth opportunities.

In addition to the accumulation, broader macroeconomic dynamics and a clearer legal environment in the US are essential factors influencing Ethereum’s trajectory. This improved regulatory landscape is enticing more institutions to engage with ETH, which is increasingly recognized not just as a stalwart of decentralized finance but also as an asset bolstered by growing legitimacy. This evolving perception is contributing to mounting expectations for Ethereum’s performance in the forthcoming months.

Simultaneously, the tightening liquidity conditions cannot be overlooked. Reports indicate diminishing balances of ETH across exchanges, while over-the-counter (OTC) services like Wintermute note a rapid decline in available reserves. This trend suggests that institutional and long-term holders are absorbing supply, resulting in a reduced quantity of coins in circulation.

The combination of heightened institutional demand, clearer regulations, and a narrowing supply presents a compelling backdrop for Ethereum. Although short-term price swings may remain a factor, the underlying fundamentals indicate a market poised for potential breakthroughs toward new heights.

Technical Indicators Reflect Possibility for Continued Growth

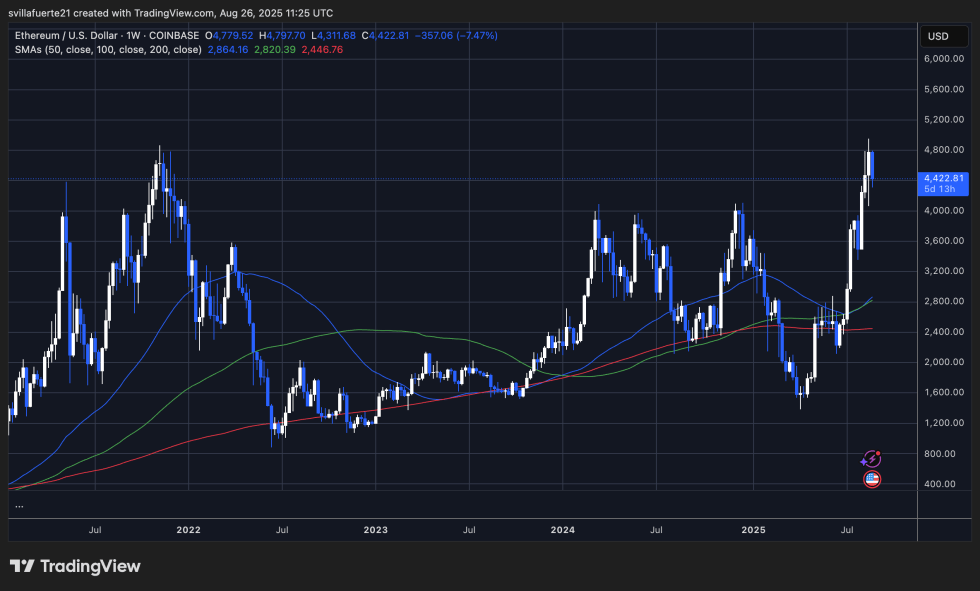

Examining the weekly chart of Ethereum unveils a significant moment for the asset, currently undergoing a critical test following its surge beyond $4,800. After this rally, ETH has experienced a correction and now trades around $4,422, demonstrating a healthy, albeit volatile, pullback following sustained weeks of growth. Despite this downturn, the overarching chart patterns still suggest a bullish framework for ETH.

The upward trajectory of the 50-week moving average, marked by a blue line, reveals renewed momentum after months of market stabilization earlier this year. Moreover, the 100-week (green) and 200-week (red) moving averages remain significantly below the current price point, reinforcing the notion that ETH is operating within a strong macro uptrend. Recent price retracements appear to be finding support within the breakout zones of $4,200–$4,400, which could develop into a new established base if bullish sentiment prevails.

Key takeaways include Ethereum’s successful navigation away from a prolonged consolidation period seen between 2022 and early 2025, during which the price lingered below $3,000. This resistance zone has now transformed into robust support, indicating Ethereum’s capacity to maintain higher valuations in the ensuing months.

Image courtesy of Dall-E, chart sourced from TradingView.