BitMine, a publicly listed firm known for its proactive investment approach, has achieved the status of the second-largest cryptocurrency treasury globally. Currently, the company possesses over $6.6 billion in Ethereum (ETH), accounting for 1.52 million tokens, which represents approximately 1.26% of the overall ETH supply.

This achievement highlights BitMine’s strategic investment philosophy, distinguishing it from other institutional players in the crypto market. Notably, the company has aspirations to increase its holdings to 5% of Ethereum’s total supply, and they have already reached 25% of this ambitious objective.

The announcement is poised to make a significant impact on market perceptions and attract institutional investors. As Ethereum continues to cement its role as a critical component of Web3, it is encouraging corporations to view ETH not merely as an investment but as a strategic asset. BitMine’s strategy reflects the same determination previously associated with Bitcoin treasury strategies but emphasizes Ethereum in the rapidly evolving digital finance landscape.

BitMine Solidifies Its Ethereum Holding Position

With recent acquisitions, BitMine has established itself as the most significant holder of Ethereum treasury, accumulating ETH valued at over $6.6 billion, an increase from $4.9 billion just a week earlier. This sharp rise demonstrates the company’s commitment and belief in Ethereum’s enduring value. The treasury now constitutes 1.52 million ETH, reinforcing BitMine’s supremacy in corporate Ethereum holdings.

On a global level, BitMine is the second-largest crypto treasury entity, following the prominent strategy of Michael Saylor, known for extensive Bitcoin holdings. This landmark move emphasizes the evolving dynamics of institutional crypto adoption, perceiving Ethereum as an essential reserve asset rather than merely a smart contract platform.

Remarkably, BitMine’s ETH holdings now exceed those of Sharplink Gaming, The Ether Machine, and The Ethereum Foundation combined, marking a pivotal shift in the competition for treasuries where firms are diversifying their crypto portfolios beyond Bitcoin.

This trend appears set to accelerate, as ETH is gaining traction, backed by robust institutional interest, ETF inflows, and expanding use cases in decentralized finance and tokenization of real-world assets. Analysts predict that if BitMine sustains its momentum, its treasury approach might redefine how companies strategize their long-term reserves in the digital economy.

Ethereum Undergoing Significant Market Dynamics

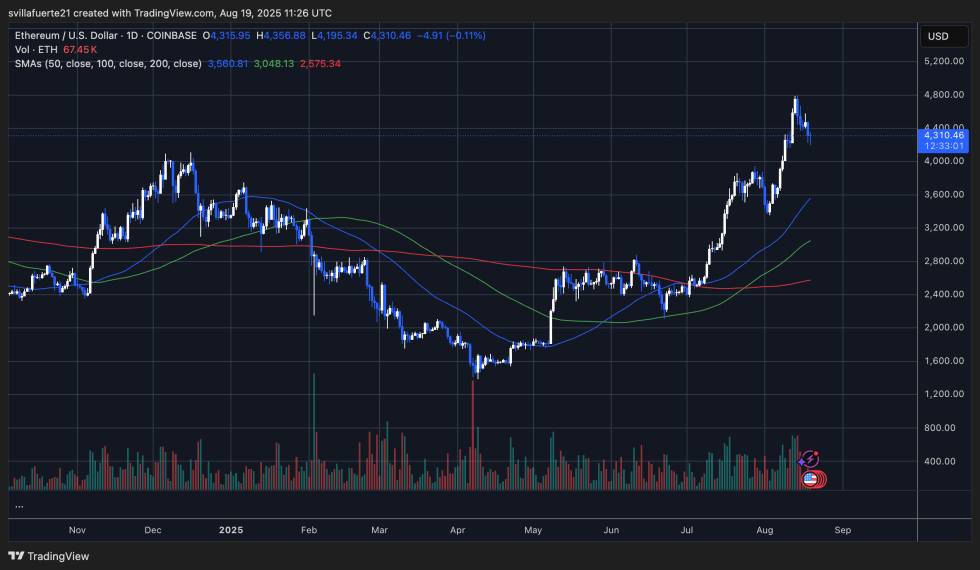

Ethereum is currently trading close to $4,310 following a pullback from its latest high of over $4,790. Recent market data suggests that ETH is undergoing a consolidation phase after a period of strong upward momentum, testing crucial support levels.

The 50-day moving average indicates an upward trend, currently near $3,560, significantly below present price levels, reinforcing the overall bullish market structure. Meanwhile, 100-day and 200-day moving averages positioned at $3,048 and $2,575 respectively, further support the notion of solid long-term support. This technical alignment hints that despite recent fluctuations, Ethereum’s broader market trajectory remains one of potential growth.

If ETH holds its ground above current levels, a rebound towards resistance between $4,600 and $4,800 seems probable in the near term. Conversely, a drop below established support could pave the way for a more substantial decline toward the $3,800 mark. The upcoming trading sessions are crucial in determining Ethereum’s future direction.

Image credit: Dall-E, chart sourced from TradingView.