In recent developments, BitMine Immersion Technologies (BMNR) has significantly amplified its Ethereum (ETH) portfolio, showcasing a commitment to digital assets in today’s evolving market. This surge reflects a growing trend among companies investing heavily in cryptocurrencies.

BitMine Expands Ethereum Holdings Exponentially

Recent reports indicate that BitMine has acquired an additional 46,225 ETH, propelling its total holdings beyond the remarkable threshold of 2.1 million ETH. This acquisition, valued at over $200 million, underscores the firm’s strategic approach to accumulating digital assets.

On September 8, BitMine made waves in the cryptocurrency world by purchasing 202,500 ETH, marking a pivotal moment as its holdings surpassed two million. The company has set an ambitious goal to secure 5% of the total ETH supply, aiming for a larger share of the digital currency market.

Positioned on the New York Stock Exchange, BitMine’s aggressive acquisition strategy has propelled its total ETH holdings to approximately $9.27 billion. This substantial investment places BitMine at the forefront of institutional cryptocurrency adoption.

According to recent data from Coingecko, BitMine boasts the largest ETH reserve among publicly traded companies. SharpLink holds a distant second place with 837,230 ETH, followed by notable players such as Coinbase and Bit Digital. Interestingly, the majority of these leading firms are based in the United States, highlighting the country’s pivotal role in the ETH ecosystem.

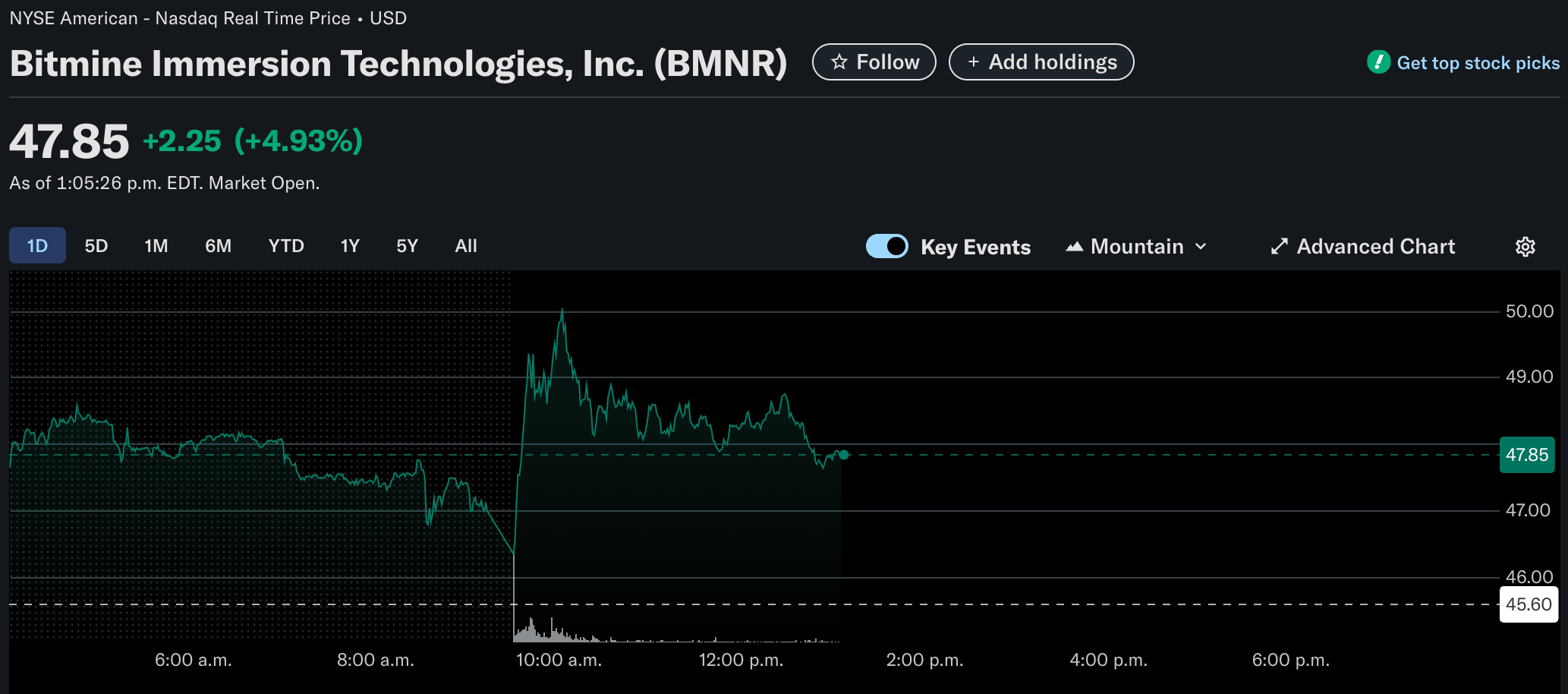

Following the latest purchase, BitMine’s stock, BMNR, has experienced a robust increase of 4.93%, trading at $47.85. Notably, the stock has surged an impressive 559% year-to-date, emerging as one of the standout performers in the crypto-related stock market this year.

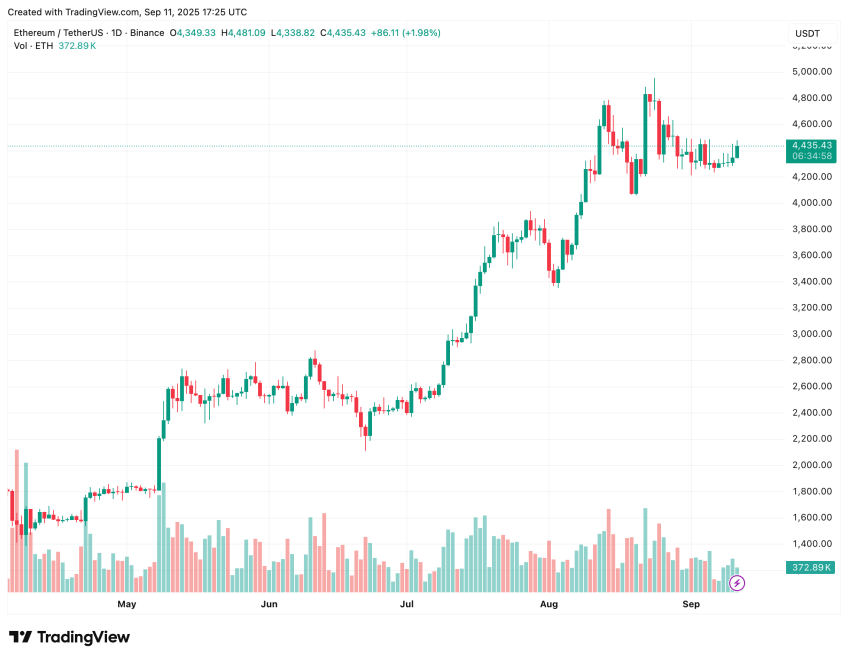

The Rising Tide of Ethereum Among Cryptocurrencies

As firms increasingly gravitate towards Ethereum, the narrative surrounding cryptocurrency investment is evolving. While Bitcoin (BTC) remains the largest digital currency by market capitalization, Ethereum is capturing significant attention as an alternative asset.

This trend isn’t limited to BitMine. Just yesterday, Robin Energy, based in Cyprus, revealed it had invested $5 million in ETH, signifying the rising adoption of this digital asset.

Other companies are following suit as well; SharpLink recently enhanced its ETH holdings by 56,533 tokens, and Yunfeng Financial, linked to Jack Ma, invested nearly $44 million into ETH, showcasing the diverse interest in the cryptocurrency space.

As staking activities on the Ethereum network continue to proliferate, analysts believe that the potential for further price appreciation in ETH remains strong. Currently, ETH is trading at $4,435, reflecting a 1.5% increase in the last 24 hours.