In recent developments, Nasdaq has initiated the process to launch a new investment vehicle, the BlackRock iShares Bitcoin Premium Income ETF. This innovative fund is designed to bolster income generation by utilizing strategies such as selling options linked to bitcoin assets.

The initial filing was made on September 30, 2025, with the SEC now in the phase of gathering public comments as part of its review process.

Structure and Portfolio of the Trust

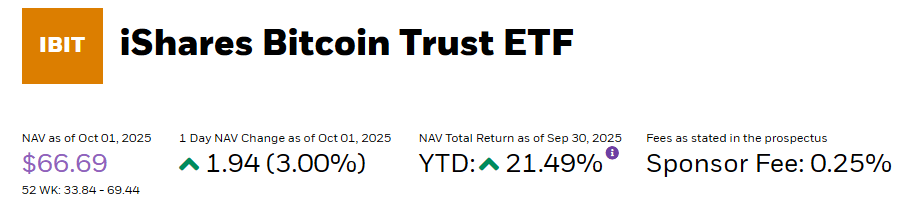

According to the Nasdaq details, this Trust primarily consists of bitcoin, equity stakes in BlackRock’s iShares Bitcoin Trust (IBIT), liquid assets, and premiums garnered from options transactions on IBIT or related indices tracking spot bitcoin ETPs.

This ETF is characterized as an actively-managed product, with the intent for it to be classified as a publicly-traded partnership for U.S. federal taxation purposes.

The filing stipulates a minimum liquidity requirement of 80,000 Shares to commence trading and outlines trading hours from 4:00 a.m. to 8:00 p.m. ET. This bold move by BlackRock aligns with a growing trend among financial institutions to explore income-generating crypto investment options.

News reports indicate that the ETF will implement a covered call strategy, aimed at providing consistent income to investors more focused on yield than speculation on price movements.

Market analysts suggest that while this strategy may cap upside potential during bullish trends, it can provide steady returns in fluctuating or declining markets.

Understanding the Covered Call Strategy

At its core, the covered call strategy is relatively simple but carries inherent risks. This Trust would possess IBIT and bitcoin holdings, simultaneously engaging in selling call options against those assets to earn premiums.

If these call options are exercised prematurely, the filing specifies that IBIT shares may be transferred to option clearers; alternative OTC options are to be settled in cash.

This blend of tangible assets and options income is designed to yield a product that functions distinctly from traditional spot ETFs.

Observers note this isn’t BlackRock’s inaugural foray into bitcoin investment; IBIT has established itself as a pivotal instrument for U.S. investors since its introduction, rapidly amassing significant funds and facilitating broader acceptance of bitcoin in regulated investment spheres.

This successful history positions BlackRock favorably as it introduces this new income-centric offering aimed at both retail and institutional investors.

Looking Ahead: Regulatory Considerations

The upcoming steps are procedural yet crucial. The SEC has invited public feedback and will evaluate whether the proposed ETF meets Nasdaq’s regulatory standards and investor safeguards.

Should the SEC necessitate modifications—potentially regarding disclosures on OTC options or daily NAV practices—both Nasdaq and BlackRock would need to address these before any trading can be initiated.

Featured image from Finance Feeds, chart from TradingView