In recent developments, a prominent financial entity has made significant strides in enhancing its holdings of both Bitcoin (BTC) and US Dollar (USD) assets. Read on to discover the details of these major expansions.

Enhancements in Bitcoin and USD Holdings

According to a recent update from the firm’s co-founder and chairman, the company has successfully acquired an additional 1,287 BTC for a substantial investment of $116.3 million, as disclosed in their report to the US Securities and Exchange Commission (SEC).

This wasn’t a single purchase; rather, it involved various transactions with 3 BTC acquired at the end of December and the bulk of 1,283 BTC bought at the beginning of January. Consequently, the firm’s total Bitcoin holdings have reached an impressive 673,783 tokens.

Along with the Bitcoin acquisitions, the firm has also initiated a USD reserve aimed at ensuring timely dividend distributions, particularly during periods of market instability. A recent expansion has further solidified this reserve.

To kickstart this initiative, the company originally set aside $1.44 billion for the USD reserve. Following an impressive addition of $748 million a few weeks back, the reserve has now increased by another $62 million, bringing the total to $2.25 billion. These expansions have been largely financed through sales from its at-the-market (ATM) stock offerings.

This firm currently stands as the largest corporate holder of Bitcoin globally, a fact well-documented by various financial analytics sources.

As it stands, the value of the firm’s Bitcoin stash is approximately $63.48 billion, representing a significant 25% appreciation over its initial investment of $50.55 billion. However, despite this overall positive trend, the previous year presented considerable challenges for the company.

The official SEC filing highlights an unrealized loss of $5.40 billion on the firm’s digital assets as of December 31st. The numbers worsen for the fourth quarter alone, reflecting an unrealized loss of $17.44 billion.

This downturn can be attributed to the bearish market conditions observed throughout the final months of 2025. Nevertheless, the company has chosen not to liquidate any of its holdings, indicating a strong commitment to its treasury strategy.

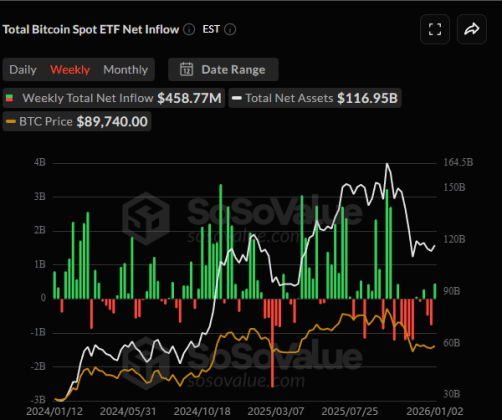

In related news, Bitcoin spot exchange-traded funds (ETFs) have recently experienced the highest net inflows since October, signaling renewed interest in this investment vehicle.

Spot ETFs are designed to offer investors indirect exposure to Bitcoin’s price fluctuations, serving as a popular option for those preferring a less direct investment strategy. This method has become particularly attractive to institutional investors.

Although interest in spot ETFs has dwindled since October, last week marked a departure from this trend, witnessing net inflows of around $458.77 million.

Current Bitcoin Pricing

As of now, Bitcoin is valued at approximately $94,200, reflecting an increase of 8% over the course of the last week.