This week, Bitcoin surged past $100,000, peaking at $104,000 before stabilizing around $103,000. This movement was sparked by news of upcoming discussions between U.S. and Chinese officials in Switzerland regarding a potential trade deal. The market reacted positively, fostering renewed optimism, and Bitcoin climbed accordingly. However, analysts emphasize that the underlying factor is global liquidity.

Global M2 Hits $111 Trillion

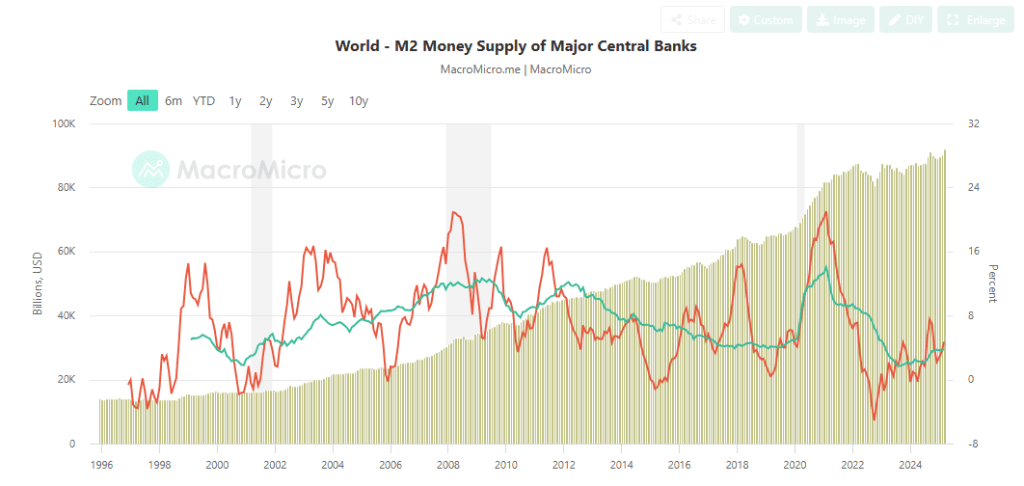

Julien Bittel, a macroeconomic analyst at Global Macro Investor, believes that the global M2 money supply serves as a prominent indicator for Bitcoin’s trajectory. He shared a graph showing a consistent 12-week delay between rising M2 figures and Bitcoin’s price movements. Essentially, when M2 rises, Bitcoin tends to follow about three months later.

Many of you have been asking for the updated Global M2 vs. Bitcoin chart. Here it is…

And indeed – it reaffirms the same narrative:

We’re on the way up… pic.twitter.com/kv7QSE9iGN

— Julien Bittel, CFA (@BittelJulien) May 9, 2025

From early 2023 to early 2024, the global M2 money supply rose from $98 trillion to just above $108 trillion, coinciding with Bitcoin finally surpassing the $100,000 threshold. However, by mid-2024, M2’s growth slowed down temporarily.

During that slowdown, Bitcoin experienced a decline, dipping below $80,000, which Bittel described as a consolidation phase. Presently, M2 is on the rise once more—surpassing $111 trillion. If this trend continues, BTC could keep climbing through mid-2025.

Bittel stated, “We’re on the rise,” attributing this to the significant increase in global M2.

Others See Bitcoin as the Leader

Contrary to Bittel’s predictions, analyst Benjamin Cohen expresses skepticism about the assumption that Bitcoin consistently lags behind changes in liquidity. He noted that Bitcoin reached its peaks in 2017 and 2021 before M2 did, which contradicts the idea of M2 leading by 12 weeks.

Cohen proposes a different angle: Bitcoin may actually lead the M2 changes, indicating that any current price increase might predict a possible decline in global liquidity in the months ahead.

What if #Bitcoin leads liquidity, rather than trailing it?

A number of people use this chart, offsetting global M2 by 3-4 months, showing BTC in response to it.

The issue is that in 2021, this offset indicates M2 continued to rise for 6 months after BTC peaked. pic.twitter.com/gpkbW9jboG

— Benjamin Cowen (@intocryptoverse) May 8, 2025

Aftershocks from FTX Collapse

Cohen also recalled the significant drop in Bitcoin’s value in 2022, which aligned with a low point in M2; however, the decline lingered longer due to the fallout from the FTX crisis. He argued that Bitcoin’s price movements don’t always adhere to the same timeline as M2, as external failures like exchange collapses can disrupt established patterns.

This perspective offers a potentially different forecast. If BTC is indeed lagging behind, the current rally could suggest potential risks ahead rather than signs of strength.

Featured image from Pexels, chart from TradingView