As we reflect upon the world of cryptocurrency, one date stands out: August 11, 2020. This was a pivotal moment for Bitcoin, marking a significant shift in the perception and utility of digital currencies.

Though Bitcoin had existed for over a decade, it was on that summer day that Michael Saylor, the then-CEO of MicroStrategy, made headlines by investing a substantial $250 million in Bitcoin. This bold move not only drew attention but also redefined Bitcoin’s role in finance.

Prior to this announcement, Bitcoin was seen primarily as a store of value; post-announcement, it emerged as a serious option for long-term investment.

Bitcoin would never look the same again.

This transformative moment raises questions about Bitcoin’s trajectory and its implications for everyday investors: Can Bitcoin transform into a hybrid of currency, investment, and secure asset?

We delve deeper into this below.

The Evolution of Bitcoin Treasuries

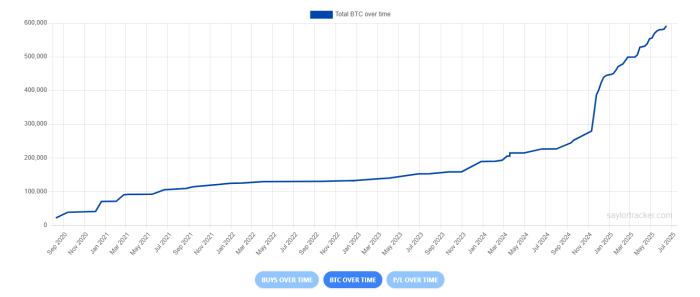

MicroStrategy didn’t stop at the initial investment; they continued to accumulate Bitcoin, fostering an environment where using Bitcoin as a reserve asset became increasingly normal.

Gradually, this notion began to expand across various sectors — organizations ranging from sovereign nations like El Salvador to tech giants such as Tesla embraced Bitcoin.

Currently, over 235 companies and institutions hold substantial Bitcoin reserves, with MicroStrategy leading the charge with 592,000 BTC valued at over $62 billion. Tesla, Coinbase, and even various governments have joined the ranks as significant Bitcoin holders.

This marks a transition where Bitcoin is treated similarly to traditional assets such as gold or bonds, evolving into a strategy centered on diversified investment rather than mere accumulation.

Let’s explore this further.

Diversifying with Bitcoin Treasuries

The strategies surrounding Bitcoin have grown beyond simple hoarding habits.

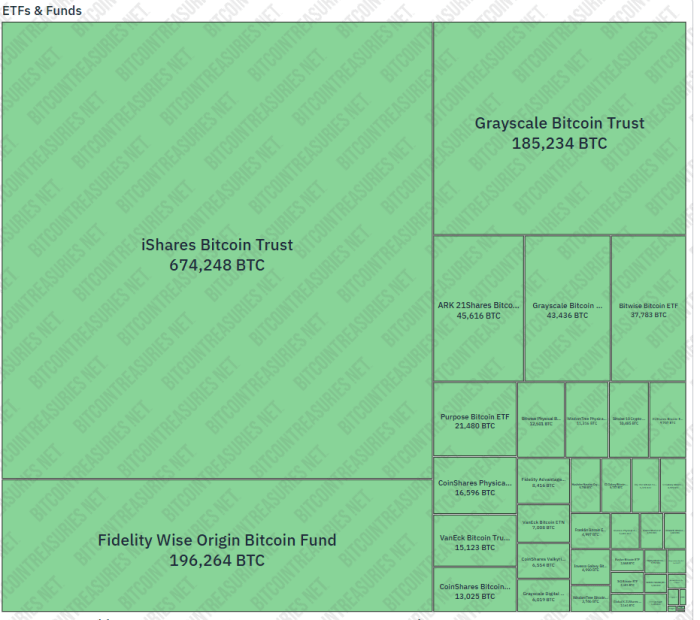

A notable portion of Bitcoin’s total supply is now being utilized in ETFs and mutual funds.

These investment vehicles offer investors exposure to Bitcoin’s potential without involving the complexities of cryptocurrency wallets or seed phrases. A straightforward account with any brokerage suffices to capitalize on Bitcoin’s growth.

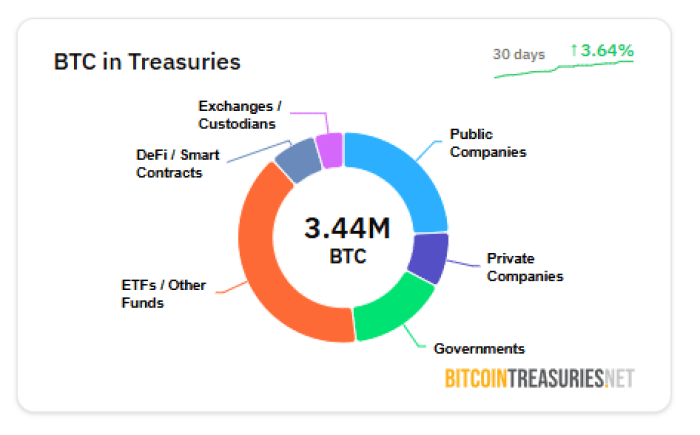

Additionally, the trend isn’t confined to publicly listed enterprises like MicroStrategy. Numerous governments also hold significant quantities of Bitcoin, sometimes acquired through enforcement actions and seizures.

In instances like that of the U.S., these holdings form part of organized national Bitcoin reserves.

Indeed, governments are among the largest Bitcoin holders, trailing only behind dedicated ETFs and public companies in total holdings.

The narrative is evolving; Bitcoin has transitioned from a niche investment to a formidable asset class. Meanwhile, Solana treasuries are gaining traction as well. The DeFi Development Corp ($DFDV) has accumulated over 620,000 $SOL, witnessing impressive stock growth of around 4,000%.

Solana’s treasuries leverage yield generation and decentralized finance (DeFi) mechanisms, presenting a more integrated model compared to Bitcoin’s traditional treasury strategies.

From Bitcoin ($BTC) to altcoins like Solana, the treasury model is carving a future where all digital currencies serve multiple purposes—being a currency, a store of value, and a potential avenue for growth.

Furthermore, the BTC Bull Token, an innovative Bitcoin meme coin, emerges as a significant player shaping this dynamic landscape.

BTC Bull Token ($BTCBULL) – The Meme Coin with Bitcoin Promise

The developments surrounding Bitcoin treasuries, investments, and the increasing demand for digital assets paint a compellingly optimistic outlook for the cryptocurrency.

BTC Bull Token ($BTCBULL) seeks to harness this momentum for mutual profit.

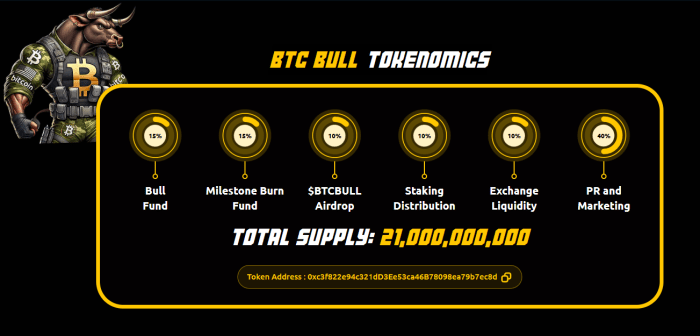

The unique tokenomics of this project incorporate a clever mix of crypto airdrops and token burns designed to ensure that $BTCBULL moves in alignment with Bitcoin. Every time Bitcoin ascends by $25,000, $BTCBULL reacts accordingly.

- $125K, $175K, $225K – Strategic token burns for deflationary pressure on prices

- $150K, $200K – Airdrops of BTC tokens to $BTCBULL holders in the Best Wallet

- $250K – Special airdrops of $BTCBULL for dedicated holders anticipating Bitcoin’s substantial gains

So, what exactly is BTC Bull Token? It’s a strategic venture that encapsulates the bullish potential of Bitcoin.

Investors earn as Bitcoin climbs, enhancing the value of meme coins. Additionally, milestone airdrops provide free Bitcoin rewards. There’s even an attractive staking opportunity with a 56% APY during the presale.

Envisioning a future where Bitcoin captures multiple roles translates into endless potential for a dedicated Bitcoin meme coin. Our projections estimate $BTCBULL could reach $0.0187 by 2026, marking a significant rise of 627% from its current value of $0.00257.

Explore our comprehensive guide on acquiring $BTCBULL and visit the presale page for more details.

Envisioning a Future where Bitcoin Dominates

What do you envision for Bitcoin? Will it be recognized as a universal currency? Countries like El Salvador are already paving the way by accepting it as legal tender.

Do you see Bitcoin as the ultimate store of value? With an average annual return (AAR) of 230%, it far surpasses the S&P 500’s mere 10% AAR, making it an attractive option.

Are you interested in establishing a Bitcoin treasury to combat inflation? The trend is established with growing interest from various sectors.

Get prepared for a world where Bitcoin serves diverse functionalities, and harness this imminent reality with BTC Bull.

Always conduct thorough research; this content should not be interpreted as financial advice.