BTCS Inc., a prominent player in the Ethereum (ETH) blockchain space, recently announced its ambitious plan to raise up to $2 billion through stock sales. This significant move was revealed in an S-3 registration statement filed with the SEC, outlining the company’s intentions to enhance its cryptocurrency portfolio.

BTCS’s Ambitious Fundraising Initiative

In a recent filing with the U.S. Securities and Exchange Commission, BTCS aims to raise $2 billion via multiple share offerings. The company intends to leverage these funds to bolster its digital assets and expand its operational footprint.

The offering will allow BTCS to sell common shares, capped at a total of $2 billion. In the SEC filing, the firm stated:

Our goal is to utilize the proceeds from this sale for the acquisition of digital assets, enhancing our working capital, and fulfilling other corporate needs.

Furthermore, BTCS has also filed to resell over five million shares connected to previous convertible notes and warrants, expecting to gain approximately $12 million from this initiative.

Throughout 2025, BTCS has consistently added to its ETH holdings. Recently, they acquired 14,420 ETH, pushing their total reserves to 70,028 ETH, valued at around $275 million.

Data from CoinGecko indicates that BTCS ranks fifth among public companies holding significant ETH treasuries, trailing behind BitMine Immersion Technologies, which boasts an impressive 566,776 ETH.

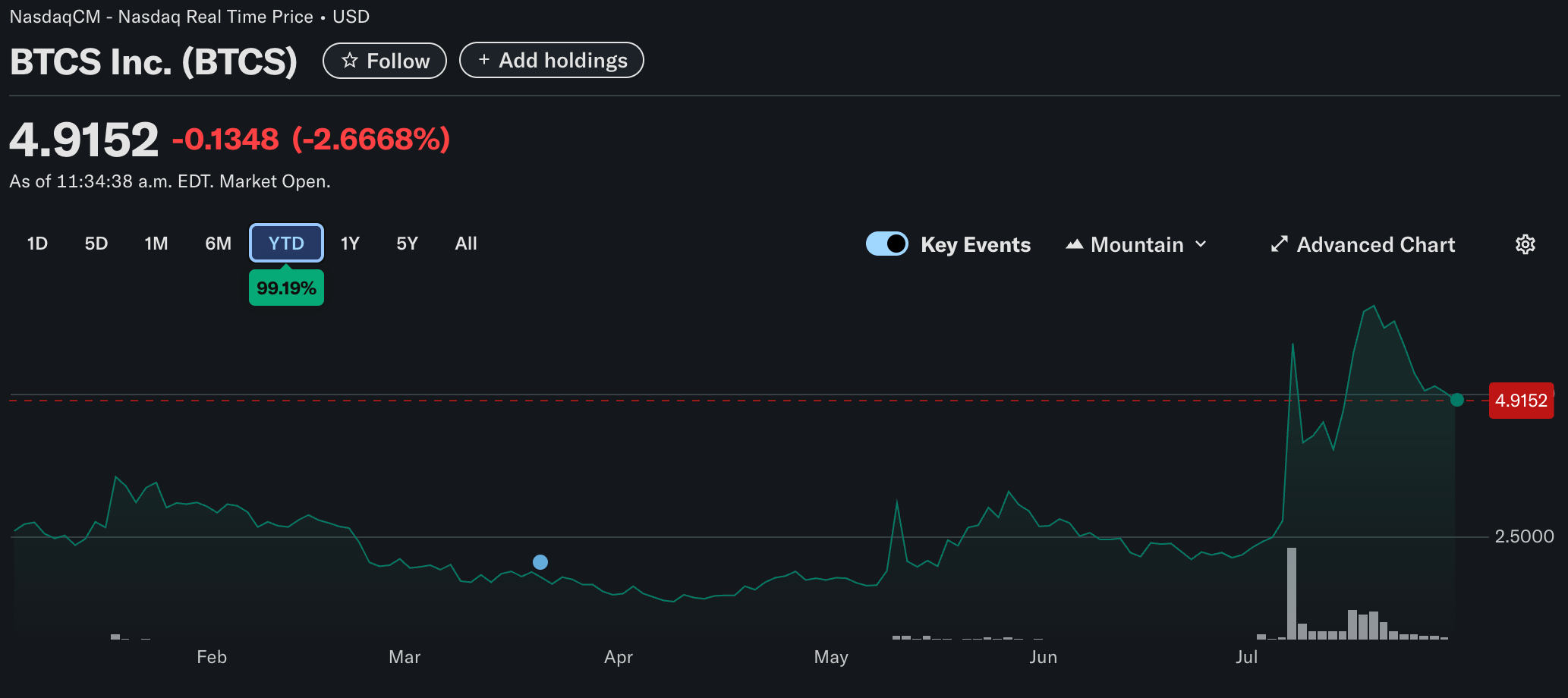

Currently, BTCS shares experienced a minor dip, trading 2.6% lower at $4.91. Nevertheless, the company has seen an impressive year-to-date increase of nearly 100%.

Ethereum Accumulation Trends in 2025

The previous years may have been dominated by companies like MicroStrategy and Tesla hoarding Bitcoin (BTC), but this year is poised to be notable for Ethereum acquisitions.

Another Nasdaq-listed company, SharpLink Gaming, recently added 79,949 ETH to its assets, bringing its digital asset total to a substantial 360,807 ETH as part of a broader strategy to invest up to $5 billion in more ETH.

Moreover, Bit Digital expanded its holdings by purchasing 19,683 ETH, utilizing proceeds from a $67.3 million share sale. GameSquare is also making waves, investing $5 million into ETH as part of its treasury strategy.

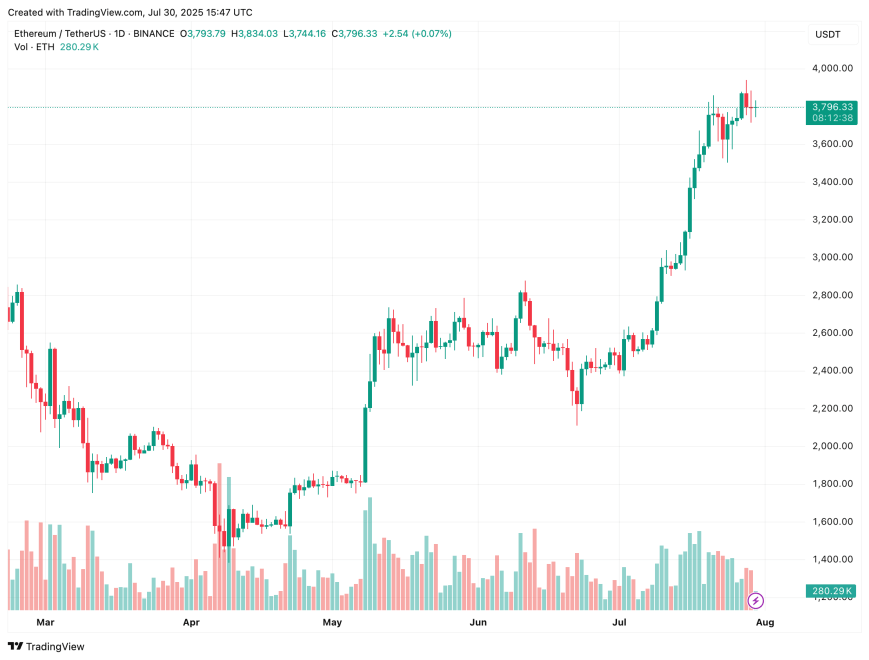

In a related note, interest in spot Ethereum ETFs is surging, outpacing inflows seen in BTC ETFs. As of now, ETH is trading at $3,796, reflecting a 0.8% increase over the past 24 hours.