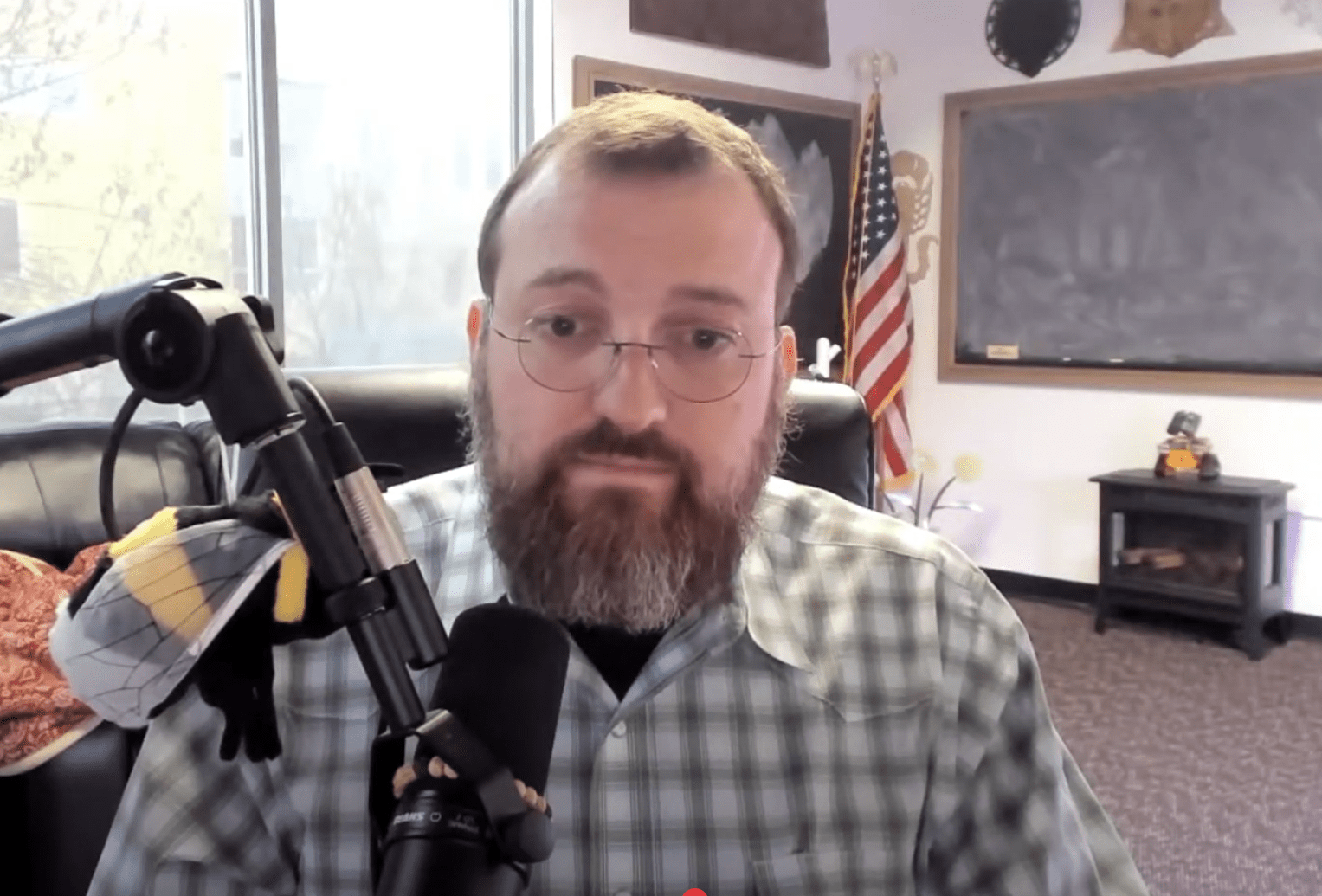

In a recent discussion, Charles Hoskinson spotlighted Argentina as a pivotal area for Cardano’s growth, attributing its potential to a mix of favorable political changes and a thriving crypto economy. He emphasized that after extensive groundwork in Africa, the timing couldn’t be better for Cardano to capitalize on opportunities in Latin America.

Why Argentina Is Key for Cardano

“Argentina may soon be a leading example of adopting private cryptocurrency over centralized options,” Hoskinson remarked, highlighting the innovative landscape compared to other nations. He revealed that around $100 billion of Argentina’s total GDP is now interacting with cryptocurrency, showcasing a significant shift in the economic framework.

Hoskinson credited these developments to the visionary leadership of President Javier Milei, who is seen as a transformative figure. “Our ally in Argentina, Milei, is not letting the people down,” he asserted. “He is actively opening the economy,” marking a contrast to his more critical view of leaders in other countries.

Moreover, Hoskinson drew a sharp distinction with El Salvador, which gained notoriety for integrating Bitcoin as legal tender. He described the landscape there as undermined by authoritarianism, questioning the authenticity of its crypto initiatives. “That’s not true Bitcoin—where’s the transparency?” he asked, pointing to the discrepancies in governance.

In Argentina, however, Hoskinson perceives an environment that aligns with Cardano’s core values, asserting that Milei is not merely permitting crypto but fostering a financial ecosystem that diminishes reliance on central banks.

Cardano has strategically positioned itself in this emerging market. “We’ve established the largest crypto office in Buenos Aires, with a dedicated team,” he mentioned. This robust setup not only bolsters Cardano’s presence but also suggests the seriousness with which local authorities view the platform. “They recognize our commitment to shaping the future of blockchain in Latin America,” he added.

Reflecting on previous setbacks in Africa, particularly in Ethiopia, Hoskinson noted that valuable lessons have been gleaned. “We’re still committed to Africa,” he confirmed, “but we’re taking a more informed approach this time, focusing on grassroots fintech initiatives.”

As for Argentina, Hoskinson expressed confidence in the nation’s readiness for widespread adoption of blockchain solutions. “We are poised to seize this opportunity—our strategic plans are already in motion,” he declared.

At the time of his remarks, ADA was valued at $0.645, highlighting ongoing opportunities in the cryptocurrency space.