In the evolving landscape of finance, stablecoins are gaining traction as a key player connecting digital currencies and traditional finance (TradFi). Their significance in the ecosystem is becoming increasingly evident as various sectors recognize their potential.

Recent predictions suggest a promising future for stablecoins, with significant institutional investments and regulatory developments paving the way for growth. Analysts have pointed out that the stablecoin market capitalization could rise dramatically, potentially reaching an impressive $4 trillion by 2030.

Examining the Future of Stablecoins

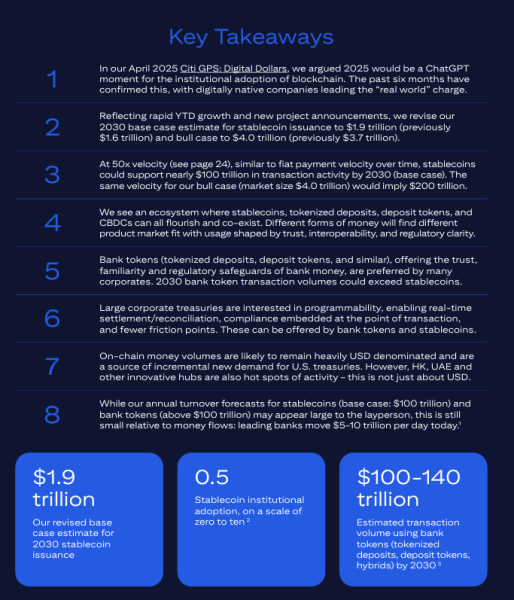

Research from leading financial institutions, such as Citi, indicates a shift in the market dynamics. Their latest study estimated stablecoin issuance could achieve a base case of $1.9 trillion by the decade’s end. In an optimistic scenario, that figure might soar to $4 trillion.

Expanded usage of stablecoins could usher in a massive surge in transaction capabilities, potentially facilitating annual transaction volumes near an astounding $100 trillion. This could outstrip the current operational landscape significantly, leading to unparalleled efficiencies.

However, the transition isn’t devoid of challenges. Many enterprises exhibit reluctance, often viewing stablecoins as experimental tools rather than essential components of their financial infrastructure. Existing payment mechanisms in various regions already operate efficiently, which leads to skepticism about adopting new methodologies.

Interestingly, a major opportunity exists in the realm of cross-border transactions, where current inefficiencies could see substantial improvements through stablecoin integration. Nevertheless, experts note that the usage of tokenized bank deposits might even outpace that of stablecoins by 2030.

Tokenized bank assets—deposits and similar instruments—offer trust and regulatory compliance that many businesses prefer over traditional stablecoins, highlighting a potential shift in market dynamics.

The potential for marked growth in the stablecoin market is underpinned by ongoing discussions amongst governments about establishing robust frameworks for regulation. This includes stipulations for the issuance, backing, and redemption of these instruments.

Europe’s Strategic Initiatives in Stablecoins

In an effort to maintain competitive parity, several European banking institutions—including names like UniCredit and ING—are collaborating to launch a euro-backed stablecoin, set to debut by late 2026.

This initiative, which will be based in the Netherlands, aims to enable the region to assert more independence from the growing dominance of U.S. dollar-pegged tokens. Concerns regarding the reliance on foreign digital currencies for payments have escalated, prompting this strategic move.

Along with aligning with the EU’s MiCA regulation, the project aims to foster liquidity and build trust among users while underpinning European monetary sovereignty amid increasing global competition.

Exploring the Best Wallet Token ($BEST)

The Best Wallet Token ($BEST) emerges as a vital asset within this landscape. It represents a non-custodial solution designed for users to securely manage, exchange, and transfer their tokens.

The $BEST utility token rewards holders with lower transaction fees and enhanced staking rewards. Moreover, it provides access to exclusive crypto presales, allowing users to engage in promising projects with ease.

As the landscape continues to evolve, users have the opportunity to invest in the Upcoming Best Card, which aims to simplify cryptocurrency transactions, enhancing overall user experience.

With substantial potential on the horizon, the next few years will be crucial in determining whether stablecoins can solidify their role in global finance. As we move forward, it’s vital for investors and users alike to be equipped with the right tools, and Best Wallet strives to empower participants in this evolving space.

Authored by an Industry Expert on Bitrabo —