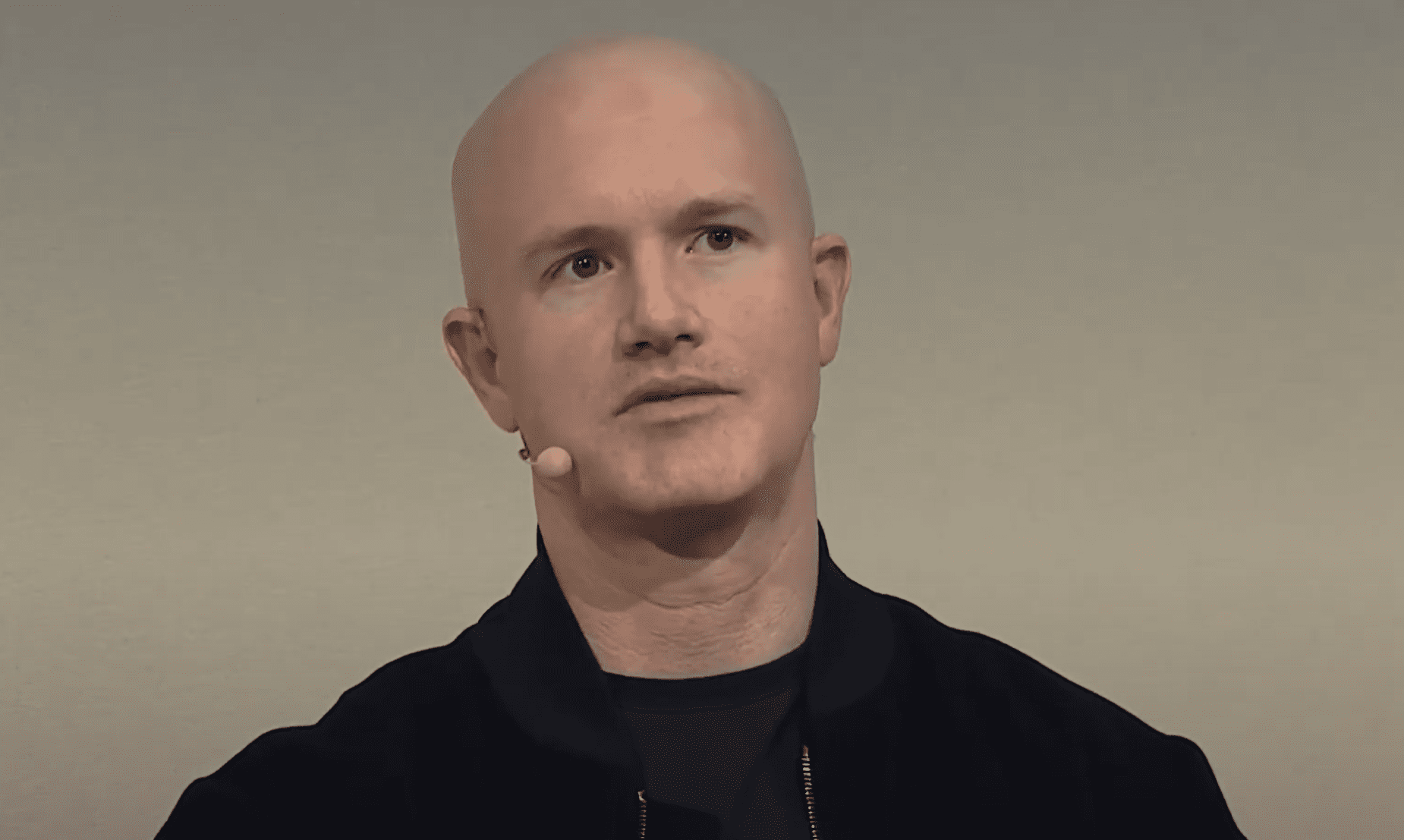

In a major announcement during the recent Annual State of Crypto Summit held on June 12, Coinbase co-founder and CEO Brian Armstrong presented a visionary perspective: Bitcoin may one day challenge the US dollar as a primary global asset. This revelation, made before a gathering of legislators, investors, and developers in New York, sparked discussions about the future role of cryptocurrencies in economic structures. Armstrong tweeted about his vision, indicating a strong belief in Bitcoin’s potential to reshape financial systems.

The Future of Currency: Bitcoin as a Possible Reserve Asset

Armstrong articulated the dual functions of money: serving as a medium of exchange and as a store of value. He highlighted that while dollar-pegged stablecoins excel at facilitating transactions, traditional fiat currencies struggle with long-term value retention. “Countries are facing tremendous challenges in managing their fiscal policies,” he stated, prompting him to share what he refers to as “my unconventional proposition.”

He emphasized that if public debt continues to escalate, Bitcoin might emerge as a safeguard against rampant fiscal irresponsibility. In uncertain economic climates, he argued, individuals might gravitate towards Bitcoin, potentially positioning it as the predominant reserve currency worldwide. This conclusion stems from Bitcoin’s inherent cap of 21 million coins, which in Armstrong’s view acts as a crucial limit on government overspending and monetary policies.

The backdrop to his assertion lies in the staggering US national debt—currently around $37 trillion—having increased nearly $4 trillion in just over a year. Armstrong has been vocal about impending risks associated with national deficits, positing that failure to address these issues could lead to a significant migration from traditional currencies to cryptocurrencies. Earlier, he had called for the US government to initiate a comprehensive strategy for a “strategic Bitcoin reserve” in a blog post.

The sentiment expressed by Armstrong resonated strongly with attendees, particularly following an unexpected keynote from former President Donald Trump. Trump reiterated the importance of Bitcoin within national economic strategy, asserting that legislative measures were underway to promote dollar-pegged stablecoins and ensure America takes the lead in the evolving crypto landscape. He took pride in being considered the first “crypto president,” signaling a notable shift in governmental attitudes towards digital currencies.

Since taking office, the administration has shown commitment to this vision, with Trump having signed an executive order aimed at establishing a Strategic Bitcoin Reserve as well as a dedicated US Digital Asset Stockpile. This initiative mandates the Treasury to procure and consolidate Bitcoin, reinforcing a proactive approach to digital asset management. Recently, Bo Hines, Executive Director of the President’s Council of Advisers on Digital Assets, revealed plans for unveiling detailed strategies regarding the Strategic Bitcoin Reserve, signaling swift developments in the arena of crypto governance.

At the close of the conference, Bitcoin’s market value stood at an impressive $104,876, reflecting growing investor confidence and interest in this digital asset’s long-term potential.