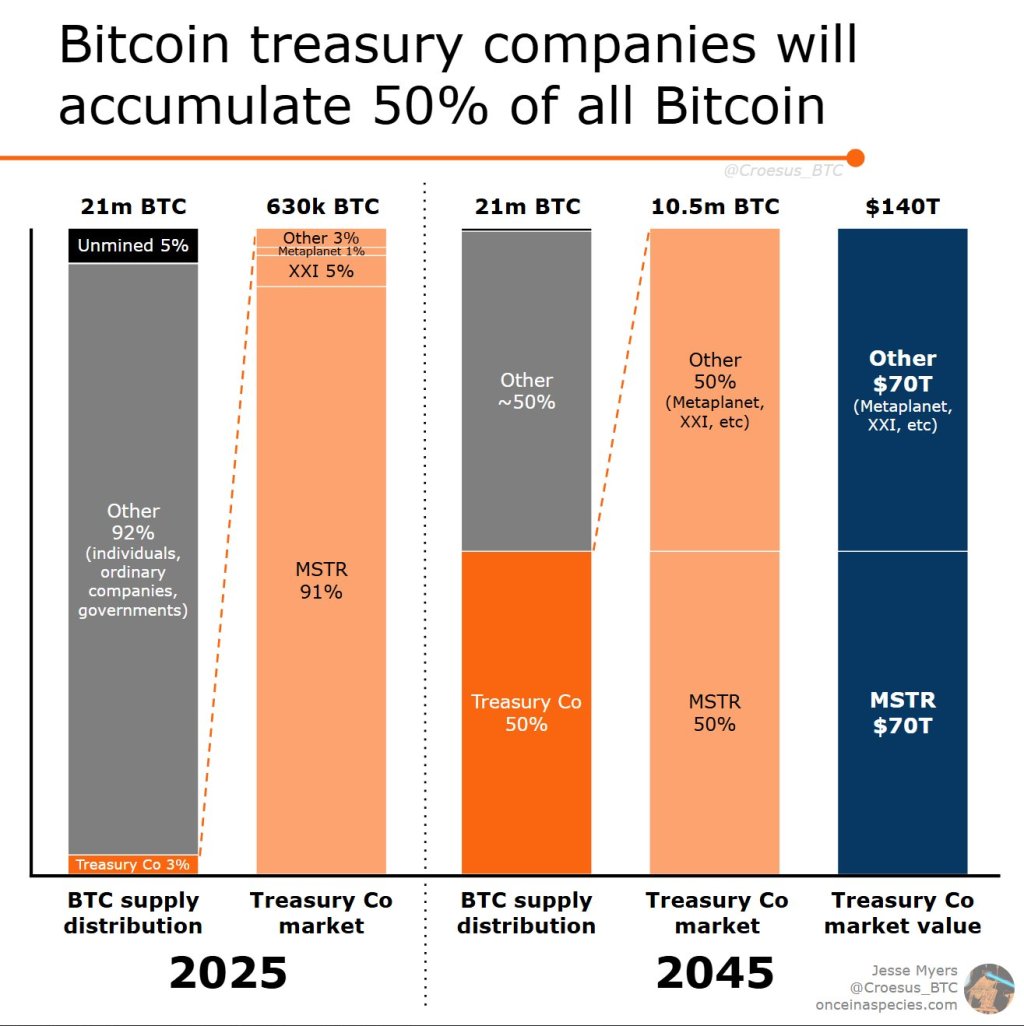

Recent comments by industry veteran Jesse Myers have stirred fresh discussions on the evolving landscape of corporate investment in Bitcoin. Sharing insights with his vast audience of 92,400 followers on X, he declared, “A corporate strategy could hold $70 trillion worth of Bitcoin by 2045, establishing itself as the most valuable entity in history.” He elaborated that “Bitcoin Treasury Companies are poised to possess 50% of all BTC, a reality that may catch many Bitcoin enthusiasts off-guard.”

The Rise of Treasury Firms Targeting Bitcoin

In a fascinating discussion on X, Myers envisioned a future where dedicated treasury vehicles—primarily public firms focusing on leveraging inexpensive fiat to increase their Bitcoin holdings—become the primary buyers of Bitcoin through 2045. This notion, partly inspired by the thoughts of renowned entrepreneur Michael Saylor, is gaining traction.

“A significant portion of capital seeks the optimal store of value. Currently, Bitcoin stands as the most favorable SoV asset,” Myers quoted Saylor, referencing his projection of a $280 trillion market cap in the next two decades, suggesting an impressive value of approximately $13 million per Bitcoin.

MicroStrategy, recently rebranded as Strategy, provides a compelling example of this trend. The firm has amassed approximately 550,000 BTC, utilizing innovative fundraising through high-yield preferred stock programs to accelerate its purchases.

The financial machinery driving this accumulation is institutional, with two distinctive offerings—Strike (STRK) and Strife (STRF)—offering yields of eight and ten percent, terms almost unbeatable in traditional markets. Proceeds upwards of $1.27 billion from these issuances are dedicated to further Bitcoin investment.

Myers posits that such financing structures transform Strategy into a “capital magnet,” attracting the interest of bond investors from a colossal pool estimated at $318 trillion into Bitcoin. Should growth align with Saylor’s forecasts, Strategy could secure five million BTC, roughly one quarter of the total supply by 2045.

Moving beyond Strategy, other firms are joining the wave. Notably, Japan’s Metaplanet has recently expanded its treasury to 7,800 BTC following a substantial bond sale, aiming for a target of 10,000 BTC by the end of this year. Similar strategic maneuvers from prominent players like 21 Capital—backed by significant entities such as SoftBank, Tether, and Bitfinex—reinforce Myers’s assertion of an emerging industry.

Myers’ analysis estimates current treasury holdings at about three percent of total Bitcoin supply, equating to roughly 630,000 BTC. However, this figure could swell to an astounding fifty percent—10.5 million BTC—by 2045, with remaining portions shared among governments, traditional companies, and individual investors. At a projected value of $13 million per Bitcoin, the corporate segment could command a market worth of $140 trillion; with Strategy’s portion potentially exceeding $70 trillion.

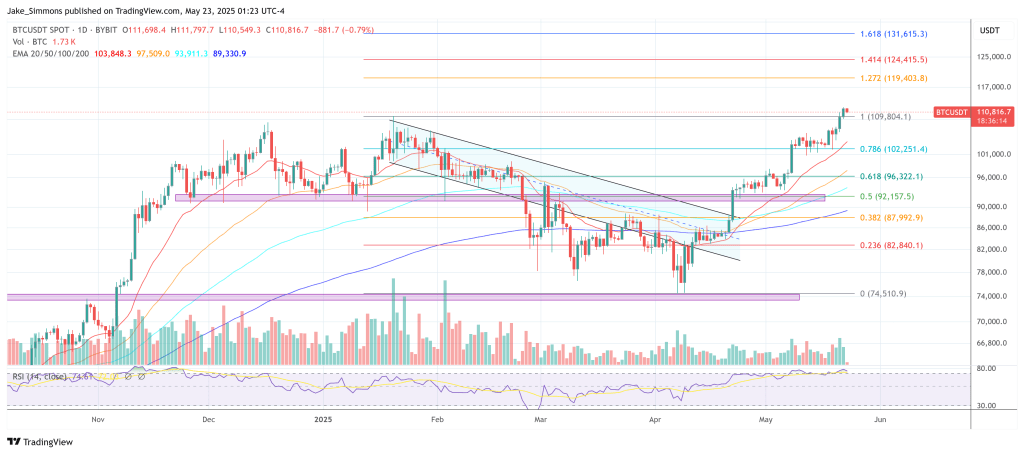

As of now, Bitcoin’s trading value sits at approximately $110,816, painting a compelling picture of its potential in the institutional landscape.