Recent analytics reveal that the total Unrealized Loss in the cryptocurrency market has reached an astounding $350 billion, highlighting Bitcoin’s notable share in this figure.

Significant Rise in Unrealized Loss Amidst Market Downturn

According to a recent update by Glassnode, a leading on-chain analysis provider, the current Unrealized Loss reflects the potential losses investors are experiencing on their holdings. This metric provides an insight into market sentiment and investor behavior during volatile times.

This metric is derived by analyzing transaction histories of various tokens to determine their historical selling prices. If the last known price a token was sold for is lower than its current market price, that token is considered to be at a loss.

The Unrealized Loss is calculated by totaling the difference between the last selling price and the current market price of all tokens that are currently valued below their purchase price.

Conversely, there is also an indicator known as Unrealized Profit, which tracks the supply of tokens that have increased in value since their acquisition.

Below is a comparative chart illustrating the trends in Unrealized Loss across the cryptocurrency landscape, including Bitcoin, over several years:

The analysis shows a significant hike in Unrealized Loss after the market downturn that began last October. As investors feel the pressure of unfavorable market conditions, the loss peaked at around $350 billion, with Bitcoin alone accounting for roughly $85 billion. These statistics reflect the challenging emotional landscape for many investors.

According to Glassnode:

With a variety of on-chain metrics pointing towards decreasing market liquidity, we expect a period of heightened volatility in the upcoming weeks.

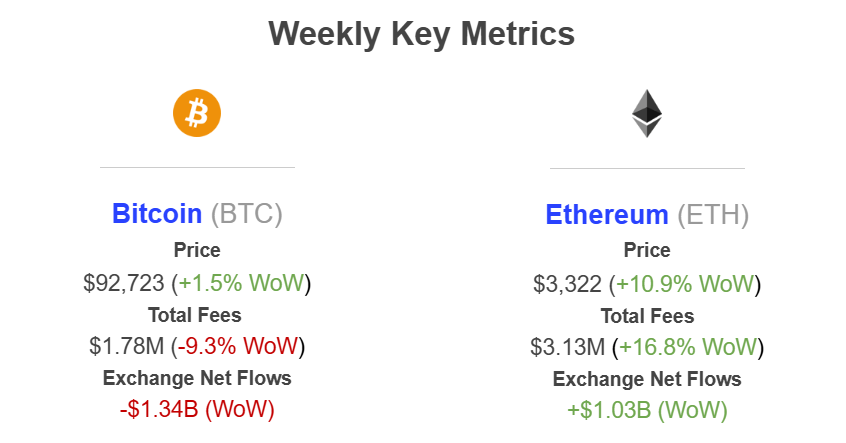

In related news, Bitcoin and Ethereum are exhibiting contrasting trends in their Exchange Netflow data this week, as noted by institutional DeFi service provider Sentora in a recent post.

The data reveals that Bitcoin’s Exchange Netflow showed a significant negative value of -$1.34 billion in the last week, indicating that centralized exchanges have experienced net withdrawals.

Conversely, Ethereum’s Exchange Netflow displayed a sharp increase, with a positive value of $1.03 billion. This inflow suggests that many investors are looking to leverage the services offered by exchanges, which can often lead to a bearish outlook for prices when large amounts are deposited.

Current Bitcoin Pricing Trends

Bitcoin has struggled to maintain a price level above $92,000 and has reverted to around $90,000.