In a landmark move, the Securities and Exchange Commission (SEC) has unrolled the ambitious initiative known as Project Crypto, led by Chair Paul Atkins. This initiative aims to revolutionize the regulatory landscape for digital assets, addressing the urgent need to modernize existing securities regulations. By promoting an on-chain financial system, the SEC looks to empower both investors and companies, breaking free from legacy frameworks that often hinder innovation.

Legal expert Jake Chervinsky, now the Chief Legal Officer at Variant Fund, has shared his insights on this pivotal development. He indicates that Project Crypto opens the door for a supportive regulatory environment, encouraging the growth of crypto with clearly defined guidelines. Among the crucial focal points are frameworks for the issuance of tokens, comprehensive custody solutions, and the establishment of decentralized finance (DeFi) protocols for securities trading.

Although immediate changes to current laws are not anticipated, Project Crypto lays the groundwork for a robust regulatory structure that promises to redefine the American digital asset ecosystem. With a timeline of approximately three and a half years for implementation, the SEC faces a significant challenge. Nonetheless, many industry leaders view this as a foundational step towards establishing the United States as a dominant player in the global crypto arena.

Chervinsky’s Vision for Project Crypto

In a recent comprehensive discussion on social media, Chervinsky highlighted the significant opportunities that Project Crypto presents. He pointed out that the initiative signifies a forward-thinking approach from the SEC, promoting rather than hindering innovation. Under the guidance of Chair Paul Atkins, the SEC is prioritizing this initiative, indicating a broader shift toward fostering creativity in the financial technology sector.

Chervinsky underscored that although the announcement lacks immediate legal impact, it directs SEC staff to hone in on critical domains: creating safe harbors for new token offerings, approving custody and trading possibilities, and structuring on-chain securities markets that utilize DeFi solutions. A well-articulated safe harbor could simplify the process for token creation and distribution, steering clear of outdated securities laws.

The potential for broker-dealers and investment advisers to manage and trade crypto assets could vastly open up the market, counteracting restrictive norms from the past. Chervinsky also highlighted the unmet promise of DeFi-driven on-chain securities markets, which remain largely underexplored due to earlier regulatory obstacles.

For Project Crypto to come to fruition, a thorough rulemaking process will be essential—this means drafting, public discussion, and finalizing new regulations. Chervinsky stresses the importance of this timeline, as the launch of new products may complicate future amendments. Under the direction of Commissioner Hester Peirce, the groundwork laid by the Crypto Task Force sets the stage for what Project Crypto is poised to deliver.

Concluding his remarks, Chervinsky asserted that although the implementation will require years of effort, sustained cooperation between the crypto community and the SEC is crucial to ensure that Project Crypto yields lasting benefits, positioning the U.S. as a leader in crypto innovation.

Current Altcoin Market Overview: Analyzing Support Levels

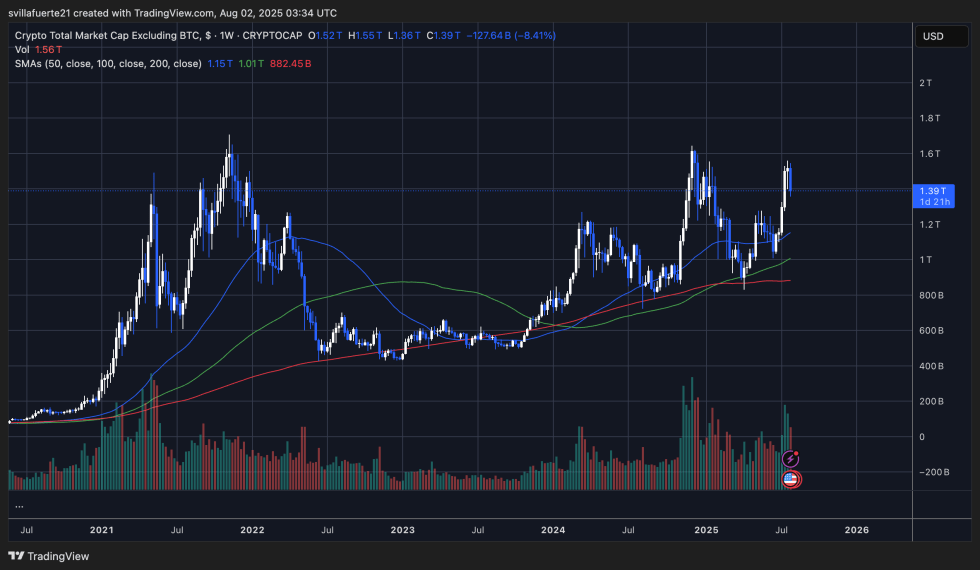

The total market capitalization of altcoins, excluding Bitcoin (TOTAL2), has recently seen a notable decline of 8.41%, settling at around $1.39 trillion after peaking at $1.55 trillion. This notable downturn follows a series of bullish trends, where altcoins had shown remarkable gains. The data indicates that TOTAL2 is currently testing the critical 50-day moving average at approximately $1.15 trillion, with the 100-day moving average at $1.01 trillion serving as a significant structural support level.

Despite the recent turbulence, the overarching upward trend remains intact. The market cap is firmly above the crucial 200-day moving average, which continues to indicate a long-term bullish outlook. However, the resistance challenge at the $1.5 trillion mark reveals increasing caution within the altcoin space as traders adjust their strategies.

Trading volume has surged during this correction phase, pointing toward aggressive selling activities. Analysts are monitoring the $1.35 trillion to $1.4 trillion range closely as a potential area of demand. Should buyers manage to maintain stability above this threshold, the market might enter a consolidation phase prior to another attempt at upward movement. Conversely, a breach below this level would likely expose TOTAL2 to further declines, potentially targeting the next support zone around $1.2 trillion.

Image credits: Featured image sourced from Dall-E, with market data referenced from TradingView.