Recent insights from the on-chain analytics firm CryptoQuant have shed light on the critical Bitcoin indicators that reveal the underlying market dynamics.

Key Bitcoin Indicators to Monitor

In an engaging update shared on X, CryptoQuant elaborates on the importance of on-chain data in deciphering the true narratives of Bitcoin movements, moving beyond mere price fluctuations. The firm identifies five crucial Bitcoin indicators that drive deeper market understanding.

One of the standout indicators is the “Realized Price,” which gives an idea of the average cost basis for all BTC investors. Historically, it serves as a significant support or resistance threshold for Bitcoin’s price movements.

There are various iterations of this metric, notably the Realized Price for short-term holders, which is critical for understanding market sentiment among newer investors.

The graph indicates that Bitcoin’s current trading value exceeds the Realized Price for short-term holders, signifying that this group is experiencing net gains.

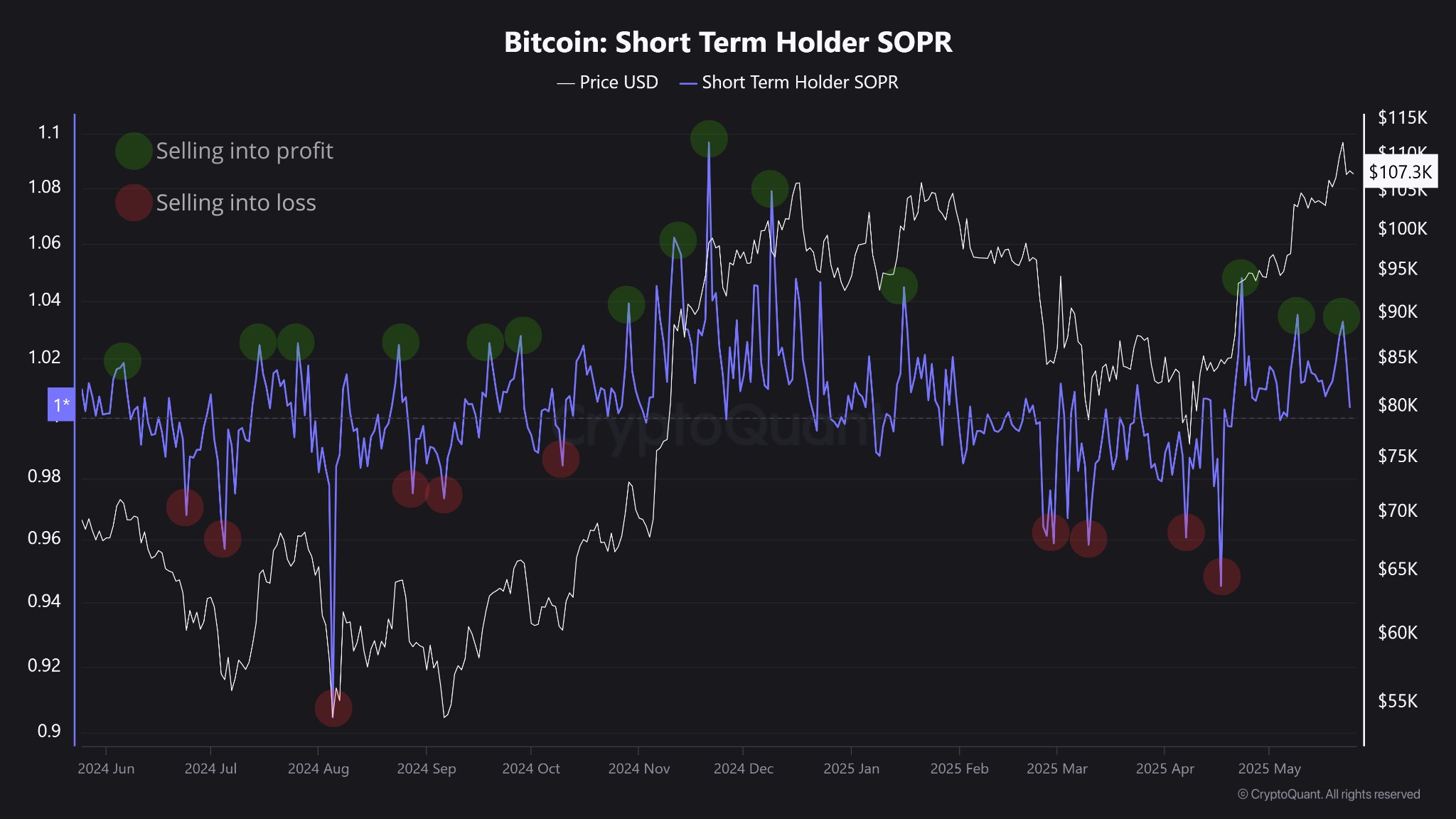

The second key metric is the “Spent Output Profit Ratio” (SOPR), which evaluates whether Bitcoin holders are selling or transferring their assets at a profit or loss. A SOPR value greater than 1 suggests profit-taking among holders, while levels below indicate more bearish sentiment predominating.

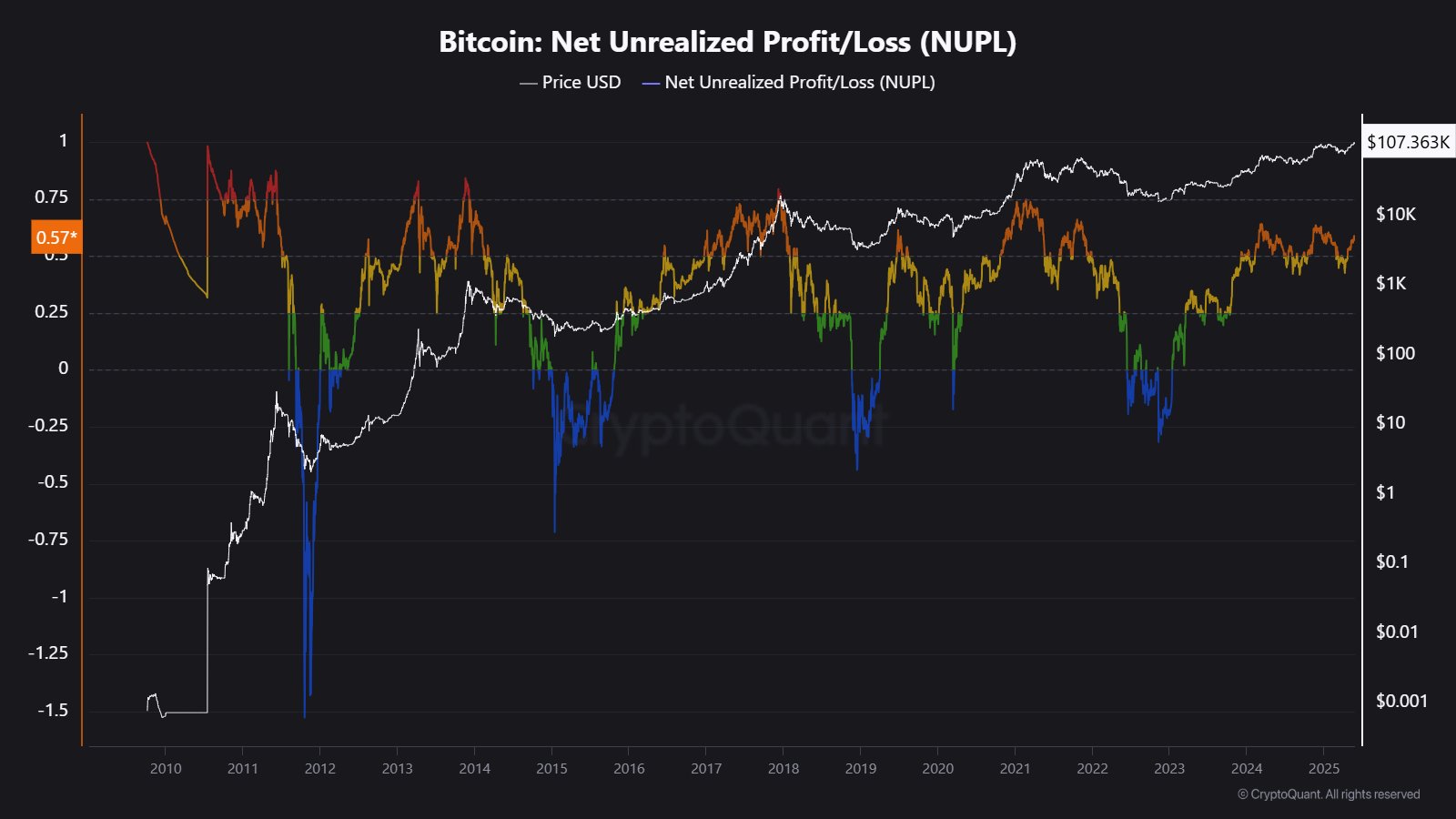

Noteworthy profit-taking spikes can create resistance in the market, while losses may hint at forthcoming bottoms. An indicator that provides foresight into these tendencies is the “Net Unrealized Profit/Loss” (NUPL).

This metric illustrates the total unrealized gains or losses accumulated by all Bitcoin investors at present.

A high NUPL indicates investors are more likely to lock in profits, which can prompt sell-offs. Conversely, a low NUPL suggests more investors may be underwater, leading to potential capitulation and a market bottom.

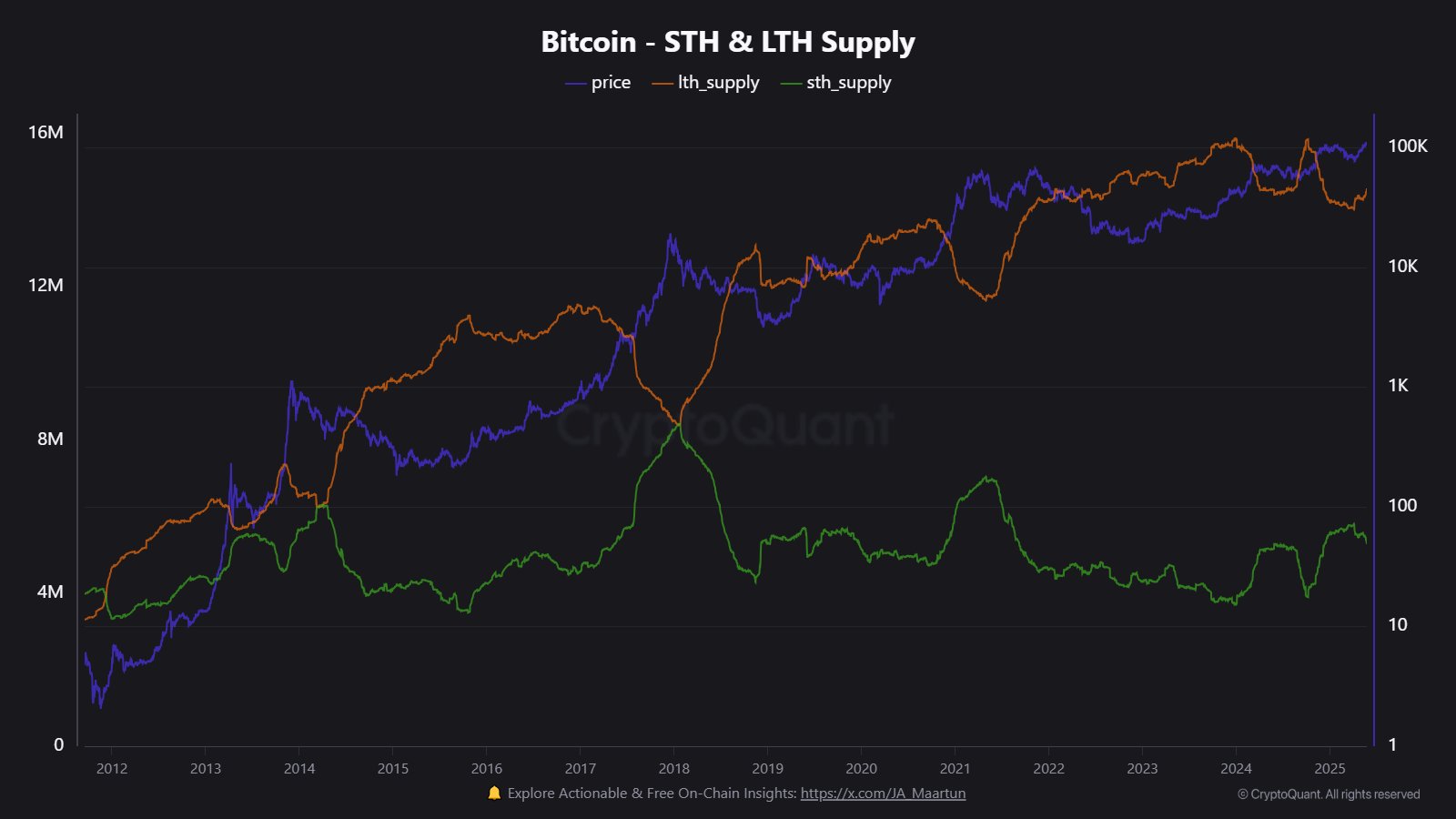

The fourth highlighted metric is the distribution of supply among short-term and long-term holders. Short-term holders are defined as those who bought Bitcoin within the last 155 days, while long-term holders exceed this timeframe.

A rise in long-term holder supply often indicates growing HODL sentiment, which is crucial for market stability. Recent data indicates a turnaround in this value, suggesting a shift in buying behavior.

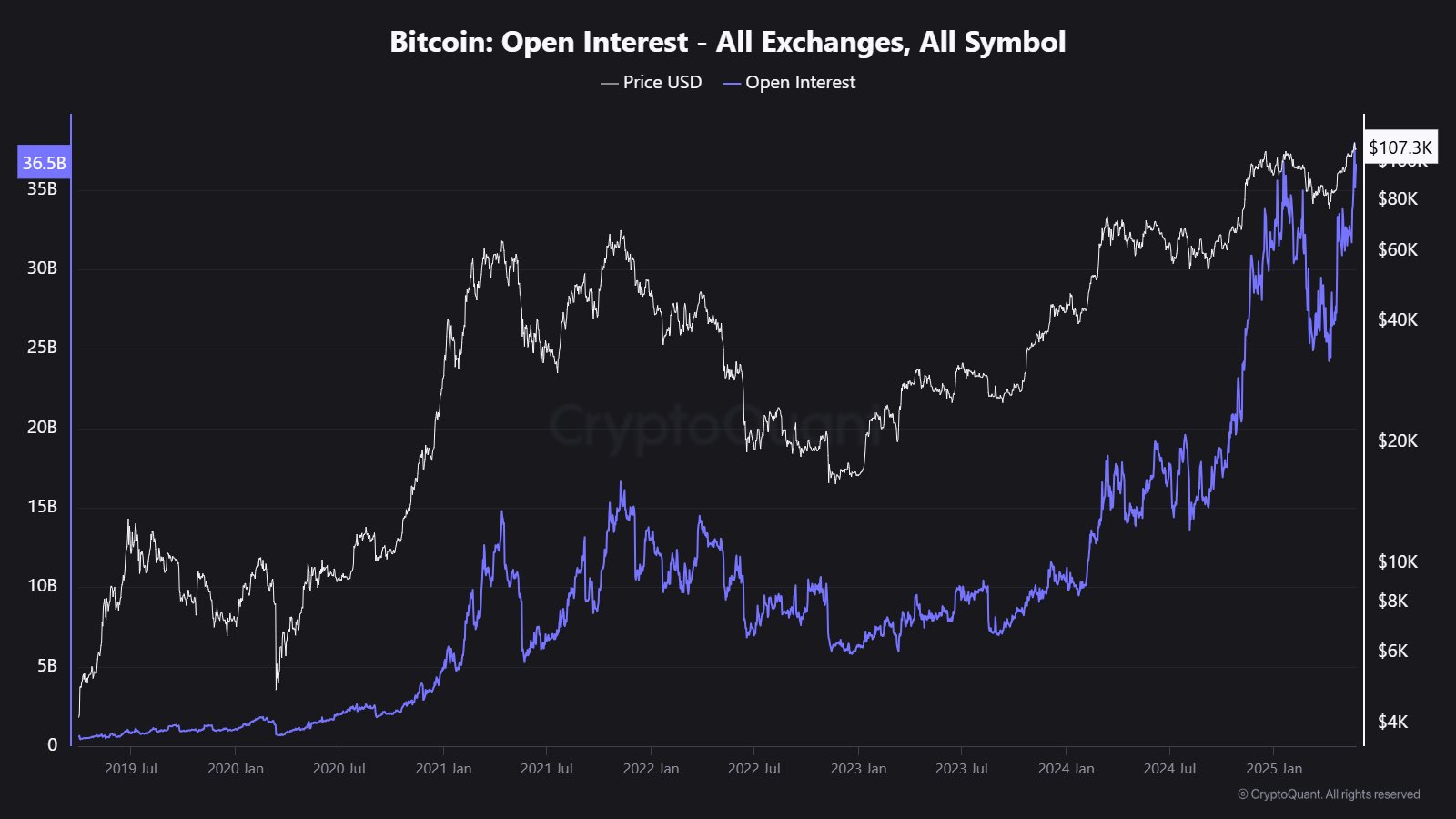

Lastly, there’s the Open Interest indicator, measuring total capital invested in Bitcoin futures contracts.

Recent trends show Bitcoin’s Open Interest has surged to record levels, indicating a spike in speculative trading activity that often precedes market volatility.

Bitcoin Price Overview

Currently, Bitcoin has retraced slightly, reducing its price to approximately $108,000.