The rise of Ethereum as a major player in the cryptocurrency sphere has become increasingly evident. Recent activity by significant institutional players, such as The Ether Machine, highlights an exciting chapter in Ethereum’s evolution.

The Ether Machine’s Strategic Move

In a groundbreaking update, The Ether Machine disclosed a strategic acquisition of 15,000 ETH for a total of $56.9 million, priced at an average of $3,809 per ETH. This landmark purchase comes at a pivotal moment, celebrating a decade since Ethereum’s inception.

Founded from a merger between The Ether Reserve and Nasdaq-listed Dynamix Corp, The Ether Machine aims to leverage Ethereum’s robust infrastructure. With the merger expected to finalize in Q4 2025, their ambitions include going public under the ticker ETHM with a target of raising $1.6 billion.

After this latest transaction, The Ether Machine now holds a substantial stash of 334,757 ETH and maintains around $407 million in liquid assets dedicated to future ETH investments. The company’s Chairman, Andrew Keys, shared his enthusiasm:

“To celebrate Ethereum’s 10th anniversary with such a significant purchase underscores our dedication to Ethereum as more than just an investment. We see it as a vital part of the new digital economy.”

Previously, Keys distinguished himself by endorsing Ethereum over Bitcoin, likening ETH’s influence on stablecoins to Google’s search engine supremacy. This reflects a broader trend as Ethereum’s utility continues to expand.

The acquisition was primarily funded by $97 million garnered from a recent private placement, with further ETH purchases likely on the horizon. Following this, The Ether Machine ascended to third place in the rankings of firms with the largest ETH reserves, now only behind Bitmine Immersion Tech and SharpLink Gaming.

Ethereum’s Growing Institutional Interest

Even as Bitcoin retains its title as the most valuable cryptocurrency, Ethereum is rapidly capturing the interest of institutional investors. In 2025, a surge in firms diversifying their assets to include ETH has been observed.

One notable example is Bit Digital, a Nasdaq-listed digital asset firm that recently acquired 19,683 ETH, raising its total to over 120,000 ETH and positioning it as the seventh largest holder of ETH.

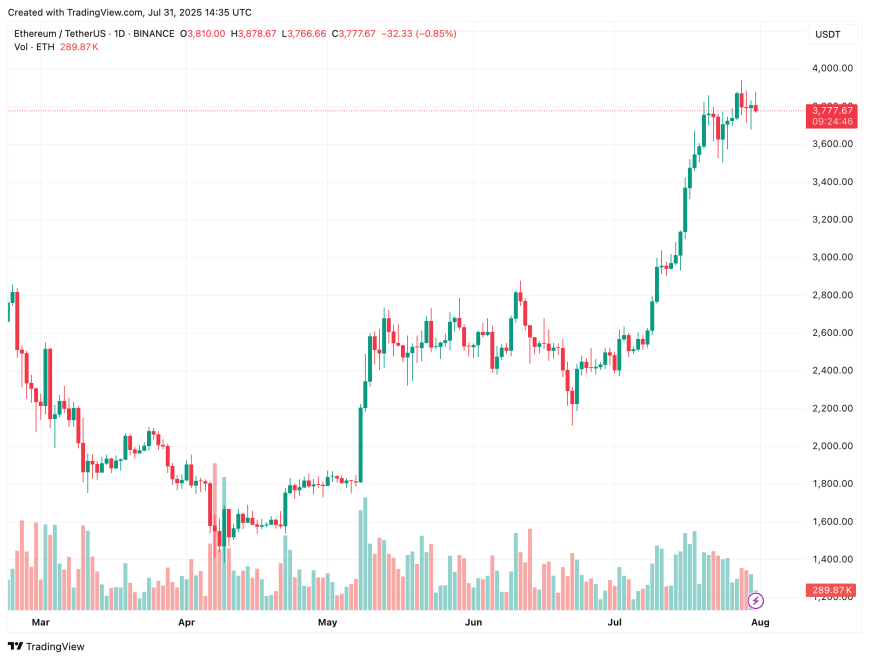

Moreover, BTCS Inc., focused on blockchain technology, announced an ambitious goal of raising up to $2 billion to bolster its Ethereum portfolio. At the time of this report, ETH was trading at $3,777, reflecting a slight decrease of 0.2% over the prior 24 hours.