Recent analytics from various blockchain data sources indicate a significant uptick in active participation within the Ethereum ecosystem. This surge in Daily Active Addresses reflects broader trends in investor engagement and trading patterns.

Ethereum Sees Surge in Daily Active Addresses

Data obtained from analytics provider Sentora illustrates that Ethereum has recently experienced a wave of user activity. The Daily Active Addresses metric is crucial for understanding fluctuations in user engagement on the blockchain, representing the number of unique wallets involved in transactions each day.

A rise in this metric suggests a growing community of users engaging with the Ethereum network, which typically indicates increased trading interest. Conversely, a decline might indicate that investor enthusiasm is waning, potentially diverting focus from the asset.

Below is a visual representation of the trend concerning Ethereum’s Daily Active Addresses over the past year:

As depicted, the recent upswing has pushed the number of Daily Active Addresses above its previous stabilization point of 600,000, showcasing a renewed interest that correlates with recent price movements.

Notably, this trend has escalated significantly in recent days, with current metrics approximating 931,310—a figure not seen in almost two years. Historically, significant transaction activity often precedes periods of market volatility, suggesting that the community is actively trading, whether buying or selling.

While this spike indicates strong engagement, it’s essential to note that any resulting price shifts could manifest in various directions, as the metric does not disclose whether transactions are primarily purchases or sales. Recently, a substantial activity increase appears to have preceded some price fluctuations, with Ethereum depreciating in value amidst rising addresses.

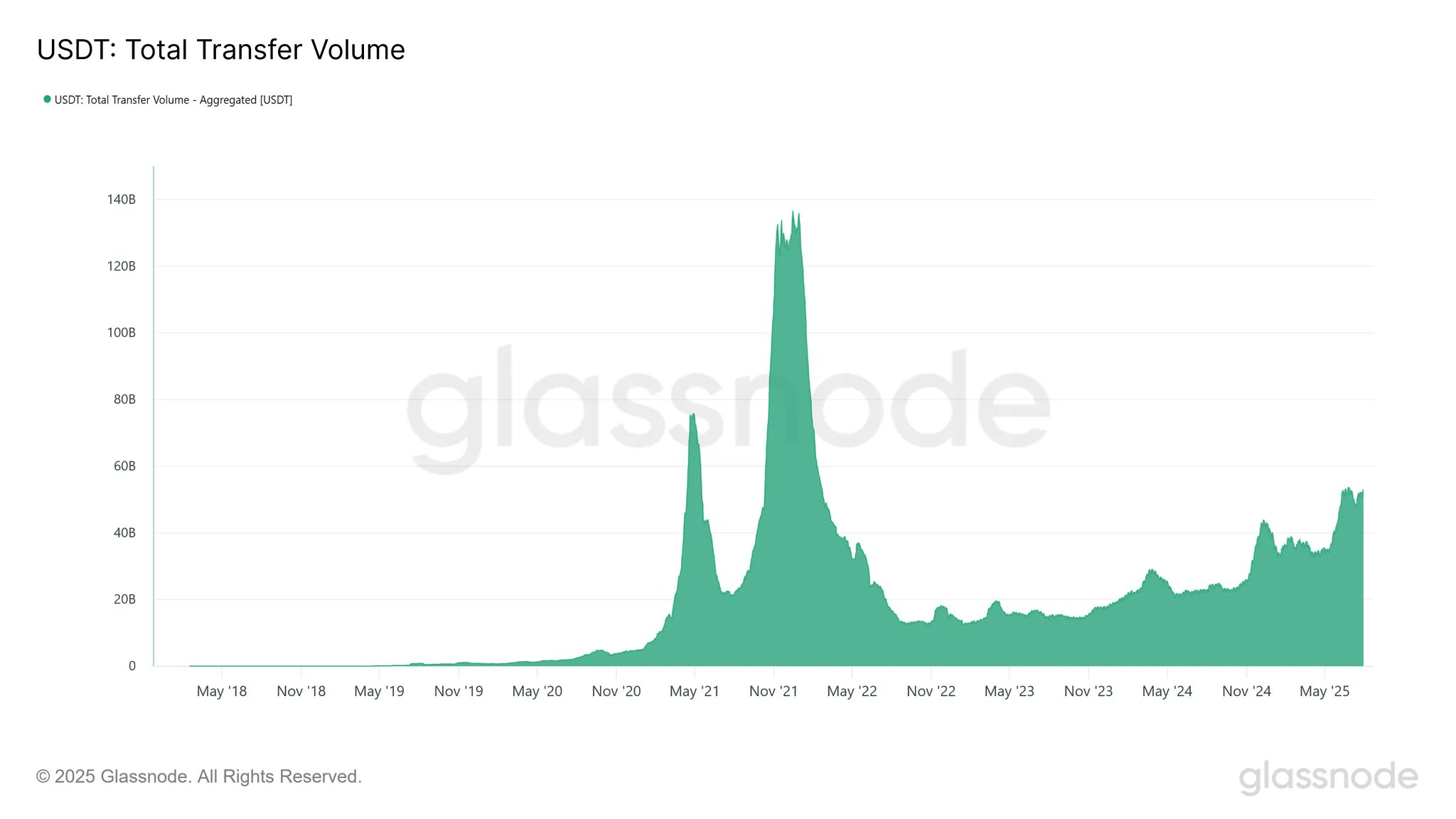

In other developments, the USDT stablecoin has seen its 30-day moving average transfer volume bounce back to approximately $52.9 billion, as highlighted by on-chain analytics provider Glassnode in a recent post.

The above graph shows a steady recovery in USDT transfer volume since the downturn in 2022. Glassnode notes that this recovery indicates a gradual uptick in stablecoin utilization and overall market movements.

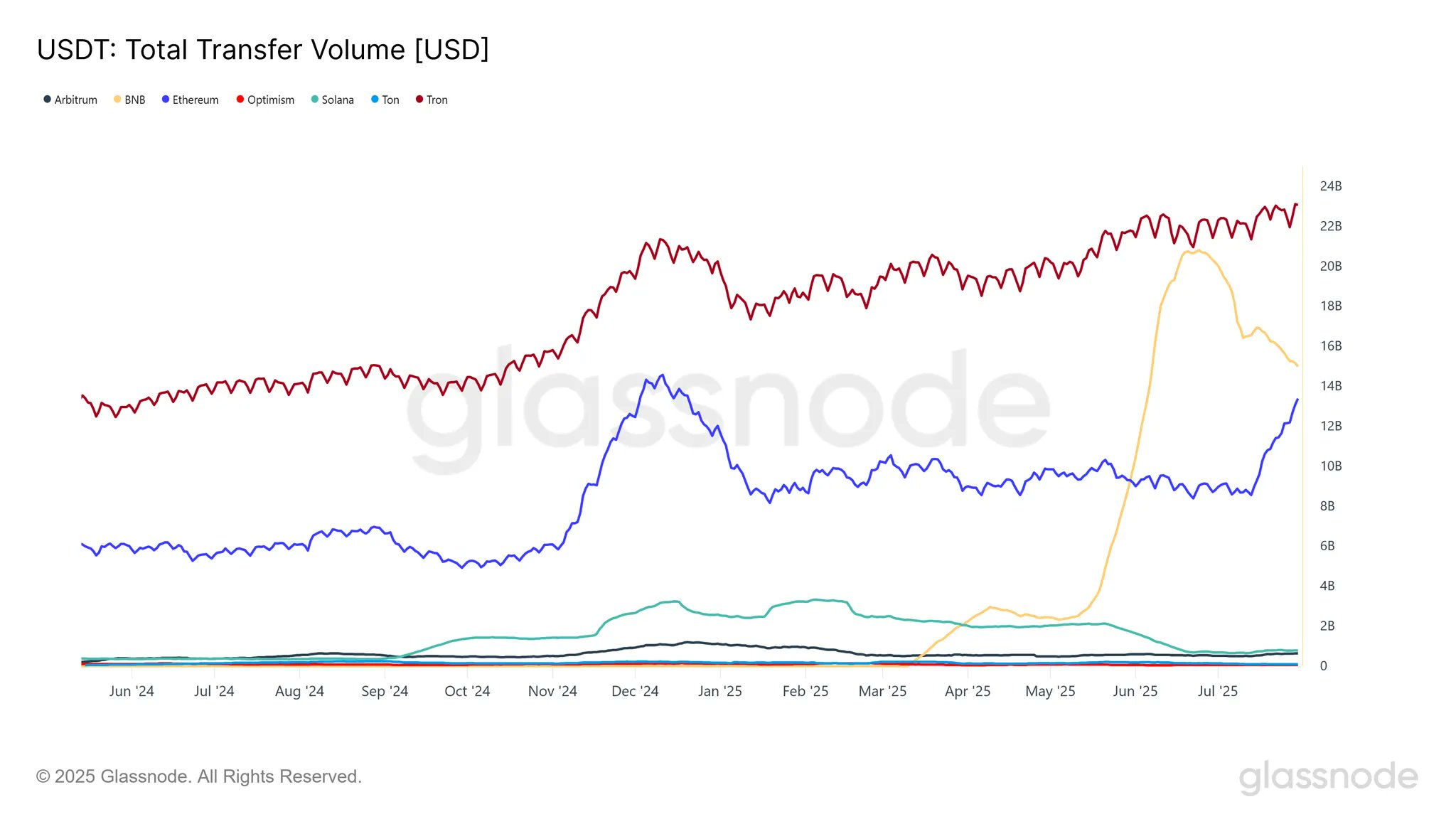

Interestingly, Ethereum does not currently rank among the top two platforms receiving the majority of this stablecoin’s volume.

Dominating the USDT volume are the Tron and BNB networks, attracting $23 billion and $14.9 billion, respectively.

Current Ethereum Price Analysis

As of the latest market data, Ethereum’s price hovers around $3,650, reflecting a decrease of about 3.5% in the past day.