The interest in US Ethereum spot ETFs has reached a significant milestone, fueled largely by demand from major institutions like BlackRock and Fidelity.

Surge in Demand for Ethereum Spot ETFs

Recent statistics from Farside Investors indicate that July 16th marked an exceptional day for Ethereum spot ETFs, with total inflows surging past the remarkable $726 million threshold—an all-time high. Spot ETFs are investment funds that allow investors to gain exposure to an asset without direct ownership, offering a streamlined method for traditional investors to engage with cryptocurrencies without the complexities of managing digital wallets or exchanges.

Since receiving approval nearly a year ago, Ethereum spot ETFs have experienced fluctuating levels of demand. However, recent trends show a robust uptick, with inflow momentum increasing notably in the latest weeks.

Below is a detailed breakdown of the recent netflows related to various Ethereum spot ETFs:

The chart highlights a consistent trend of daily inflows exceeding $200 million into US Ethereum spot ETFs over the past week. This suggests that institutional interest remains strong; the recent record inflow signifies a further acceleration in this demand.

Leading the charge, BlackRock’s ETF attracted nearly $500 million on July 16th alone, while Fidelity followed with approximately $133 million in purchases. The influx of capital into these spot ETFs coincides with Ethereum’s recent price breakout above the $3,000 mark, reaching as high as $3,400 for the first time since January.

As Ethereum continues to gain traction, it’s not just institutional investors who are taking notice. Data from the analytics firm Santiment indicates a marked increase in retail interest as well.

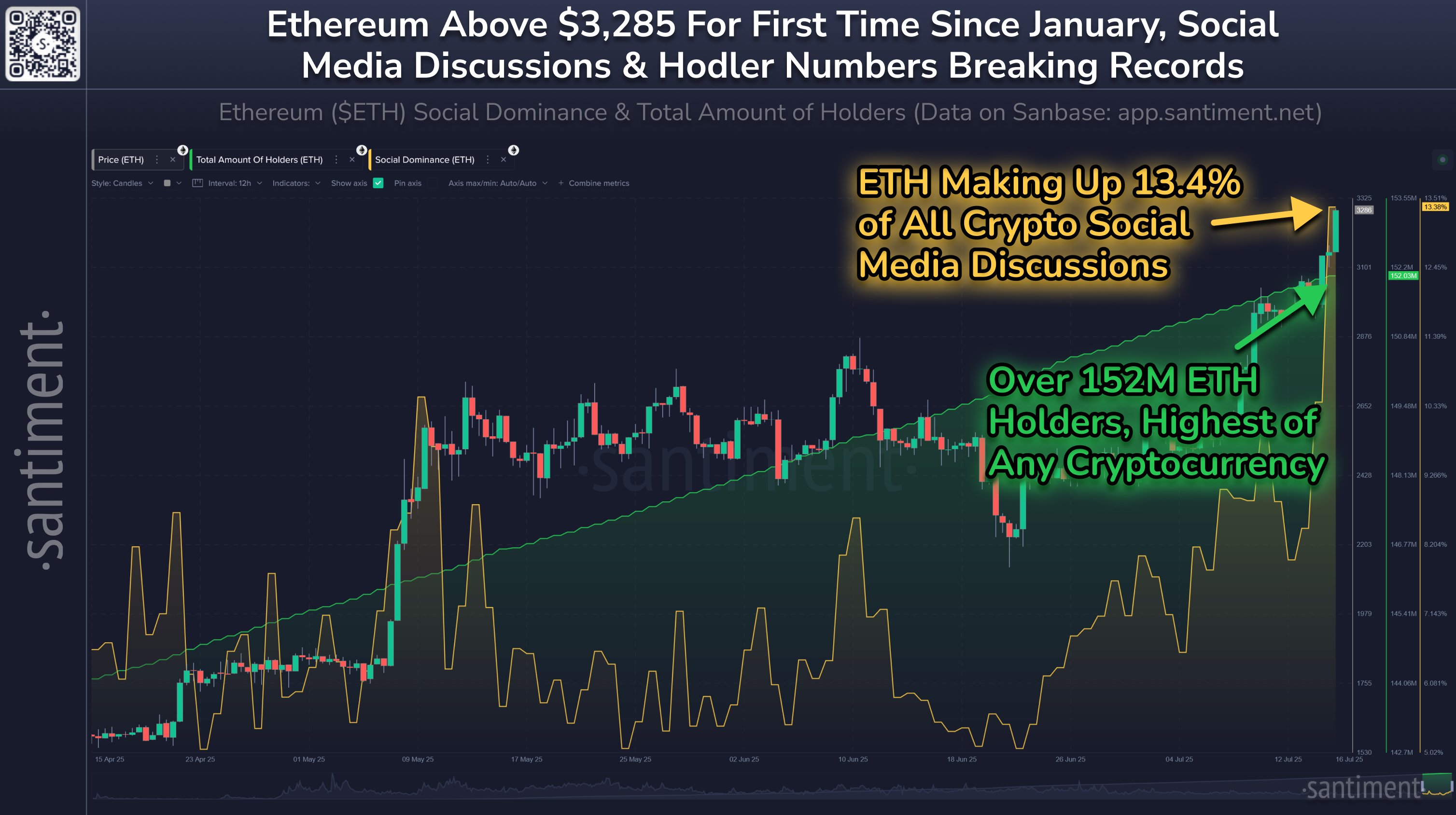

The chart presented by Santiment tracks the Social Dominance of Ethereum, a metric that illustrates the coin’s share of discussions across major social media platforms relative to other cryptocurrencies.

Given that retail investors significantly outnumber institutional players in terms of sheer numbers, this statistic serves as an indicator of the sentiments and behavior prevailing in the market. The data reflects a major spike in ETH’s Social Dominance, which has jumped to 13.4%, representing the discussions surrounding digital assets on social media platforms.

This surge indicates that retail investors are increasingly aware of Ethereum; however, it’s essential to remain cautious, as historical trends show that overhyped consensus among retail investors does not always yield favorable outcomes for cryptocurrencies. Thus, this is an aspect worth monitoring closely.

Current ETH Price Insights

As of the latest update, Ethereum is trading at approximately $3,400, representing an impressive increase of over 23% in just one week.