Ethereum is experiencing a captivating episode in its market journey, having recently surged to its highest levels since late 2021. This resurgence has sparked lively discussions among traders and analysts, as sentiments are split regarding the next steps for ETH. While some experts caution that a significant pullback may be on the horizon following this rally, others maintain that Ethereum could break past its previous all-time high and embark on a bullish trajectory.

Recent on-chain analytics have added layers to this ongoing debate. Data from Lookonchain indicates that a wallet associated with the Ethereum Foundation, identified as 0xF39d, has divested 7,294 ETH, amounting to roughly $33.25 million, within a brief three-day period. The average selling price recorded was $4,558, a move reflecting a strategy to take profits while ETH sits just below crucial resistance levels. Interestingly, this wallet has a commendable track record, previously amassing 33,678 ETH at a notable low of $1,193 in June 2022.

Nonetheless, bullish sentiment persists in the market. Proponents underscore significant institutional interest and unprecedented inflows into Ethereum ETFs as critical factors that could drive further appreciation in ETH’s price. With ETH holding steady near essential resistance, the imminent weeks may prove pivotal in determining whether the asset is set for a healthy pullback or poised for an ascent into new heights.

Smart Money Strategies in Ethereum

The recent movements in Ethereum’s pricing have been matched by increased on-chain engagement, particularly evident through strategic plays by certain wallets. The Ethereum Foundation-linked wallet 0xF39d has gained fame for its savvy trading practices. Rewinding to June 2022, when market sentiments were bleak, this wallet successfully accumulated a substantial 33,678 ETH, representing an investment valued at around $40.2 million, with an average purchase price of merely $1,193. This behavior encapsulates the foresight often credited to institutional traders.

Increased momentum is evident today, as the same wallet has recently executed a sale of over 7,000 ETH, strategically timed near the $4,500 mark, thereby securing substantial profits. Such actions characterize the influence of “smart money” in shaping Ethereum’s price dynamics, often taking strategic positions ahead of market trends. This activity has incited thoughtful debate in analytical circles, especially as ETH remains below the highs set in 2021 and market forecasts vary.

For some analysts, this selling points toward a cautious outlook, implying that Ethereum might be nearing a cyclical peak as profit-taking escalates. Conversely, others contend that despite the volatility, ETH could merely be in the nascent phases of an upward trend driven by increasing institutional investments, growing ETF adoption, and a contracted supply available on exchanges.

In a landscape defined by uncertainty, wallets like 0xF39d provide critical insights, revealing how adept investors are maneuvering within Ethereum’s complex pricing environment. Whether this moment signifies a local peak or merely a strategic hold before further gains is a contemplative question gripping the market.

Analyzing ETH’s Price Action: Support and Resistance

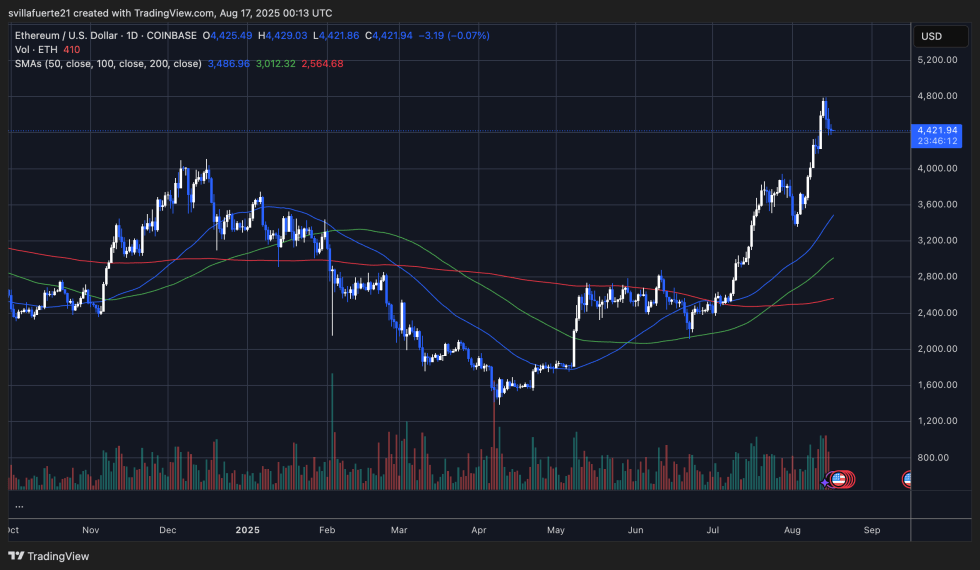

A close examination of Ethereum’s daily chart reveals a robust rally interrupted by a modest retracement from highs near $4,800. Following a significant uptick through July and into early August, ETH is currently stabilizing around the $4,420 mark. Despite this slight dip, the broader trend remains optimistic.

Notably, the 50-day moving average (depicted in blue) continues on an upward trajectory, providing essential support near $3,480. Meanwhile, the 100-day (in green) and 200-day (in red) moving averages are positioned lower at $3,012 and $2,564 respectively, indicating the extent of the current rally. With ETH trading significantly above these long-term averages, it is clear that bullish momentum is still very much present.

This current retracement appears to represent a proper correction phase, facilitating a market recalibration that can pave the way for future growth. If ETH manages to hold within the $4,200–$4,300 range, it could establish a solid foundation for another attempt at breaking through the $4,800–$5,000 resistance level.

Conversely, a decline beneath the $4,200 mark could lead to price action toward the $3,800–$3,900 support bracket, aligning with the rapidly rising moving averages. Overall, Ethereum maintains a favorable bullish outlook, with corrections manifesting more as rests than reversals.

Featured image from Dall-E, chart from TradingView