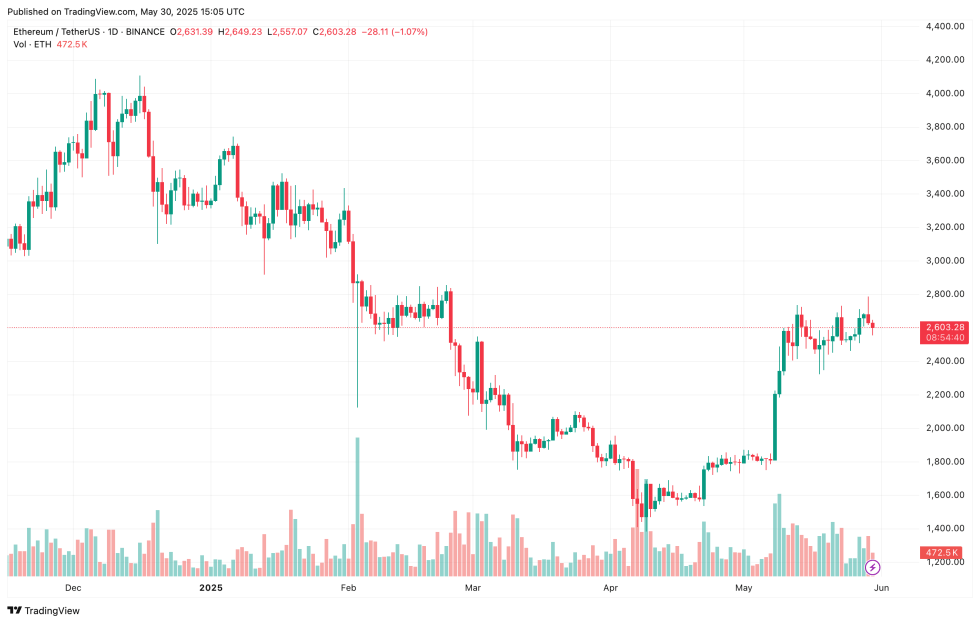

Ethereum (ETH), valued in the mid-$2,000 range, has often hovered close to the pivotal $3,000 mark but has yet to make a definitive breakthrough. Despite this, many analysts are optimistic that ETH will soon surpass this psychological barrier, signaling a potential bullish trend for the future.

Positive Indicators for Ethereum’s Performance

A recent update from crypto analyst Titan of Crypto underscores the bullish sentiment surrounding Ethereum. He posted a daily chart suggesting that ETH is emerging from a period of sideways trading, potentially positioning itself for an impressive rise towards $3,800.

Echoing this sentiment, fellow analyst Master of Crypto noted that ETH’s resilience in the current market is a promising indicator. He remarked:

It appears that a breakout is on the horizon, and hitting $3K is imminent. Outperforming Bitcoin this quarter suggests that we might be entering an altcoin rally.

Additionally, trader Jelle emphasized the importance of maintaining patience, illustrating that ETH is currently testing key resistance levels, paving the way for a significant breakthrough as it approaches the $3,000 milestone.

Moreover, the inflow of institutional investments into Ethereum is noteworthy. Recently, Ethereum ETFs witnessed inflows exceeding $91 million, with a substantial portion contributed by major players like BlackRock, attesting to growing institutional faith in the cryptocurrency.

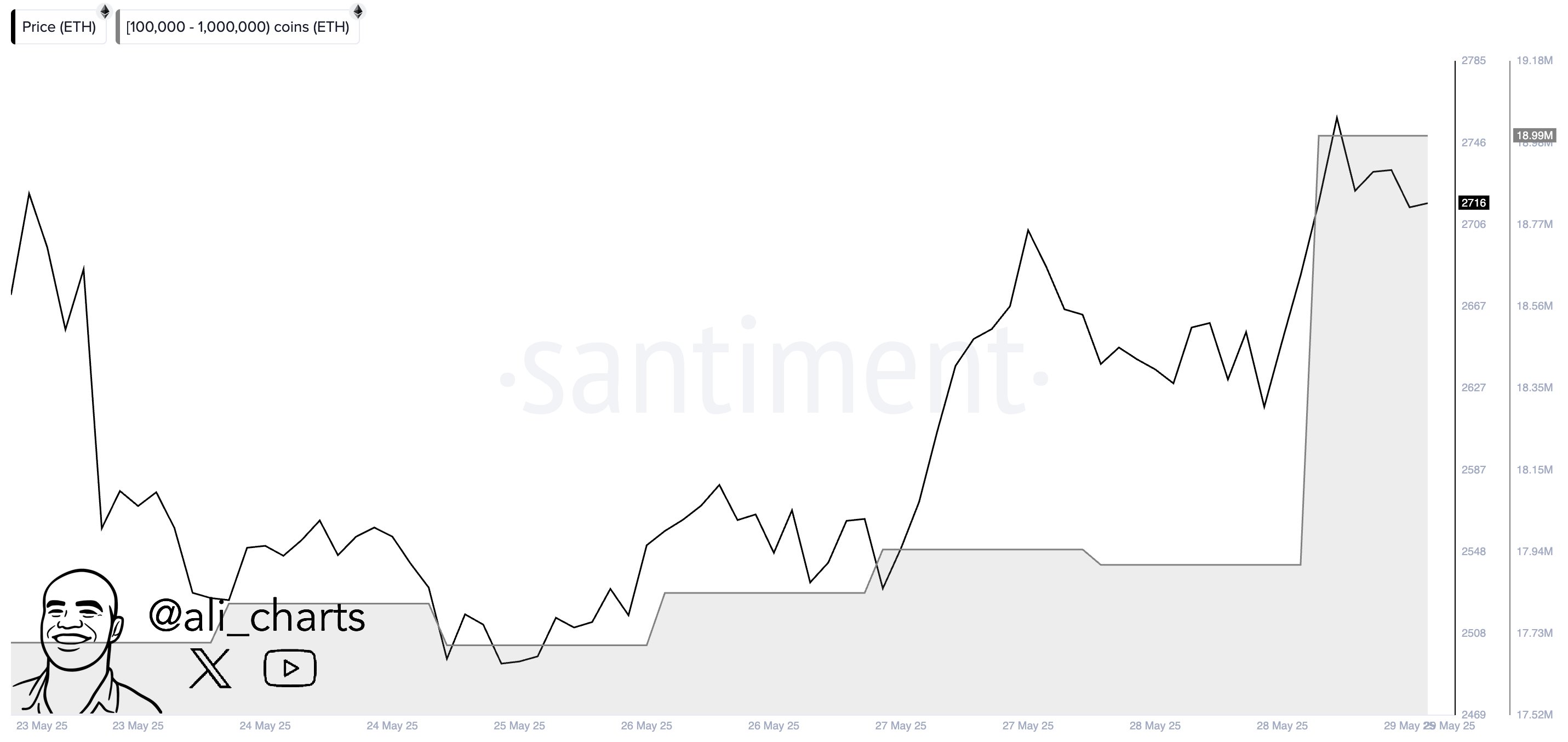

Analyst Ali Martinez also pointed out a remarkable trend in whale activity. Recent data indicates that large wallets, specifically those holding between 100,000 and 1,000,000 ETH, accumulated over 1 million ETH within a mere 48 hours, reflecting sustained bullish sentiment among major investors.

With rising ETF inflows and whale acquisitions, a trend appears to be forming that often precedes strong bullish movements. By decreasing available supply in the market, these factors are likely to contribute positively to ETH’s price dynamics.

Technical Analysis Points to a Bullish Trend

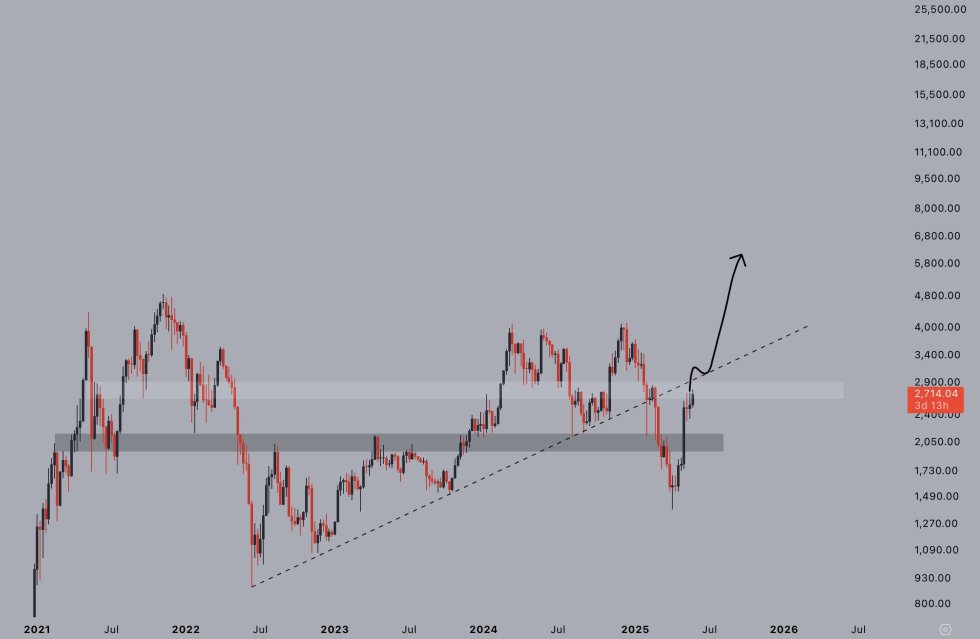

Analyzing the technical landscape, Ethereum is exhibiting promising signs of an upward trajectory. Trader Merlijn The Trader has highlighted that ETH is mirroring the Wyckoff Accumulation model, which tests market dynamics strategically.

This model typically includes a deceptive drop below support to remove weaker investors, followed by a confirmation phase where selling pressure diminishes. This lays the groundwork for a significant rise, marked by heightened trading volume, signaling the commencement of a new bullish trend.

Merlijn suggests that ETH has successfully navigated through both the spring and test phases of this model and is now gearing up for the jump phase, which could foreshadow an upward surge towards a new all-time high (ATH).

However, events impacting the market such as the anticipated FTX creditor payouts, amounting to $5 billion, could temporarily hinder ETH’s optimistic momentum, introducing short-term selling pressure. Currently, ETH is trading at $2,603, reflecting a 2.4% decline over the preceding 24 hours.