Recent data analysis indicates that the pricing dynamics of Ethereum may be substantially swayed by off-chain markets and derivatives, contrasting the price influences seen with Bitcoin.

Spot Activity Trends Reveal Key Differences Between Bitcoin and Ethereum

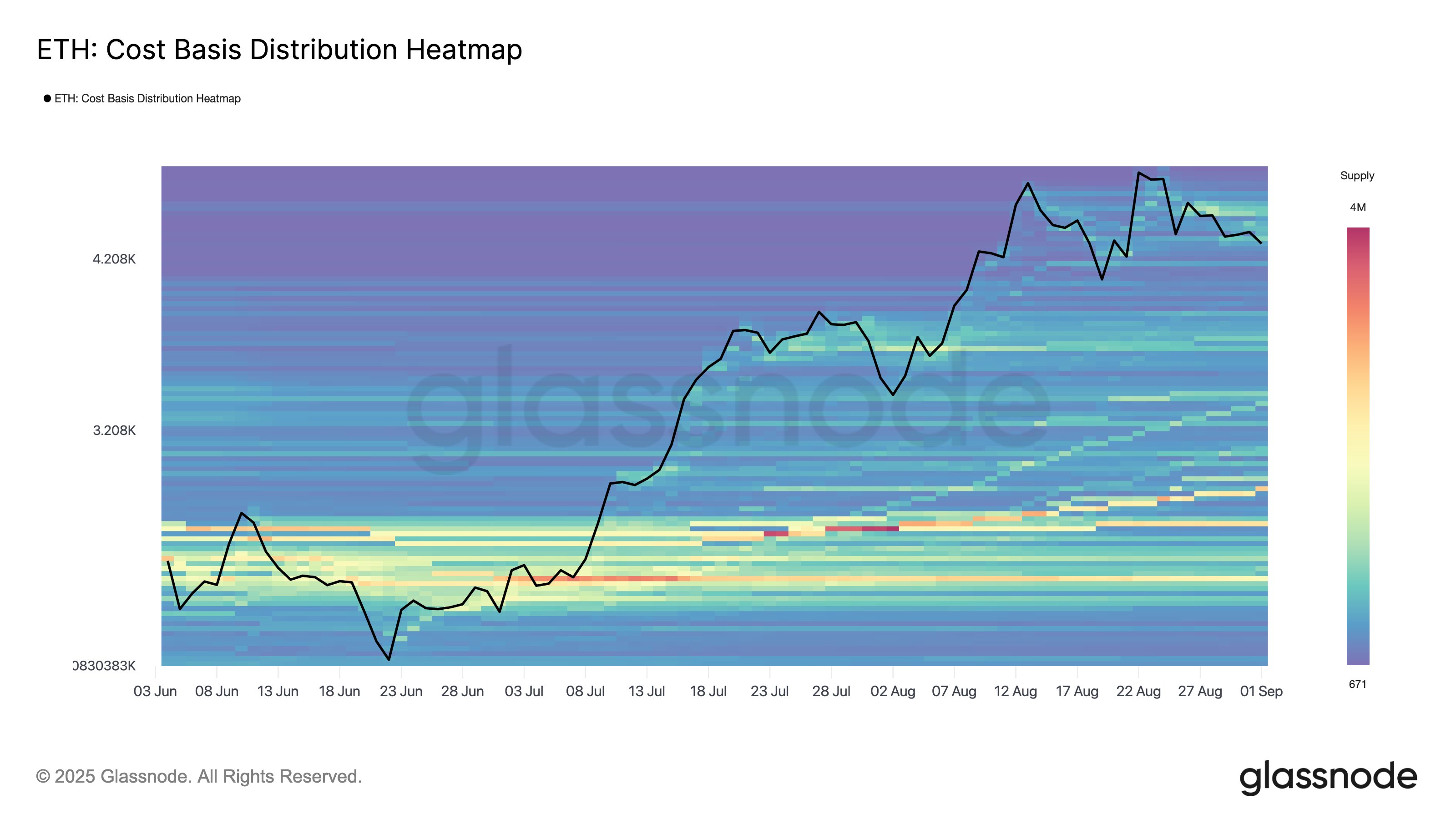

An insightful post by Glassnode emphasizes the divergences observed in Cost Basis Distribution (CBD) for Bitcoin and Ethereum. This divergence offers valuable insights for investors.

The Cost Basis Distribution serves as a critical metric, highlighting the purchasing history of various assets and helping to determine significant price levels experienced over time. Understanding where investors entered the market provides clues about their behavior when prices revisit those levels.

When assets retest these critical price points, the collective memory of investors can prompt responses, affecting market liquidity. Thus, the more concentrated the buying at a specific level, the greater the likely market reaction.

Examining the chart below, we can see the recent trends in CBD for Bitcoin:

As illustrated, Bitcoin’s CBD experienced a significant “air gap” during its sharp rally in July, as price movements outpaced buying and selling opportunities. This gap indicates that not many purchases were made at those price levels.

As Bitcoin entered a period of consolidation post-rally, trading volume began to stabilize. The demand has led to the previous air gap being filled, illustrating sustained interest in spot trading.

Conversely, Ethereum’s CBD narrative has revealed a distinct pattern.

The data indicates that while Ethereum also exhibited air gaps during rallies, it has not notably filled these gaps during periods of price slowdowns. As Glassnode notes, this behavior suggests that Ethereum’s price dynamics are increasingly influenced by off-chain markets such as derivatives.

The nature of derivatives trading often leads to heightened price volatility, raising questions about what the absence of substantial spot buying means for Ethereum’s future price movements and potential bull runs.

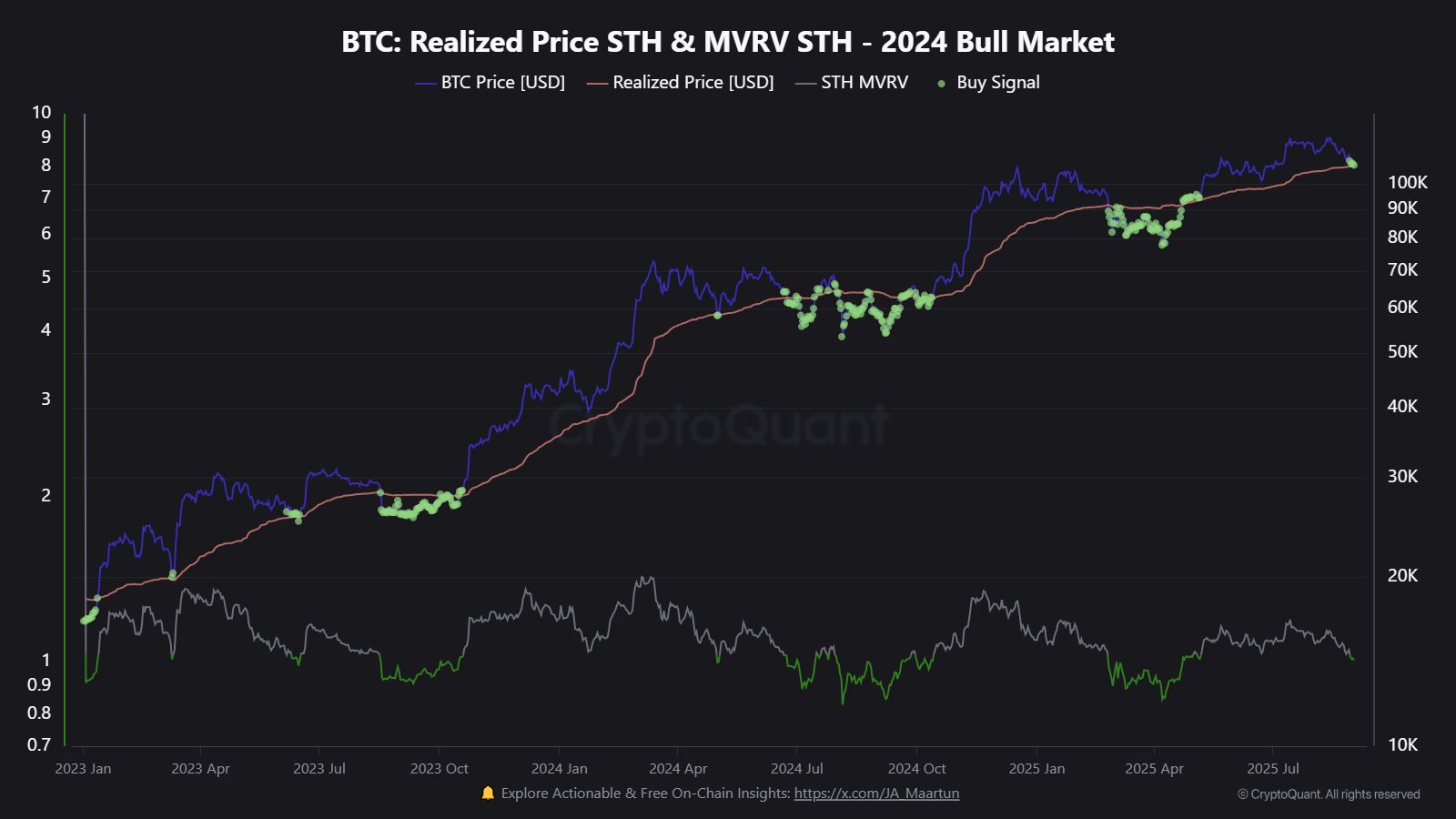

In related developments, Bitcoin has found itself at a significant on-chain cost basis level following the recent market decline. Analysis by CryptoQuant’s Maartunn reveals insights in a relevant post.

Specifically, this cost basis reflects the average price of Bitcoin purchased by short-term holders over the past 155 days. Historical trends dictate that breaching this level often triggers bearish sentiment among short-term investors.

Current Ethereum Pricing Analysis

Currently, Ethereum is experiencing a downward trend, with its value dropping to $4,270, reflecting a 6% decrease over the last week.