Wednesday brought bullish momentum to the market, yet Ethereum struggled to gain traction due to a strong resistance level. Nonetheless, recent performance indicates a potential rebound, hinting at a continued upward trend.

Ethereum’s Technical Chart Indicates Possible Rally

Ethereum briefly surpassed the $1,900 threshold amidst market recovery. This upward shift, although seemingly minor, reveals encouraging signs of strength through a developing bullish chart pattern visible on the daily timeframe.

Crypto analyst Trader Tardigrade has pointed out a Bull Pennant Pattern on the 1-day chart, which suggests a potential change in momentum. This pattern signifies a bullish trend, emerging after a significant price increase and characterized by a narrowing price range during a consolidation phase. A breakout above the upper trendline would further confirm this trend continuation.

According to the analyst, Ethereum appears to be breaking free from this bull pennant configuration. ETH’s movement above the trendline indicates an increase in upward momentum, raising the likelihood of a notable rebound and the initiation of a new rally shortly.

With the altcoin gaining strength post-breakout, Trader Tardigrade anticipates a rally back to the $2,250 mark. Surpassing this critical level could foster an extended uptrend and secure broader market support.

Previously, Trader Tardigrade highlighted a bullish signal from ETH’s Stochastic Indicator. Despite recent volatility, the Stochastic is indicating a rebound from oversold territory, with ETH also preparing for a potential rise to $3,200.

This prediction is drawn from historical patterns where ETH’s price surged when the stochastic indicator recovered from the oversold area. Similar occurrences have led to significant upswings of 100%, 169%, and 99% in the past two years.

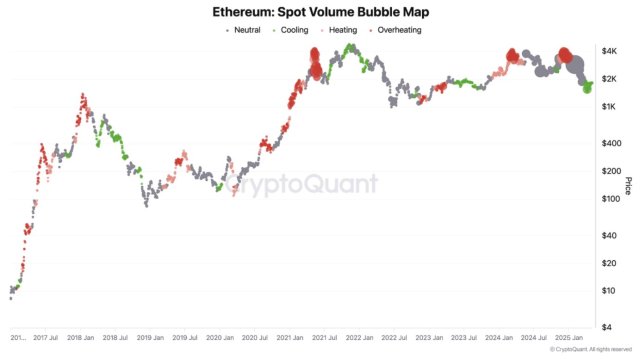

ETH Spot Volume Declining

During prior bearish periods, Ethereum’s Spot volume has seen a gradual decline. However, on-chain analyst Darkfost noted that this may actually be a positive sign.

Darkfost pointed out two interesting observations: bubbles represent spot volume, with larger bubbles indicating higher volume, and the color of each bubble illustrating the rate of volume change.

In light of ETH’s recent correction, the decrease in spot volume may contribute to lowered volatility, helping to ease the selling pressure affecting the market. However, Darkfost cautions that this decline does not imply that ETH has reached a bottom, advising investors to remain vigilant.