The landscape of digital asset investment is transforming, with recent reports shining a light on substantial capital inflows. According to a detailed analysis from CoinShares, the momentum is particularly strong this month.

Last week, institutional investments in cryptocurrency associated funds soared to an unprecedented $4.39 billion, eclipsing the former record of $4.27 billion established in December 2024. This dramatic shift underscores the growing appetite for crypto investments amidst evolving market conditions.

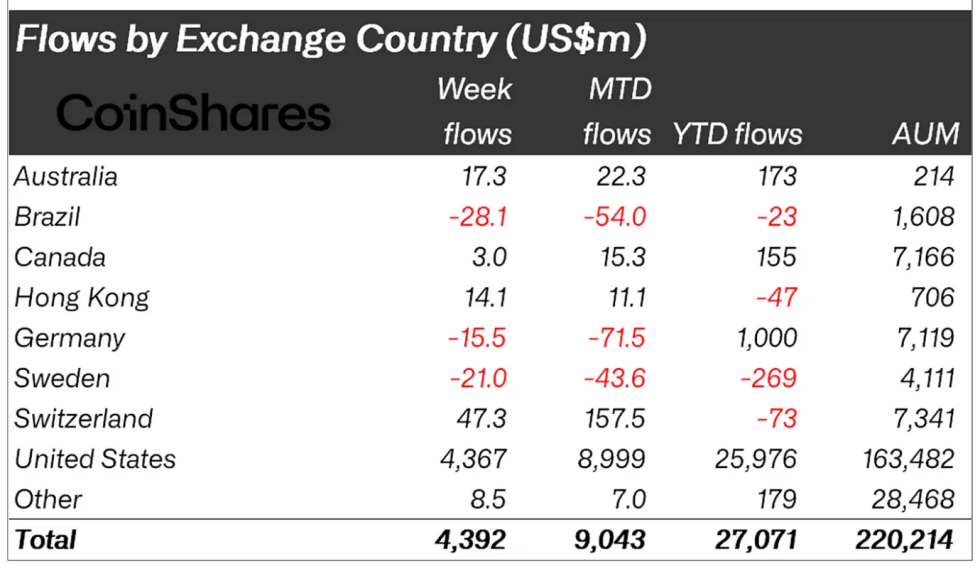

This 14th sequential week of positive investment flow has also accumulated a staggering $27 billion in total inflows for the year. CoinShares’ research lead, James Butterfill, emphasized that assets under management (AuM) have reached a historic milestone of $220 billion, indicating robust investor confidence in the sector.

The driving force behind this surge appears to be the rising institutional interest, particularly shown through the solid performance of exchange-traded products (ETPs), especially notable in the US arena.

Ethereum Sets New Records Amid Growing Demand

While Bitcoin maintains its status as a market leader, Ethereum has recently surged ahead, achieving a record-breaking $2.12 billion in weekly inflows—almost doubling its previous high of $1.2 billion.

In just 13 weeks, Ethereum products have garnered inflows that make up 23% of their total AuM. Additionally, 2025 inflows have already surpassed last year’s total of $6.2 billion, indicating a clear shift in investor preferences towards Ethereum.

In the same timeframe, Bitcoin saw $2.2 billion in inflows, marking a drop from the prior week’s $2.7 billion. Nevertheless, Bitcoin ETP volumes remained strong, making up 55% of the overall trading volume for the asset.

According to CoinShares, global trading activity in crypto ETPs reached a record high of $39.2 billion last week, signaling increased market engagement and liquidity in institutional channels.

US Leads Regional Contributions as Altcoins Gain Traction

The US market continues to dominate, contributing $4.36 billion to last week’s total inflows. Other regions such as Switzerland ($47.3 million), Hong Kong ($14.1 million), and Australia ($17.3 million) also showed positive growth.

Conversely, Brazil and Germany faced slight outflows of $28.1 million and $15.5 million, respectively, indicating a more cautious investor outlook in those areas.

In addition to the dominant players, several altcoins have also attracted significant investments. Solana drew in $39 million, XRP accumulated $36 million, and Sui received $9.3 million, highlighting the increasing interest in diverse market segments.

These statistics reflect a maturing investment landscape, where investors are diversifying their portfolios beyond the two traditional giants. The rise of ETP offerings for a variety of cryptocurrencies suggests a strategic shift among investors seeking thematic exposure throughout the crypto market.

As fund flows enhance and trading volumes and AuM reach new heights, it’s apparent that the enthusiasm for digital assets is unwavering among institutional investors as we transition into the latter part of 2025.

With growing investments in Ethereum eclipsing even Bitcoin on a relative basis, market watchers may find it fascinating to observe the ramifications of this shift on the broader dynamics of the cryptocurrency ecosystem.

Featured image courtesy of DALL-E, Chart sourced from TradingView