Ethereum is currently experiencing a notable resurgence as it aims to surpass the $3,150 mark, a pivotal point suggesting a potential recovery after a prolonged period of market negativity characterized by substantial sell-offs and uncertainty. The strengthening of the overall market has reinvigorated investor confidence, with ETH’s capacity to outperform several key altcoins reflecting enhanced demand and positive sentiment surrounding the cryptocurrency.

In support of this renewed enthusiasm, recent on-chain metrics from Lookonchain indicate a significant transaction from a well-known market player. During this recent uptick, a major whale, labeled as 0xdECF, directed an additional 5,000 ETH—valued at approximately $15.52 million—into Binance.

This wallet has gained notoriety for executing large transfers of ETH to exchanges during the downward trends, often aligning with periods of increased volatility and market panic.

The recent deposit implies that this whale remains proactive and attentive to evolving market dynamics. While such transfers may occasionally introduce uncertainty, they also signify an increase in liquidity and engagement from influential holders. With prices regaining important thresholds and whales repositioning their assets, Ethereum finds itself at a critical juncture where sustained momentum could indicate a more significant alteration in market structure.

Whale Activity Signals Mixed Market Sentiment

Data from Lookonchain reveals that whale 0xdECF has sold 25,603 ETH—approximately valued at $85.44 million—across trading platforms like Binance and Galaxy Digital since late October. Despite this notable distribution, this wallet still retains 5,000 ETH worth around $15.52 million, suggesting that while the whale has reduced its stake, it has not completely abandoned its position during the recent price slide.

This trading behavior provides essential insights into the attitudes of large holders; while they are not entirely exiting Ethereum, they are diligently managing their exposure in response to market volatility.

Continuous selling from substantial wallets can create downward pressure on prices, particularly when market conditions are volatile. However, the ongoing retention of a significant stake by the whale suggests that there is an expectation for a potential market rebound—or at least a strategic interest in benefiting from future price increases.

As Ethereum enters this critical period, its ability to maintain key levels becomes increasingly crucial. The recent recovery could solidify into a longer-term trend if accumulation outweighs distribution. Conversely, if selling pressure resumes, Ethereum might be pushed back to its lower support levels.

ETH Gains Ground but Confronts Key Resistance Levels

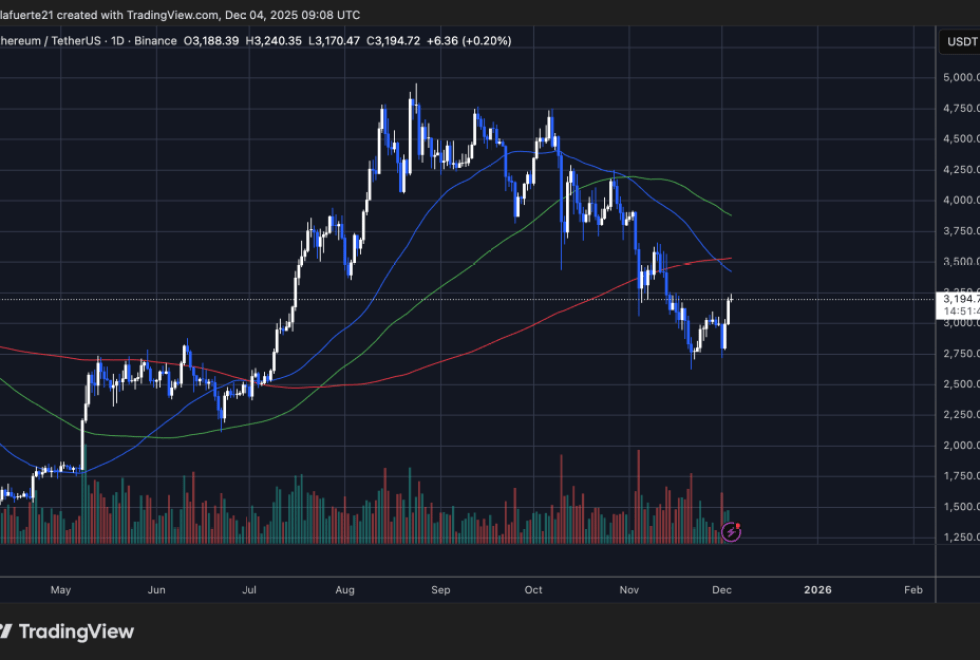

The daily charts for Ethereum illustrate a marked improvement in momentum since reconquering the $3,150–$3,200 zone. However, the broader market landscape remains delicate. The rebound from the $2,750–$2,850 support range exemplifies a dramatic shift in buyer engagement, characterized by robust demand evident in lower wicks.

Now, the price is edging closer to the 50-day Simple Moving Average (SMA), currently trending downwards just above $3,250, which now acts as an immediate resistance point. This moving average has historically limited bullish rallies since late October, representing a critical hurdle for bullish traders. Beyond this, the 100-day SMA sits around $3,450, along with the 200-day SMA close to $3,600, collectively forming a significant zone of resistance that defines the current downtrend.

Trading volume during this recent bullish move is more robust compared to earlier attempts, indicating a stronger commitment from buyers than witnessed in mid-November. Nonetheless, the macro trend remains bearish until Ethereum can decisively break above the 50-day SMA and start closing daily sessions above $3,300.

Ethereum is at a pivotal moment: maintaining support above $3,100 could bolster hopes for a continued recovery, while failure to do so near the $3,250–$3,300 resistance might set the stage for another retest of the $2,800 support zone. Upcoming market sessions will be key in determining whether this recovery signifies the beginning of a more profound trend reversal.

Featured image sourced from ChatGPT, chart from TradingView.com.