Recent analysis of blockchain activity reveals that Ethereum whales are intensifying their accumulation efforts, which could signal positive momentum for the cryptocurrency’s market value.

A Surge in Ethereum Whale Accumulation

Data from the blockchain analytics platform Glassnode indicates that considerable amounts of Ethereum (ETH) have been amassed by large holders over the past week.

In the cryptocurrency space, whales typically denote those who hold between 1,000 and 10,000 ETH tokens. This range translates to a significant investment, estimated at a minimum of approximately $2.5 million to as much as $25 million based on current market prices.

While this might not encompass the highest tier of investors, it undoubtedly involves noteworthy participants whose actions are critical to the digital currency ecosystem. Therefore, keeping an eye on these movements can provide valuable market insights.

A useful method for tracking whale behavior is by monitoring the overall Ethereum supply they control. Below is a graphic shared by Glassnode illustrating this trend over the past months.

The chart reveals a recent uptick in whale holdings, affirming that high-net-worth investors are actively seeking to acquire more Ethereum. “Daily whale accumulation has surpassed 800K ETH for nearly a week, elevating total holdings in the 1K–10K wallet range to over 14.3 million ETH,” summarized their findings.

Particularly noteworthy is a significant spike observed on June 12th, when whales acquired over 871,000 ETH in a single day—the highest influx recorded this year for this investor category.

This recent buying activity is not only impressive for 2023 but marks a historic trend. “Such a scale of accumulation hasn’t been observed since 2017,” Glassnode stated, implying that these investors may have strong confidence in Ethereum’s long-term prospects.

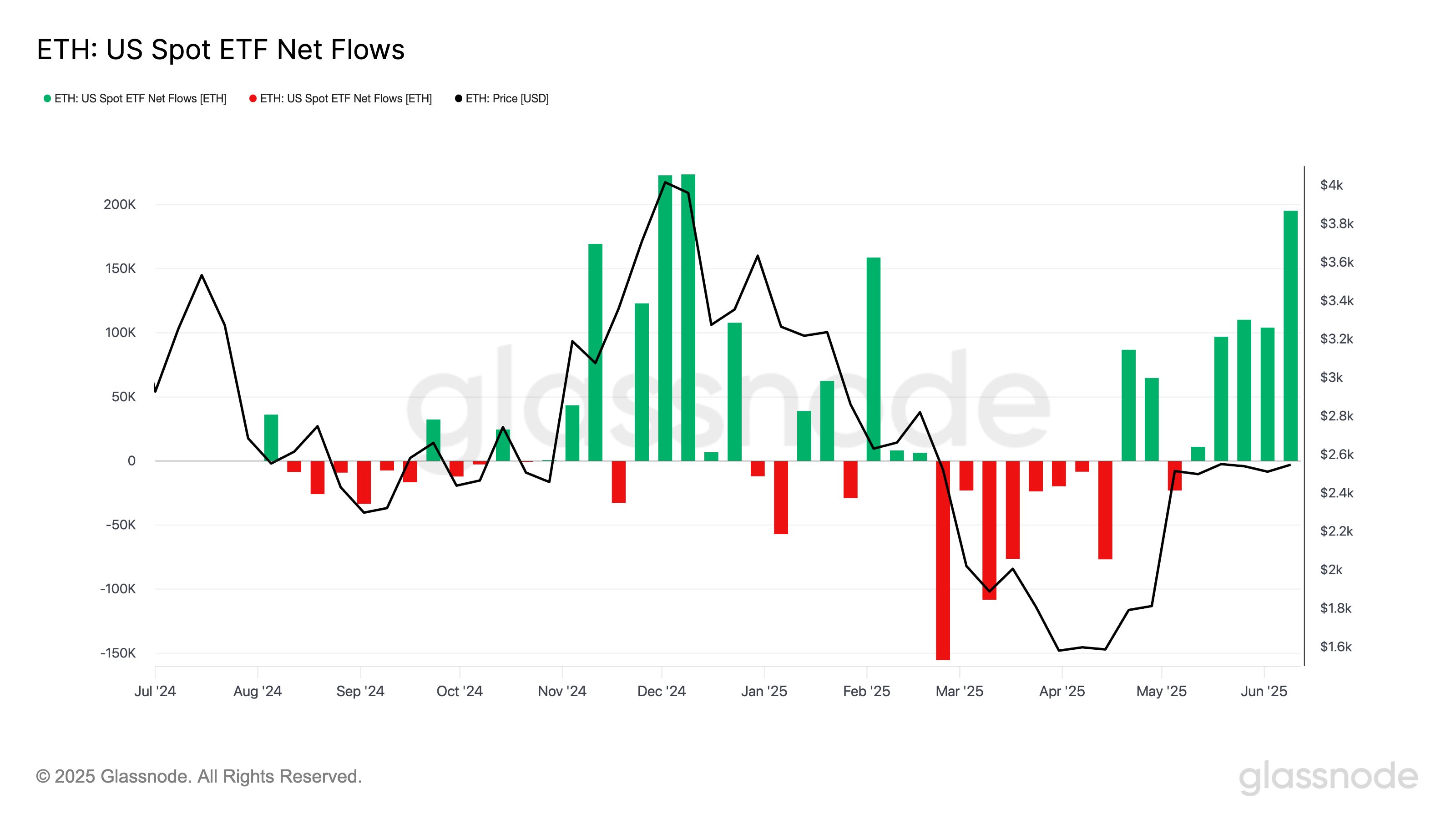

Amid this surge in accumulation, another noteworthy trend is emerging in the form of spot exchange-traded funds (ETFs). These ETFs offer a simplified avenue for traditional investors to gain exposure to Ethereum without the complexities associated with owning the cryptocurrency directly.

Being available on standard exchanges makes spot ETFs particularly appealing, especially for those who may not be well-versed with crypto wallets and trading platforms.

There has been a noticeable demand for US-based ETH spot ETFs recently, as evidenced by the netflow chart provided by Glassnode in a recent X post.

“In the past week, 195.32K ETH have flowed into US Spot ETH ETFs, marking the third-largest weekly inflow on record,” reported Glassnode.

Current ETH Market Trends

After aiming for the $2,700 mark on Monday, Ethereum’s price trajectory has shifted negatively, currently hovering around $2,470.