As the cryptocurrency sector faces increasing scrutiny, Bitcoin is currently experiencing a significant pullback, dipping to around the $115,000 range after an unsuccessful attempt to surpass its previous all-time high of $123,000. The ongoing correction, approaching 6%, is straining short-term investors who entered the market during the latest surge. Overall market sentiment is shifting, reflecting growing nervousness as volatility reasserts its presence.

In a notable development, analyst Darkfost highlighted that a wallet linked to Galaxy Digital, identified as bc1q0phe… and associated with an immense 80K BTC whale, has dramatically increased its selling activities. After recently acquiring nearly 40,000 BTC, this wallet has started to unload considerable amounts in rapid succession.

The timing of this sell-off coincides with expectations for Bitcoin to regain momentum above the previously established range. However, despite these short-term challenges, Bitcoin’s larger upward trajectory appears to be intact, thanks to support from dedicated long-term holders along with institutional interest.

Major Whale Movements: Galaxy Digital Offloads $2.6 Billion in Bitcoin

According to blockchain analyst Darkfost, Galaxy Digital has ramped up its Bitcoin sell-off significantly. After a period of minimal trading activities, today marks a pivotal moment with over 22,700 BTC—worth roughly $2.6 billion—being introduced into the market. These assets have been dispersed across major exchanges, including Binance, Coinbase, and Bitstamp, among others, indicating a substantial influx of liquidity just as Bitcoin faces renewed volatility.

The increased activity traces back to the address bc1q0phe…, known for holding a substantial amount of Bitcoin. Even after today’s extensive transactions, this wallet still maintains 10,000 BTC, equivalent to $1.1 billion in unrealized gains. This remaining stash introduces an ongoing risk of selling pressure, particularly if investor sentiment shifts downwards or critical support thresholds are breached.

With Bitcoin trading around $115,000 and short-term investors feeling the pinch, the upcoming trading periods are poised to be crucial. Analysts predict a surge in volatility, marked by rapid price fluctuations and potential capitulation events should additional Bitcoin from the Galaxy Digital address flood the market. Conversely, persistent demand from institutional investors and long-term holders could bolster support and mitigate selling pressures.

BTC Testing Key Support Amid Surge in Volatility

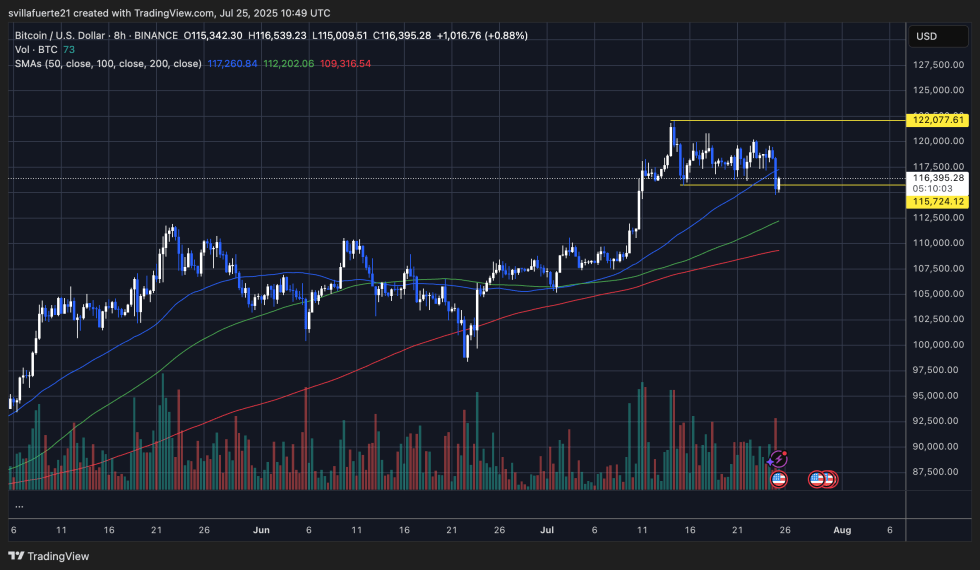

Recent analysis of the 8-hour chart reveals Bitcoin’s retraction from its recent peak of $123,000, with current consolidation around $116,400 following a temporary dip to $115,000. This market correction places Bitcoin just shy of the 50-period moving average (marked at $117,260), indicating a softening of short-term momentum. Nonetheless, the price remains securely above both the 100-period and 200-period moving averages, currently situated at $112,202 and $109,316 respectively—signifying the broader bullish trend is still in play.

Notably, trading volume has surged amid the recent downturn, suggesting heightened market involvement as Bitcoin tests its support. A critical line at $115,724 acts as a pivotal horizontal benchmark, aligning closely with the lower boundary of the trading range Bitcoin has adhered to for nearly two weeks. A definitive drop below this support level could reveal downside vulnerabilities, targeting the $112,000 region, yet thus far, this support has held strong.

Analysis indicates increasing volatility and uncertainty without a clear breakdown just yet. For bullish investors, reclaiming the $117,260 mark is essential to restore momentum and challenge the next resistance at $122,077 once again. Until then, the market seems positioned within a consolidation phase, adjusting to recent gains amidst significant whale activities and larger economic uncertainties. The forthcoming trading sessions will likely delineate the next directional movement for Bitcoin.

Featured image from Dall-E, chart from TradingView.