The cryptocurrency market is experiencing a revitalization as Bitcoin surpasses the $117,000 milestone following the Federal Reserve’s recent interest rate cut. This move, which many analysts had anticipated, signals the beginning of a potentially transformative period for digital currencies. With interest rates lowered and favorable liquidity conditions, there is growing optimism among investors that Bitcoin could soon challenge its previous peak of around $124,000.

The positive momentum reflects a broader trend in the market, as traders are increasingly optimistic about potential gains amid improving macroeconomic factors that favor riskier assets. However, it’s crucial to note that not every indicator points to unmitigated growth. Some analysts caution against the possibility that institutional selling could exert downward pressure on prices in the weeks ahead. Data from prominent analyst Darkfost shows that notable entities like Galaxy Digital are liquidating part of their Bitcoin holdings by transferring significant quantities to exchanges and private wallets.

These transfers raise valid concerns regarding future selling pressure, even as demand from various market sectors appears to be strengthening. While both retail and institutional investments bolster the bullish outlook, profit-taking activities from large stakeholders could introduce price volatility. The upcoming weeks will reveal whether positive market conditions can outweigh these challenges, potentially driving Bitcoin into exciting new ranges.

Institutional Selling Impacts Market Dynamics

As per Darkfost’s insights, Galaxy Digital’s recent actions include the movement of over 800 BTC in a single day, with substantial deposits to platforms like OKX, Bitstamp, and Binance. One striking transaction involved transferring 131 BTC directly to Fidelity, piquing the interest of traders and raising important questions about the shifts in institutional strategy.

This trend of selling can signal a concerning development for many investors. Galaxy Digital’s offloading is in stark contrast to the prevailing narrative surrounding Bitcoin’s breakout above $117,000. Although the Fed’s interest rate cut sets up a perfect macro landscape for price growth, the ongoing sell-off by major players hints at possible upcoming corrections. Market analysts caution that these behaviors indicate that some large holders may be capitalizing on the rally while they still can.

On the flip side, some experts argue that the actions of a single organization, even one as significant as Galaxy Digital, do not negate the overall upward trend. The market still sees strong inflows from retail investors and smaller institutions. The technical indicators remain largely positive, suggesting that Bitcoin could continue its bullish path if the momentum is sustained.

The current climate displays a divergence between institutional profit-taking and robust inflows from other sectors. If selling accelerates in the near term, we could expect short-term volatility that tests Bitcoin’s durability. Conversely, if market demand can absorb the selling pressure, Bitcoin may still be gearing up for new all-time highs in the coming weeks.

Navigating Key Price Levels

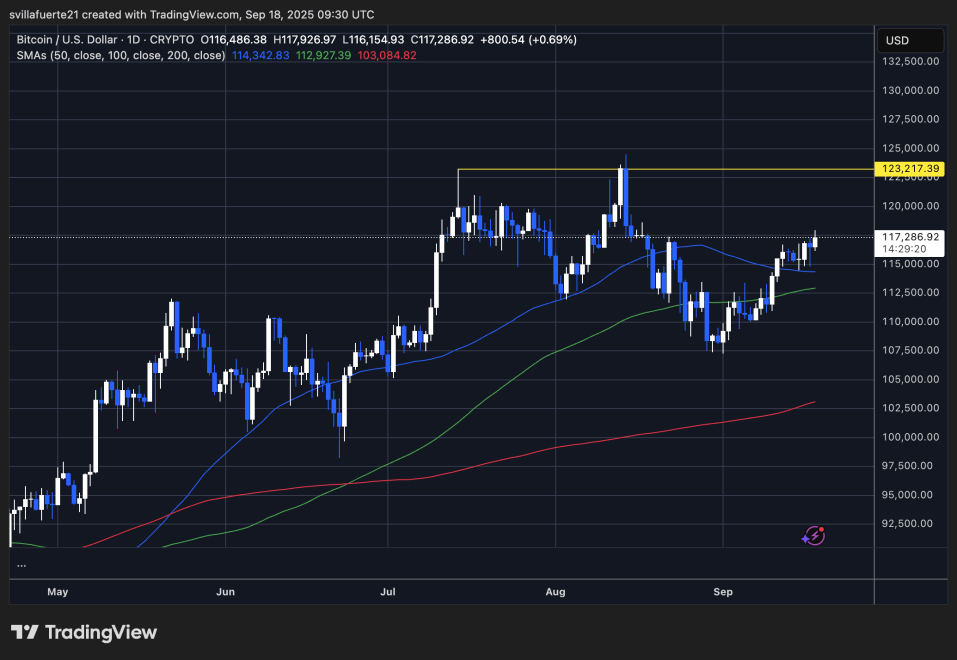

Currently, Bitcoin is trading at approximately $117,286, showcasing its ability to consolidate near crucial resistance levels. The $123,217 mark stands out as a significant barrier that Bitcoin must overcome. A successful breakout above this level could pave the way for a retest of previous all-time highs or even the establishment of new records.

The relevance of moving averages further supports the bullish narrative. The 50-day Simple Moving Average (SMA) is on an upward trajectory, currently providing support around $114,342. Additionally, the 100-day SMA sits around $112,927, reinforcing the notion that buyers are stepping in during dips. Meanwhile, the 200-day SMA, positioned significantly lower at $103,084, reflects a long-term bullish trend that should not be overlooked.

At this moment, Bitcoin finds itself in the upper range of its trading zone, but a lack of definitive momentum poses a challenge. For bulls, a convincing surge above $118,000 to $120,000 is necessary to foster further upward movement towards the crucial $123K resistance. On the downside, falling below $115K may prompt a wave of short-term selling pressure.