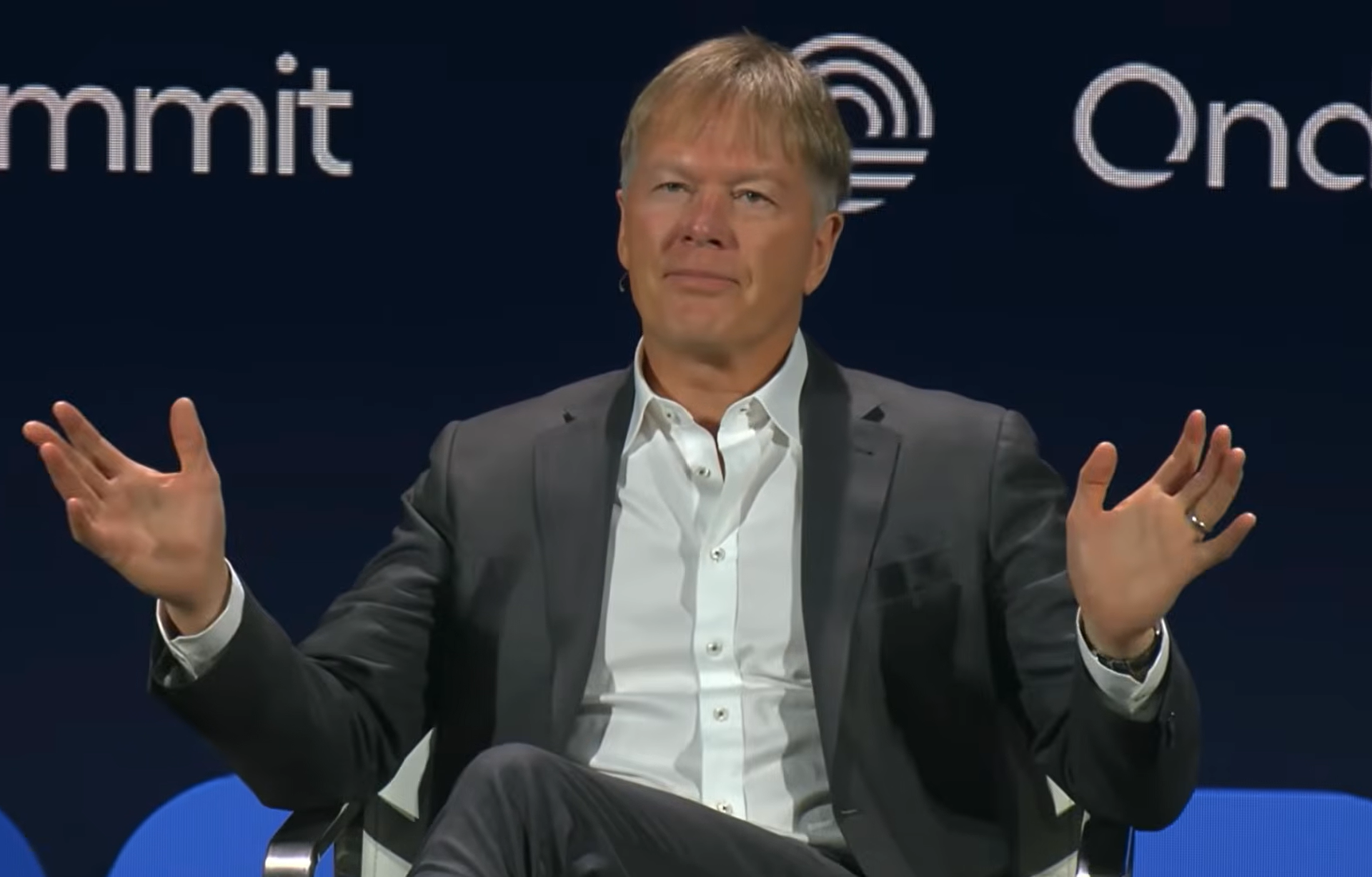

In a recent discussion at a notable conference, Dan Morehead, the CEO of Pantera Capital, shared insights that have sparked substantial interest in the cryptocurrency market. He posited that a new era of competition among nations for Bitcoin could emerge, indicating a potential “global race” towards acquiring BTC within the next few years as geopolitical dynamics evolve.

“I maintain a strong belief that we are on the brink of a historic shift in how nations view Bitcoin,” Morehead stated emphasizing that countries such as the United States are beginning to build Bitcoin reserves strategically. Nations with alliances to the U.S., which include countries like the UAE, are also stepping into the cryptocurrency arena.

Morehead believes that as geopolitical tensions mount, nations might reconsider their choices about where to maintain their national savings. “Countries opposing U.S. influence, such as China, are likely to question the logic behind holding wealth in assets that can be easily affected by external pressures,” he added. “Transitioning to Bitcoin is a safer alternative.”

He forecasted a wave of acquisition in the coming years, predicting that “in the near future, we may witness several regions with the goal of purchasing a million Bitcoins each. It’s crucial to invest beforehand.”

Optimistic Outlook for Bitcoin’s Future

Following his predictions about competitive acquisitions, Morehead reflected on the current market conditions. He compared recent trends to historical patterns, noting that while 2025 surprised him, he sees no deviation from the established narrative. “If you had asked me at the start of 2025, I would have projected a positive crypto outlook, yet we saw a 9% decline instead,” he remarked.

In his analysis, the cyclical nature of crypto trading is evident. “This represents our fourth cycle in just over a decade,” he stated, highlighting the emotional transitions from confidence during bullish phases to skepticism in downturns. He emphasized that maintaining perspective over a longer time frame is pivotal, suggesting that respecting Bitcoin’s rhythm over four years can lead to better investment outcomes.

Morehead pointed to historical predictions from Pantera Capital as an example of the cycle’s reliability, citing their accurate forecast for Bitcoin’s value hitting $117,452 on a specific date. Acknowledging his initial doubts about the cycle’s continuity, he ultimately concluded that the pattern remains consistent.

Regarding market demand, Morehead noted the emergence of new investment avenues such as listed ETFs and digital treasury firms. “Investors surged towards these options, collectively amassing over a hundred billion in crypto assets,” he stated, suggesting the market might stabilize as these initial surges level off.

Long-term economic factors such as ongoing monetary policy and Bitcoin’s limited supply were pivotal points in his argument. “The readiness to print money to address financial needs is unprecedented,” he explained. The continuous decline in fiat purchasing power serves as a logical incentive for diversifying into hard assets like Bitcoin. “Annual debasement rates hover around 3%, making it evident that constrained supply assets are increasingly appealing,” he highlighted.

Morehead also discussed the ongoing competition between gold and Bitcoin, noting that shifts in institutional investments are becoming more commonplace. “ETF inflows reveal a parallel trend in both gold and Bitcoin, further validating their respective markets,” he shared. His long-term vision remains clear: “In the coming decade, I firmly believe that Bitcoin will significantly surpass gold in performance.”

Interestingly, Morehead pointed out that ongoing skepticism among institutional investors is still a bullish sign, given the proportional light positioning in Bitcoin. “How can a bubble exist when ownership is minimal?” he queried, revealing that many institutions currently report negligible investments in Bitcoin. “The reasons for avoiding Bitcoin have diminished noticeably, though major firms still lag in adoption,” he concluded.

As of the latest update, Bitcoin is being traded at $69,418.