Recent findings from industry reports indicate a significant trend in the financial sector: the increasing integration of cryptocurrencies into traditional investment portfolios. An emerging survey reveals that a substantial percentage of hedge funds are now embracing this digital asset class.

In fact, the latest data suggests that approximately 55% of hedge funds have incorporated crypto assets into their strategies. This marks a notable increase from previous years, highlighting a growing acceptance of cryptocurrencies among traditional investors.

Embracing Crypto: A Cautious Yet Promising Approach

Despite this trend, most hedge fund managers are taking a measured approach. A large portion of these funds maintains a minimal exposure to digital currencies; notably, over half of the funds invest less than 2% of their total portfolios in crypto.

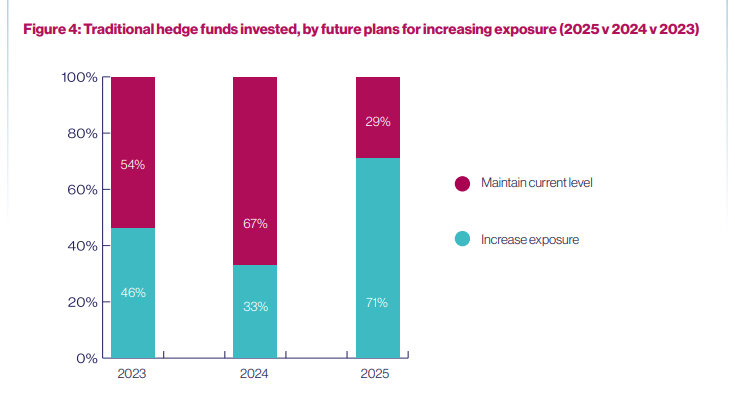

On average, hedge funds are allocating about 7% to crypto-related investments, but this might soon change. An impressive 71% of those with existing crypto assets plan to increase their investments within the coming year.

Concerns about risk management are also prevalent. Many investors cite various motives for including cryptocurrencies, such as portfolio diversification (47%), potential for market-neutral strategies (27%), and the possibility of asymmetrical returns (13%).

The scale of this survey is quite significant, with over 122 hedge fund managers managing assets worth more than $980 billion. The findings reflect a 17% year-over-year uptick in the proportion of funds with crypto exposure.

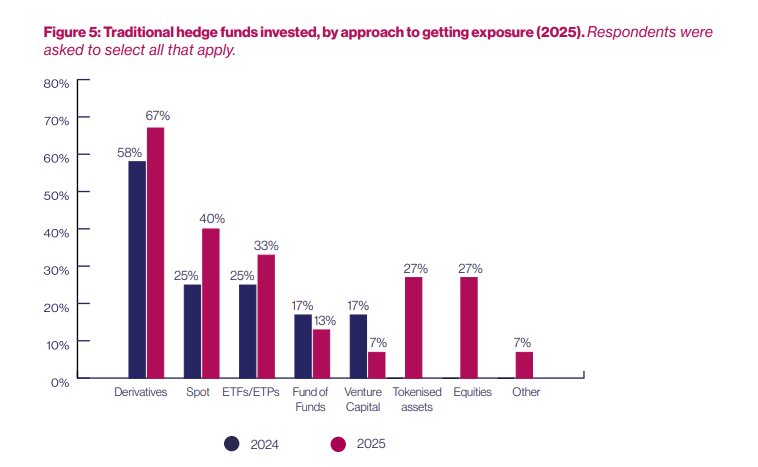

Interestingly, many fund managers are choosing to take indirect positions in cryptocurrencies. Findings show that 67% of hedge funds are utilizing digital currency derivatives—an increase from 58% last year. This strategy allows for exposure without direct ownership of the cryptocurrencies.

While this method may seem less risky, it is not without its challenges. The drastic market fluctuations, exemplified by the significant liquidations during the October 2025 market crash, serve as a cautionary reminder of the inherent volatility in the crypto space.

Methods for Gaining Crypto Exposure

Within the investment landscape, spot trading continues to gain traction, growing from 25% to 40%. Meanwhile, traditional derivatives still hold their ground, accounting for about 33% of crypto access methods.

With options such as tokenized assets and relevant equities comprising about 27% each, it is evident that hedge funds seek a diversified approach to their asset strategy. This variety allows investors to weigh flexibility against direct ownership, tailoring portfolios based on specific risk limits.

In terms of dedicated crypto funds, these entities are experiencing considerable growth. Reports indicate an increase in average assets under management to over $130 million in 2025, compared to $79 million in 2024 and upwards of $40 million in 2023.

The most commonly held cryptocurrencies include Bitcoin (86%), Ethereum (80%), Solana (73%), and XRP (37%). Of note is Solana’s sharp increase in adoption, which surged from 45% last year. Additionally, yield strategies are flourishing, with 39% of crypto funds employing custodial staking and 35% utilizing liquid staking.

Rising Interest from Institutional Investors

As interest from institutional investors rises, notable challenges still exist. Participation in fund-of-funds has jumped to nearly 40% in 2025, up from just 21% the previous year. Allocations from pension funds, foundations, and sovereign wealth funds have also increased, now sitting at 20%, up from 11%.

A recent survey indicates that two-thirds of institutional investors are now allocating capital to digital assets. However, it is essential to note that half of the traditional hedge funds without current crypto exposure do not plan to invest over the next three years.

Image sourced from Unsplash; chart from TradingView.