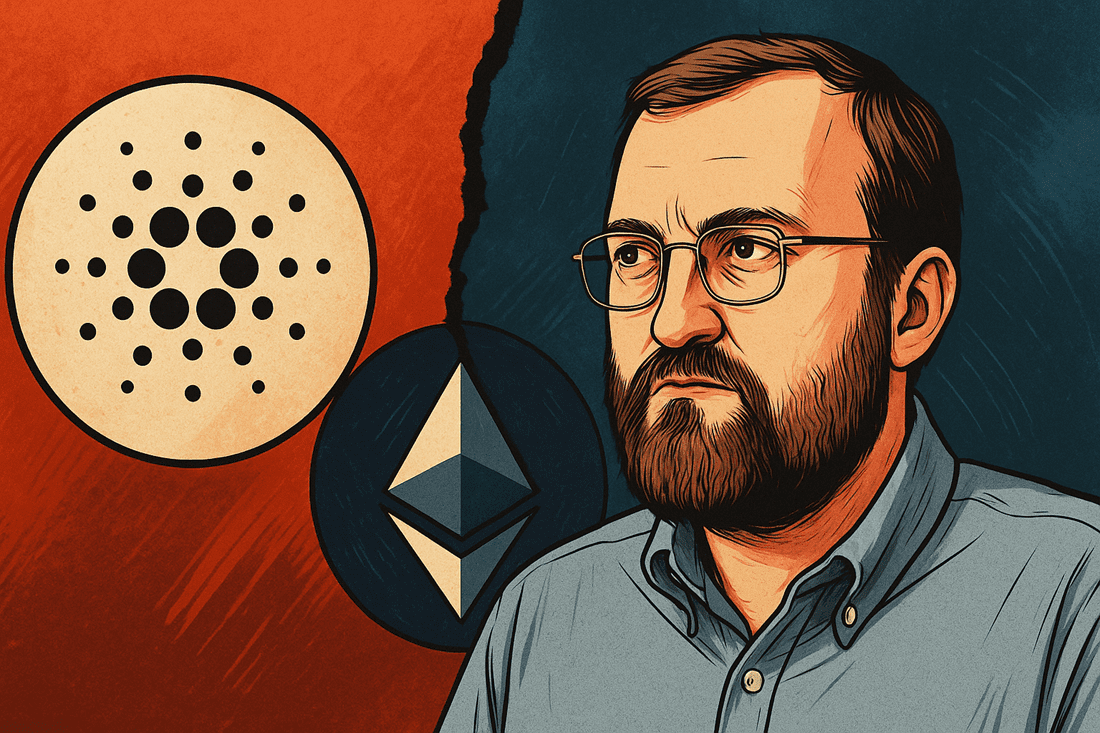

The heated exchange between prominent blockchain figure Charles Hoskinson and NFT artist Masato Alexander has captured the crypto community’s attention. This conflicts surround allegations that Hoskinson redirected a significant sum of ADA—approximately 318 million tokens valued at $619 million at that time—from pre-sale wallets into Cardano’s reserves during the Allegra hard fork in 2021. As the situation intensifies, Hoskinson has taken to social media platform X to frame the entire episode as a calculated maneuver by Alexander to promote his Ethereum-based project.

In a captivating post, Hoskinson questioned the authenticity of Alexander’s claims. “Is this just a ploy for visibility to help fund an Ethereum project? It’s astonishing,” he asserted, sharing a screenshot of a private conversation where Alexander revealed his efforts to secure funding for his venture, Akua.

The screenshot prompted an immediate response from Alexander, who pushed back, stating, “Do you seriously want to expose DMs, Charles? Let’s not go there.” This interaction unveiled further discussions, including one with Phil Harman, CEO of Anastasia Labs, who suggested the possibility of a Cardano version of Akua. Harman later expressed discontent at the exposure of their exchange, emphasizing that he was only trying to provide constructive feedback on Alexander’s decentralized application (dApp).

Akua aims to innovate within the prediction market space, focusing specifically on managing risks associated with natural disasters, such as earthquakes. As outlined in a white paper, the project intends to evolve and cover wider threats. The initiative’s architecture is built for Ethereum Virtual Machine (EVM) compatibility, a point highlighted by Cardano engineer Lucas (@rvcas), who accused Alexander of using the controversy as a marketing tactic to gain attention from Ethereum supporters.

Hoskinson agreed with this viewpoint, labeling the scandal as a calculated smear tactic designed to attract the Ethereum community, threatening to pursue legal actions and calling for an independent audit to clarify the treasury transactions in question. He asserts that over 99.8% of the original ADA vouchers have been redeemed and that the small remaining balance—estimated between 18 to 24 million ADA—was contributed to Intersect, a newly established member-based governance organization.

Understanding the ADA Voucher Sweep

In a more detailed discussion on X, Hoskinson delved into the 2021 voucher sweep’s mechanics, noting that many Japanese retail buyers, particularly elderly individuals, faced difficulties in the original redemption process. “There was a commercial obligation to modify the redemption process,” he noted, specifying that two out of three genesis key-holders approved the upgrade that eliminated the unredeemed addresses.

According to Hoskinson, no ADA was “stolen,” dismissing the narrative as “absurd” and criticizing media interpretations that supported this perspective. Conversely, Alexander regards the voucher sweep as an unjust alteration that deprived early investors of their funds, claiming that only about $7 million from the swept assets has been traced to Intersect.

As reported by Bitrabo, a thorough ADA voucher redemption audit is currently being conducted by the esteemed law firm McDermott Will & Emery (MW&E) and audit firm BDO, expected to provide clarity once completed. The exact publication date is yet to be announced.

As of the latest data, ADA is trading at approximately $0.7889.