Bitcoin encountered a sharp decline on July 4 followed by further losses the next day. Despite this, by the end of the week, there was a sign of demand as the price showed stability over the weekend. While some suggest that the downtrend may have ended, an analyst is not convinced.

Bitcoin Continues to Face Strong Selling Pressure: Analyzing the Situation

Referring to on-chain data, the analyst indicates that sellers are in control and the downward trend persists. By pointing out the Bitcoin MVRV Momentum indicator, the analyst highlights that it has entered negative territory for the first time in over 16 months.

A similar occurrence took place in March 2023. Although there was a recovery in the months following a plateau period in early Q3 2023 leading to a surge in Q4 2024, it remains uncertain if the current scenario will unfold in a similar manner.

The Bitcoin MVRV Momentum indicator, a technical tool derived from on-chain data, compares the market value with the realized value of BTC. These readings are commonly used to assess market sentiment.

When the indicator surpasses the 1-year moving average, Bitcoin prices typically rise. During the period when prices soared to above $70,000, reaching as high as $73,800, the indicator remained notably above the moving average.

Currently, with the indicator below the moving average, it points towards overall market weakness. If this trend persists, it may imply a shift towards a bearish market after a strong performance in the first half of the year.

Despite the data indicating market weakness, investors are facing a decision point, especially considering the previous recovery in March 2023 under similar circumstances. This suggests a potential buying opportunity amidst bearish signals.

On the other hand, a breakout from the 12-month moving average could signal the beginning of a bearish phase with further losses anticipated.

Should Bitcoin Traders Exercise Patience?

The current situation calls for traders to exercise caution and closely monitor the market conditions. The recent price decline made Bitcoin more appealing for selling, intensifying the downward momentum. Consequently, it offered buyers a chance to purchase at a discounted rate, leading to a short squeeze and the liquidation of leverage sellers.

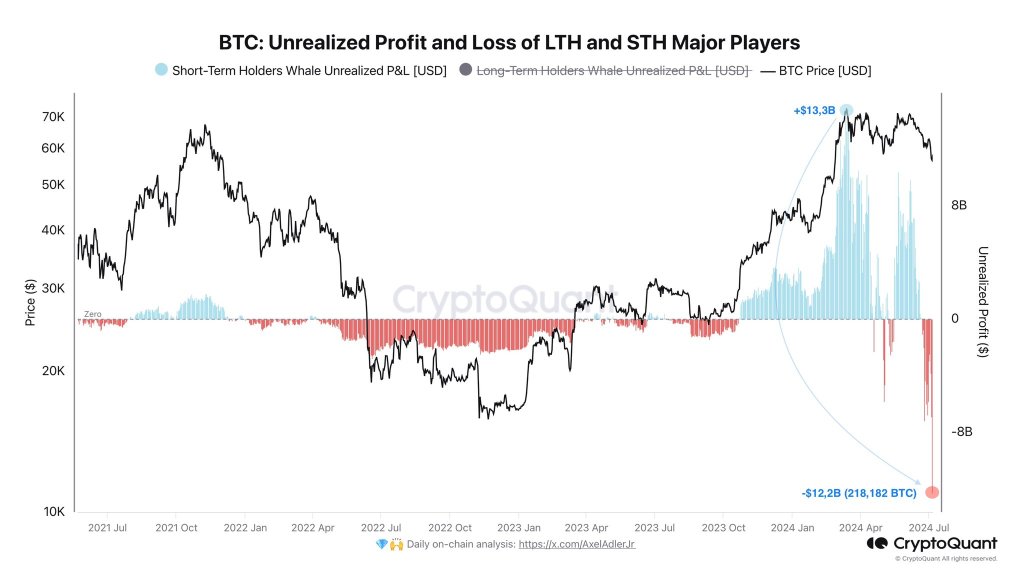

It remains to be seen whether leverage traders will exit following the recent gains in the last 48 hours. Additionally, an on-chain analyst highlights that short-term holders are still facing substantial unrealized losses. If these holders panic and start selling due to a price drop, it could lead to a rapid decline in Bitcoin’s price.