The current state of the cryptocurrency market illustrates a complex landscape, marked by cautious trading and persistent uncertainty. Bitcoin is struggling to break free from the $90,000 resistance, demonstrating limited ability to gather momentum from fresh demand.

Ethereum, on the other hand, is witnessing marked fluctuations and a notable increase in selling pressure. This behavior is indicative of a broader sentiment rooted in risk aversion among investors who are opting for more selective investments instead of aggressively chasing upward trends.

According to a recent study by XWIN Research Japan, an important transformation in the cryptocurrency landscape is taking shape. It may not be visually apparent through traditional price metrics, yet the flow of capital within the market is undergoing significant changes. On-chain analytics reveal that while liquidity remains intact, its allocation has evolved.

The total supply of ERC20-based stablecoins has escalated to around $160 billion, approaching historic highs. Although there was a slight contraction during the uncertain market conditions of 2022, this supply has since shown a consistent upward trend.

This trend does not indicate an exodus of capital from crypto; instead, it reflects a strategic repositioning of funds within the ecosystem. Investors are accumulating stablecoins as they act as “waiting liquidity,” standing by for more definitive signals before making their next move. The liquidity is neither dissipating nor disappearing; it remains in a state of readiness for future opportunities.

Japan: The Emerging Hub in Global Capital Shifts

The implications of this capital behavior are particularly significant for Japan’s cryptocurrency environment. With increasing regulatory clarity and evolving tax structures, Japan is poised to attract back a considerable amount of domestic investment that has been reserved due to uncertainty in recent years.

The potential influx of previously sidelined capital, complemented by renewed enthusiasm from individual investors, could significantly enhance local liquidity, facilitate more robust price discovery, and strengthen Japan’s influence in the global crypto arena.

One pivotal factor in this transition is the rising prominence of JPYC, a stablecoin pegged to the yen. While US-dollar-based stablecoins maintain a dominant role in global crypto transactions, a yen-backed currency offers Japan a unique advantage.

- JPYC is moving beyond mere speculation and increasingly serves as a framework facilitating genuine economic activities.

- It promises integration with Web3 services and provides domestic and international payment solutions that align with Japan’s economic framework.

Looking ahead, forecasts indicate that Japan’s cryptocurrency sector may gradually shift focus from short-term price speculation. Rather, it may evolve into an ecosystem where capital circulates actively and is utilized for practical, beneficial purposes. The efficiency with which Japan harnesses and directs this globally mobile type of liquidity will significantly influence the market’s forthcoming growth trajectory.

Testing the Waters: Crypto Market’s Structural Support in a Risk-Averse Climate

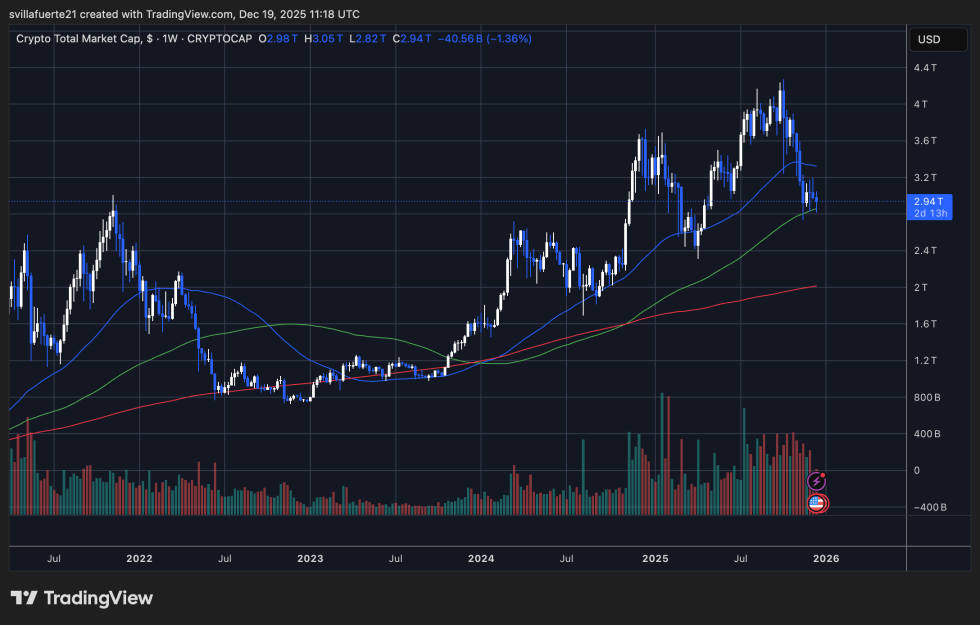

Evidence points to structural strains within the total cryptocurrency market cap as it struggles to maintain momentum above crucial high levels. Recent analysis highlights a retracement toward the $2.9–$3.0 trillion zone, which now functions as a pivotal inflection point for the broader market. This price level aligns with key moving averages, underscoring its significance as both medium- and long-term support.

The market’s rejection in the $4 trillion range signifies a notable turning point. Following a considerable expansion phase throughout 2024 and early 2025, the market has entered a correction characterized by lower highs and diminished upward momentum. Analyzing trading volume supports this narrative: increased selling pressure during downturns accompanies lackluster rebound attempts.

Despite this decline, the long-term trend remains relatively intact. The market is still significantly above the 2022–2023 baseline, indicating that current fluctuations seem more like a consolidation phase rather than an outright collapse. However, the persistence of trading below several short-term moving averages suggests that investor risk appetite is currently limited.

To revive the bullish outlook, it’s crucial for the total market capitalization to stabilize above the $3 trillion mark and to reclaim resistance levels around $3.3–$3.5 trillion. A failure to maintain this current support level could expose the market to a more profound retracement toward the $2.4–$2.6 trillion range, an area that previously showed robust historical demand.

Featured image sourced from reputable content providers, with charts or figures taken from TradingView.com.