In recent discussions, UK comedian Jimmy Carr proposed a novel idea for boosting national finances: utilizing excess electricity to mine bitcoin. This concept represents a shift toward innovative financial strategies that governments might consider.

Could the UK Harness Nighttime Energy for Bitcoin Mining?

During a recent interview on a popular podcast, Carr raised questions about the absence of a sovereign wealth fund in the UK and highlighted opportunities to leverage national assets for public benefit. He emphasized the need for bold thinking around public resources.

“Certain resources should benefit everyone,” he remarked, referencing the vast oil and gas reserves beneath British soil, as well as offshore wind farms. Carr noted that current profits predominantly benefit the Crown and questioned why these finances shouldn’t be directed towards the populace.

He expanded this idea to include various infrastructures, such as “communication towers.” Carr clarified he wasn’t advocating for socialism, insisting that a shared ownership of some assets could yield greater societal good.

Continuing with his proposal, Carr suggested bitcoin mining as a pragmatic avenue for tapping into unused energy. “If our government decided to mine bitcoins, I’d fully support it,” he stated. “Many power plants simply idle overnight, so why not put that energy to work?” He viewed such an initiative as a possible “new gold standard” for the country.

Jimmy Carr suggests utilizing neglected energy resources for bitcoin mining. “Our power stations don’t do anything at night, so we’re going to mine for bitcoins. Great. New gold standard. Fine.” pic.twitter.com/GZRvQT8mua

— Documenting ₿itcoin (@DocumentingBTC) December 17, 2025

While Carr’s remarks were not backed by detailed policy frameworks or capacity statistics, the idea itself invites contemplation. His argument highlighted the potential of underused infrastructure and suggested that traditional funding methods should not be the only solution to financial concerns. “Let’s think creatively about our country’s finances,” Carr urged. “Is taxation the only path?”

Made by a well-known entertainer rather than a policymaker, Carr’s comments nevertheless stand out. They portray bitcoin not merely as a commodity but an asset that a government could feasibly mine using surplus energy, thus redefining its role within national economics.

Comparative examples exist where similar models have been successfully implemented. Bhutan has developed its own state-connected bitcoin mining operation, predominantly powered by renewable hydropower. This approach effectively monetizes surplus energy production.

El Salvador has embraced the concept of utilizing excess energy as well, mining nearly 474 BTC over three years through geothermal power sourced from a volcanic plant. Iceland, too, has seen an influx of miners capitalizing on its clean, abundant energy, making it one of the top mining locations worldwide.

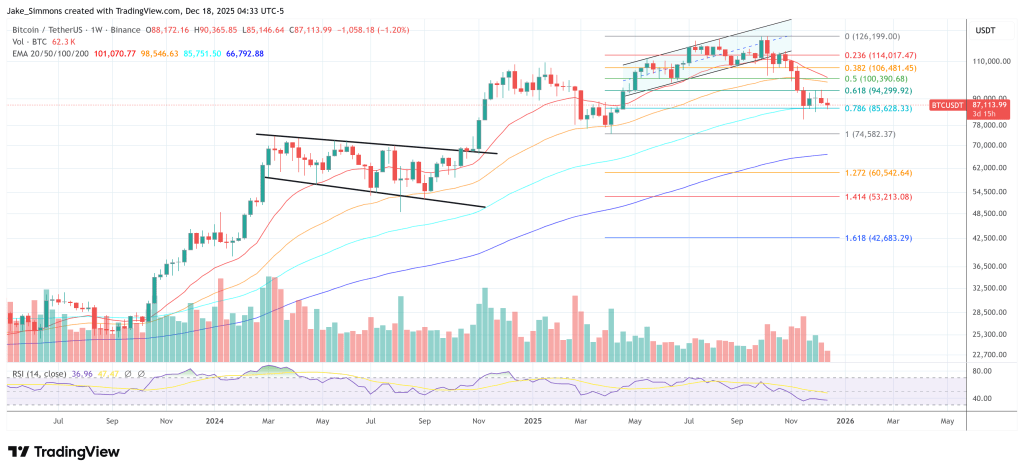

As of now, the price of bitcoin is soaring at $87,113, showcasing its continuing significance in the global financial landscape.