The landscape of Bitcoin trading has taken a turn, with the cryptocurrency experiencing a dip of 2.4% in the last week, settling at approximately $115,382. This decline follows a peak of over $123,000 earlier this month, indicating market fluctuations are at play.

Although this drop hasn’t confirmed a full trend reversal, various on-chain metrics reveal that traders are adjusting their strategies in response to these fluctuations, showcasing increased market engagement.

Reconfiguring Exchange Dynamics

Insights from crypto analyst Enigma Trader reveal a notable shift in exchange dynamics based on data from CryptoQuant. Recent inflow and outflow trends are indicating a redefining of market sentiment among traders.

In a recent article titled “Massive Inflows Spark BTC Dump — But Outflows Return,” the analyst emphasized that an inflow spike noted on July 17, which totaled upwards of 32,000 BTC, resulted in an increase in selling pressure.

Consequently, Bitcoin saw a sharp decline, at one point dropping below $115,000. However, recent trends show a resurgence of outflows, suggesting renewed accumulation could be on the horizon.

After the major influx, data revealed significant outflows of -7,400 BTC, -12,080 BTC, and -16,100 BTC in subsequent days.

These outflows, typically indicative of a move from exchanges to personal wallets, demonstrate either an intention to hold or a strategic repositioning of investments, which can help alleviate immediate selling pressures.

Enigma Trader posits that if the trend of outflows persists while Bitcoin hovers near its support levels, there is potential for a bullish resurgence, especially if consistent momentum is maintained.

This perspective aligns with historical trends, where sustained outflows generally correlate with rising investor confidence and a tendency towards long-term holding.

However, it’s essential to consider the broader market context, including macroeconomic factors, sentiment risks, and possible regulatory changes. The current scenario indicates a cautious optimism interspersed with short-term volatility.

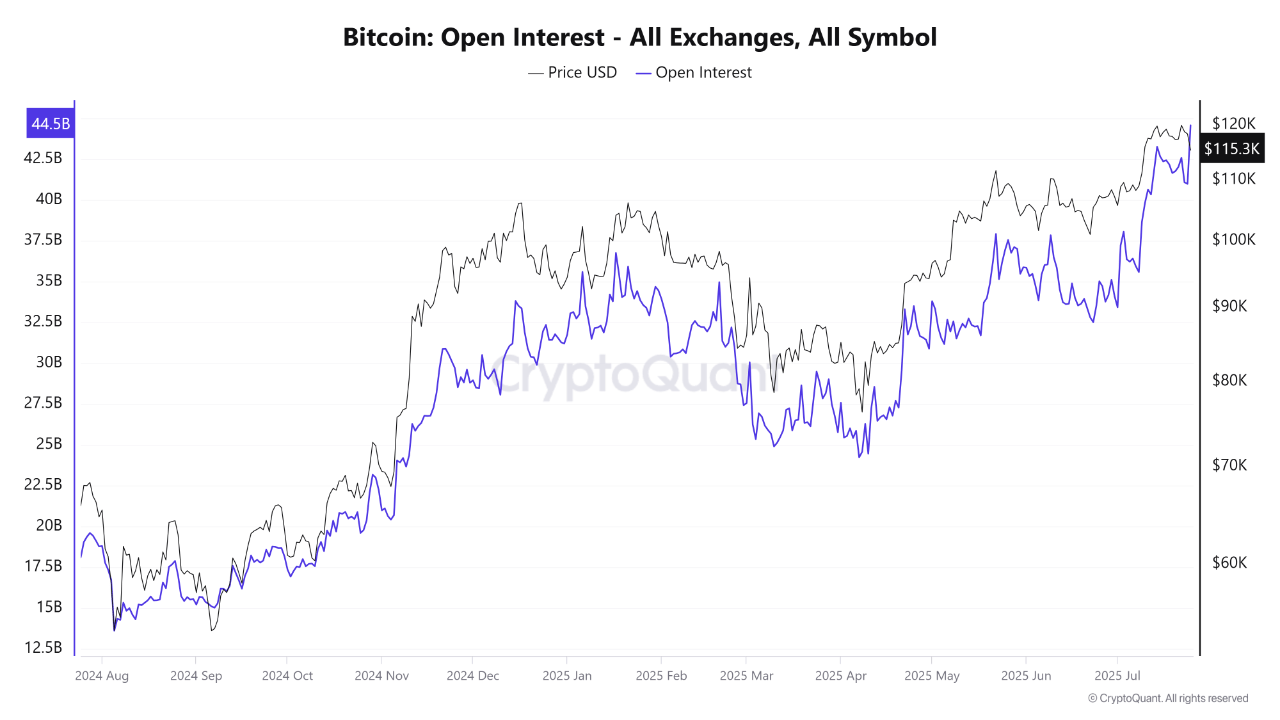

Soaring Open Interest Reflects Speculative Behavior

In parallel, CryptoQuant’s analyst Arab Chain has identified another critical aspect of Bitcoin’s market structure: open interest in Bitcoin derivatives has surged to a new high of $44.5 billion.

This increase in open interest is occurring amidst falling prices, suggesting many traders are opening new positions during this dip. While some traders may be going long in anticipation of a market recovery, a substantial portion may be placing short trades, betting on further price drops.

Such a mix—escalating open interest alongside declining prices—introduces heightened risk for liquidation events, particularly if an abrupt market shift occurs.

Arab Chain cautions that elevated open interest under these conditions is often indicative of speculators leveraging their positions, rather than long-term investors, making the market vulnerable to volatility. A rapid price movement could potentially trigger widespread liquidations.

Featured image created with DALL-E, Chart from TradingView